The PRB & US Power Plant Retirements

I’ve been hearing about US power plant retirements in the pipeline and although I knew it would hit the Powder River Basin (PRB) the hardest.

I’ve been hearing about US power plant retirements in the pipeline and although I knew it would hit the Powder River Basin (PRB) the hardest.

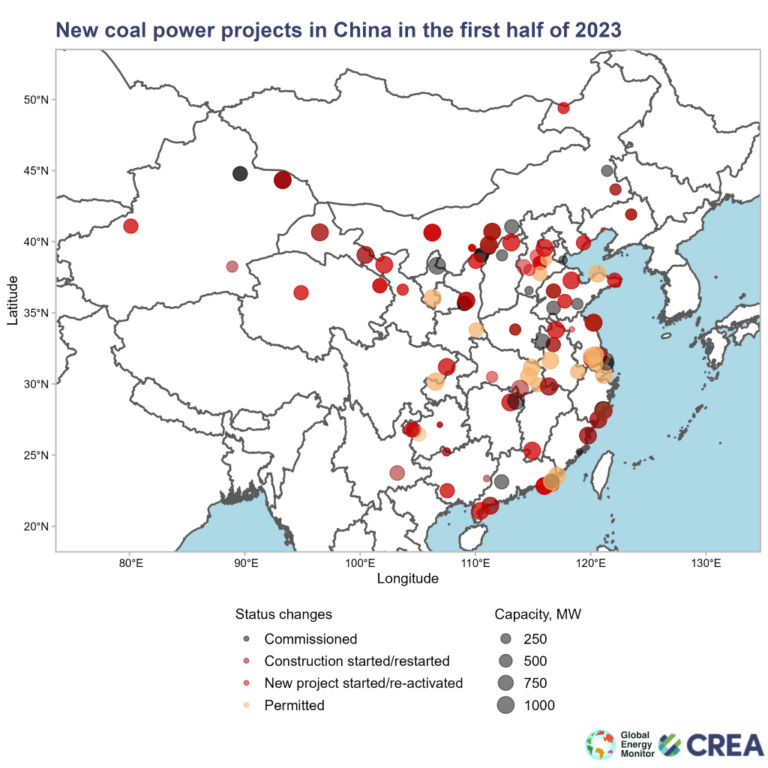

It’s important to think about Chinese policy and ask ourselves why their actions don’t quite line up with their rhetoric.

In the first half of 2023, China approved 52 GW of new coal power projects, a significant increase from the 15 GW permitted in H1 2022

European natural gas prices experienced the largest jump since March of the previous year due to concerns over potential supply disruptions.

NextDecade Corp. will proceed with an $18.4 billion LNG plant in Texas, aiming to supply customers in Europe and Asia from 2027.

European coal price have found a footing in the $110-120/mt range as natural gas supply sees uncertainty in absence of Russian flows.

The Heating Season Started Early in Germany. Everyone is waiting to see how bad the energy crisis gets in Europe.

Germany’s Steag to bring back 2.3 GW of coal capacity. They’re demanding permissions be prolonged to 2024, and not tied to gas scarcity.

The Eucalyptus Paradox – Mining Metals Supply Chain. Society has the goal of energy transition but it’s unwilling to investment in the mines.

Wood is now Europe’s Largest Renewable Energy Source. Burning wood pellets is the largest source of renewable energy ahead of wind and solar.

Inflation much worse than the 1970’s. Niall Ferguson outlines the comparison from the 1970’s and says it could be worse this time around.

European Commission President at the Bled Strategic Forum. I’ll highlight a few key items of her speech and then discuss the implications.