EQUITIES

Coal Equity Research Coverage

Introduction

With only two official sell-side analysts covering the coal sector, we thought it would be beneficial for investors to get an independent point of view from a non-Wall Street oriented research team.

Coverage

We are therefore initiating coverage on the following pure play coal equities:

- Alpha Metallurgical Resources (AMR)

- Arch Resources (ARCH)

- Ramaco Resources (METC)

- Warrior Met Coal (HCC)

- Alliance Resource Partners (ARLP)

- CONSOL Energy (CEIX)

- Corsa Coal (CSO.V)

- Peabody Energy (BTU)

- Morien Resources (MOX.V)

- Coronado Global Resources (CRN.AX)

- New Hope Group (NHC.AX)

- Stanmore Resources (SMR.AX)

- Whitehaven Resources (WHC.AX)

- Yancoal (YAL.AX)

- Thungela Resources (TGA.LN)

We currently have detailed financial modeling and forecasts on the US-listed coal producers, and we’re in the process of ramping-up to similarly have detailed modeling on Canadian and Australian names, as well as Thungela Resources, listed in S. Africa and London.

Methodology

The Coal Trader team will undertake a bottom-up approach to evaluate individual companies as investment opportunities.

Financial Statements Review: We delve into each company’s financial statements, including the income statement, balance sheet, and cash flow statement to assess the company’s revenues, expenses, profitability, debt levels, and cash flow patterns over time.

Ratio Analysis: We concentrate on enterprise value (EV) to free cash flow (FCF) as we believe this is the best approach to ascertaining “value” and normalize value across the peer group.

Industry Analysis: We are always performing research on the coal sector to understand the competitive landscape, growth prospects, and challenges.

Competitive Positioning: Understanding each company’s competitive advantage is crucial in determining each company’s outlook and profitability pathways against one another. Moreover, as with any sector, product differentiation, market share and barriers to entry play an important role in the coal sector.

Management Evaluation: Each company’s management team and track record are important gauges to keep in mind when investing in a cyclical industry like the coal. Shareholder value can be generated as well as squandered easily depending on managements view on the outlook and where we are in the cycle.

Profitability Prospects: We assess each company’s profitability prospects by considering factors like market demand, product marketability, access to markets and logistics, and expansion plans.

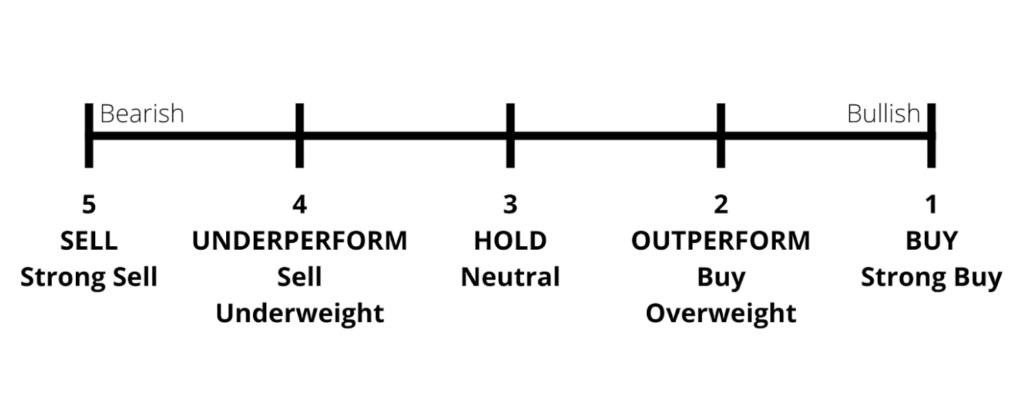

Investment Recommendation: After reviewing all of these factors, we make an investment assessment based on the following classic rating system:

The information and assessment(s) herein represent a long-term view as described more fully below. The analyst may have different views regarding short-term trading strategies with respect to the equities being assessed, options on such equities, and/or other securities or financial instruments issued by the company, and such views may be made available to all or some of our subscribers from time to time.

- We generally expect “Buy” assessments to have an above-average risk-adjusted total return over the next 12 months.

- We generally believe “Neutral” assessments will have an average risk-adjusted total return over the next 12 months.

- We generally expect “Sell” assessments to have a below-average risk-adjusted return over the next 12 months.

Disclosures:

The Coal Trader is presented for informational and entertainment purposes only. The information presented herein should NOT be construed as investment advice. Always consult a licensed investment professional before making important investment decisions. Nothing in this Site constitutes professional and/or financial advice, nor does any information on this Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. The author of this Site is not a fiduciary by virtue of any person’s use of or access to this Site or its Content. Remember that past performance is not indicative of future results. The financial markets can be volatile and unpredictable; therefore, you should carefully consider all risks and do your own research before making any financial decisions. The Disclaimer, located here, along with the Terms of Use and Privacy Policy, governs your access to and us of www.thecoaltrader.com including any content, functionality and services offered on or through this Site, whether as a guest or a registered user. From time to time, this Site, its affiliate entities, authors, owners, employees, and/or members of their immediate families, may have a long or short position in the equities or other financial instruments mentioned in this Site.