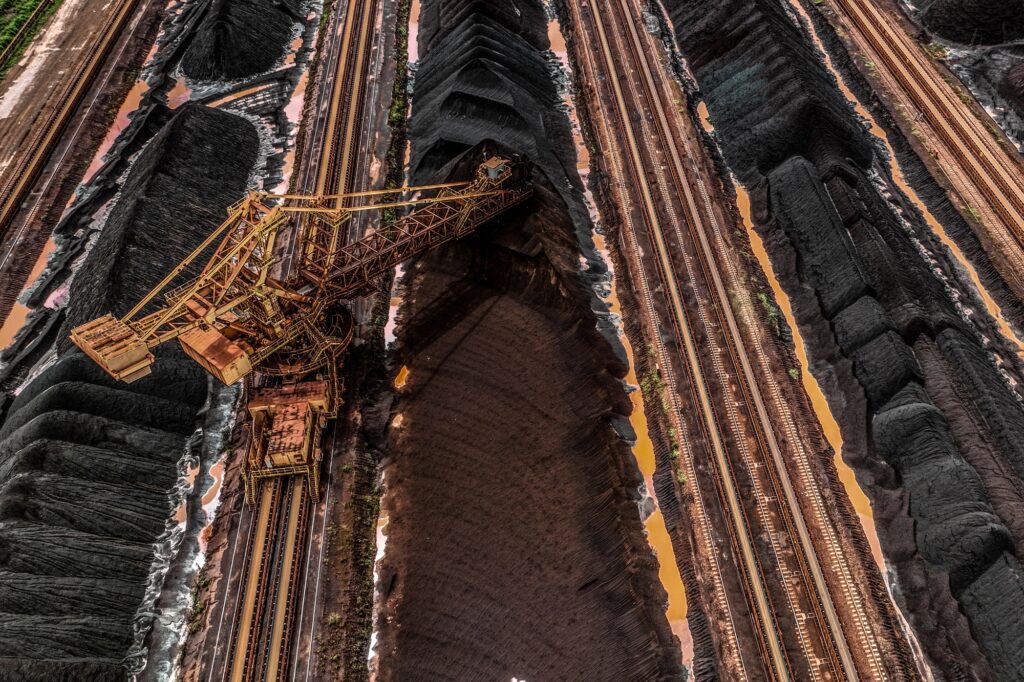

- China increases imports as steel output edges up

- India’s exports of iron ore, pellets up sharply

- Brazil raises exports by around 10% y-o-y

Morning Brief: Global iron ore trade volumes inched up by around 5% on the year to 1.59 billion tonnes (bnt) in CY’23 from 1.52 bnt recorded in CY’22. The increase was wholly due to the marginal rise in Chinese crude steel production in CY’23 amid the lack of any definite policy of production cap of the Chinese government and high volume of steel exports, BigMint understands.

With total iron ore and pellet exports totalling around 855 mnt, Australia accounted for around 54% of total global exports, while Brazil, the second-largest producer, accounted for around 24% of seaborne exports at over 380 mnt – up 10% y-o-y. Notably, exports of iron ore and pellets by India surged 177% y-o-y to 44 mnt from around 16 mnt.

Countries such as Sweden increased their iron ore and pellet export volumes significantly due to the inherently high quality of Nordic ore amid increasing demand for high-grade ore for DR-ironmaking.

Global iron ore consumption, as per data collated by BigMint, stood at 2.51 bnt in CY’23 compared with 2.25 bnt in CY’22 – an increase of close to 12% y-o-y. This necessarily explains the rise in seaborne trade in CY’23.

Factors driving seaborne trade

- Higher imports by China: China increased its imports of iron ore by nearly 7% in CY’23 as the country’s crude steel production edged up by 1.2-1.3% despite falling sharply in December. China’s domestic iron ore production fell marginally last year, while steel output was firm at 1.02 bnt in the absence of production control directives, as well as steel exports touching a level of over 90 mnt in CY’23. Also, iron ore stocks at Chinese ports decreased from 134 mnt seen in early Jan’23 to 105 mnt in Oct’23, which also supported import bookings.

- India’s exports touch 3-year high: India’s exports of iron ore and pellets rose sharply to a 3-year high of over 44 mnt in CY’23. The government’s move to rescind a 50% export duty on all grades of iron ore and 45% on pellets in November 2022 led to exports regaining momentum in CY’23. Out of 44 mnt, around 33 mnt were iron ore – mostly low-grade as the export tariff on iron ore above 58% stands at 30%. Nearly 11 mnt of pellets were exported last year.

- Brazil ramps up exports: Iron ore and pellet exports increased by around 10% y-o-y to over 380 mnt in CY’23 from a level of 346 mnt in the preceding calendar year. The world’s second-largest iron ore producer was able to increase exports significantly due to higher production by Vale – one the world’s largest iron ore miners. Vale increased production by 4.3% y-o-y to 321.15 mnt in 2023, as per the company’s annual report. Production volumes exceeded the forecast of 315 mnt.

Outlook

In CY’24, global seaborne iron ore trade will depend on China’s steel production volumes. Outlook on Chinese crude steel production will emerge more clearly after the Two Sessions in March even as no indication of a production cap is yet in sight, as the government looks to sustain economic growth momentum. However, the property sector slump is a major drag on steel demand and relatively weak steel margins will continue to remain a deterrent.

That said, the unorganised nature of the domestic scrap sector in China and highly volatile electricity prices (amid recurrent problems with hydropower generation seen last year) have impacted EAF steel production, and this is continuing to reinforce the dependence on iron ore. China targets a 15% share for EAF steel production by CY’30.

Major global iron ore miners have kept their production guidance intact for CY’24, as BigMint reported earlier, and a mild recovery in the EU and Japan, possibility of stimulus-induced recovery in China, and strong economic momentum in South East Asia amid fast-paced growth in crude steel capacity addition are expected to keep global iron ore trade supported.