China Coke Producers Push Back on Price Cuts

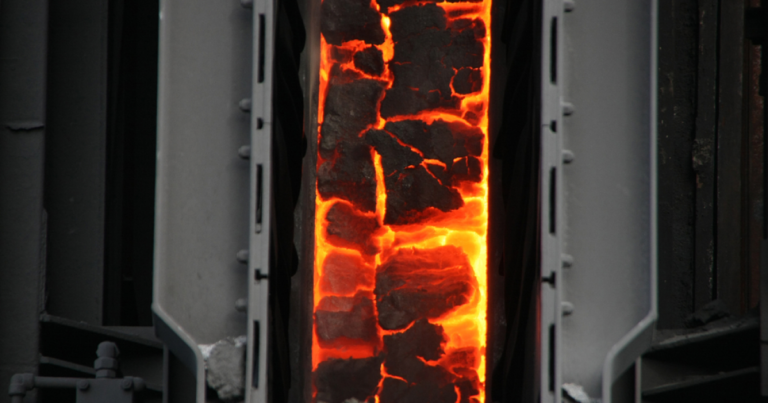

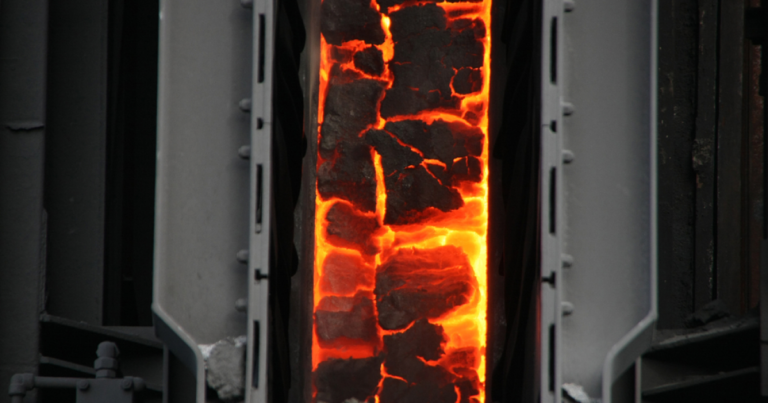

China metallurgical coke producers are pushing back against price cuts of 50-55 yuan per ton suggested by major steel mills in Hebei province and Tianjin City.

China metallurgical coke producers are pushing back against price cuts of 50-55 yuan per ton suggested by major steel mills in Hebei province and Tianjin City.

In January 2024, India witnessed a 41% m-o-m drop in met coke imports, reaching 0.28 million tonnes compared to 0.47 mnt in December 2023.

From Jan to Dec 2023, national coke, pig iron and steel production increased year-on-year, while crude steel production remained flat

China’s metallurgical coke market is expected to see slight increases in both supply and demand this year.

The Atlantic Basin metallurgical coke markets are poised for a slow start in Q1 due to subdued steel production…

China’s metallurgical coke production reached an estimated 490 million mt in 2023, up 3.6% from 2022.

The coke market is operating weakly. The maintenance of blast furnaces in steel plants is just in need of suppression.

Chinese prices of metallurgical coke are likely to decrease in the first half of January as steel mills become less active

Chinese coke makers seeking chances to hoard cost-effective metallurgical coal cargoes ahead of the country’s Lunar New Year holiday

Chinese prices of metallurgical coke will strengthen further for the duration of this month, though some downside risks exist.