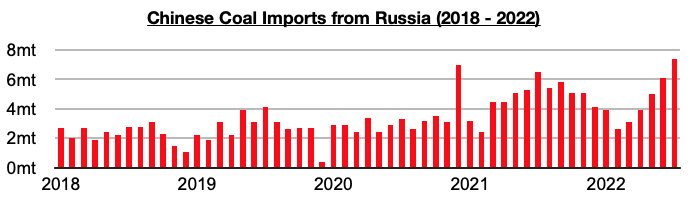

Chinese import data suggests Russian coal producers are pivoting towards China due to the economic sanctions in Europe. The magnitude of volumes are not material relative to the size of the Chinese domestic market, which will easily absorb the incremental supply, but it does demonstrate the new trade flows in this embargo era.

I would assume these volumes will increase over time since the European sanctions deadline just passed a month ago. In my opinion, all of the incremental thermal supply from Russia and Mongolia is easily soaked up by Chinese demand. In 2020 China built 25 gigawatts GW of coal-based power, followed by 33 GW in 2021, and 8.6 GW was approved for construction in Q1 2022. Source linked here, here and here.

For comparison, the US has 212 GW of capacity in operation as of late 2021. Source here. So China is adding more than a third of US coal-fired capacity in the past 2.25 years alone. They need all the tons they can get, in addition to their own domestic coal production ramp.

Meanwhile, 40 million tons per annum (mtpa) from Russia are now missing in Europe thanks to the sanctions. Seaborne thermal markets have a hard, if not impossible, task of balancing the new supply/demand dynamic.

You can read the entire article by Breakwave Advisors here, or in the link below:

https://www.breakwaveadvisors.com/insights/2022/9/1/china-buying-even-more-russia-coal

Recent Posts___________________________________________________________________

India’s Steel Ministry Considers Temporary Tariff to Curb Chinese Imports Amid Rising Concerns

Russian Coal Miners Declare Hunger Strike Over Unpaid Wages

European Steelmakers Call for Urgent EU Support Amid Industry Crisis

Pingback: India to Boost Coal Power Fleet 25% - The Coal Trader