China’s steel and iron ore demand recovery would be slower than anticipated as market confidence has been dampened by no stimulus measures for downstream property, infrastructure and manufacturing sectors in the just-concluded Two Sessions government meeting March 5-11.

The imbalance in supply-demand fundamentals was the key reason for iron ore prices to plunge. Market sources expect no further positive changes in the near term. Based on historical data, accomplishing a balance and a trend change are all the result of macroeconomic policies as well as companies’ commodity strategy modifications.

Supply-demand imbalance

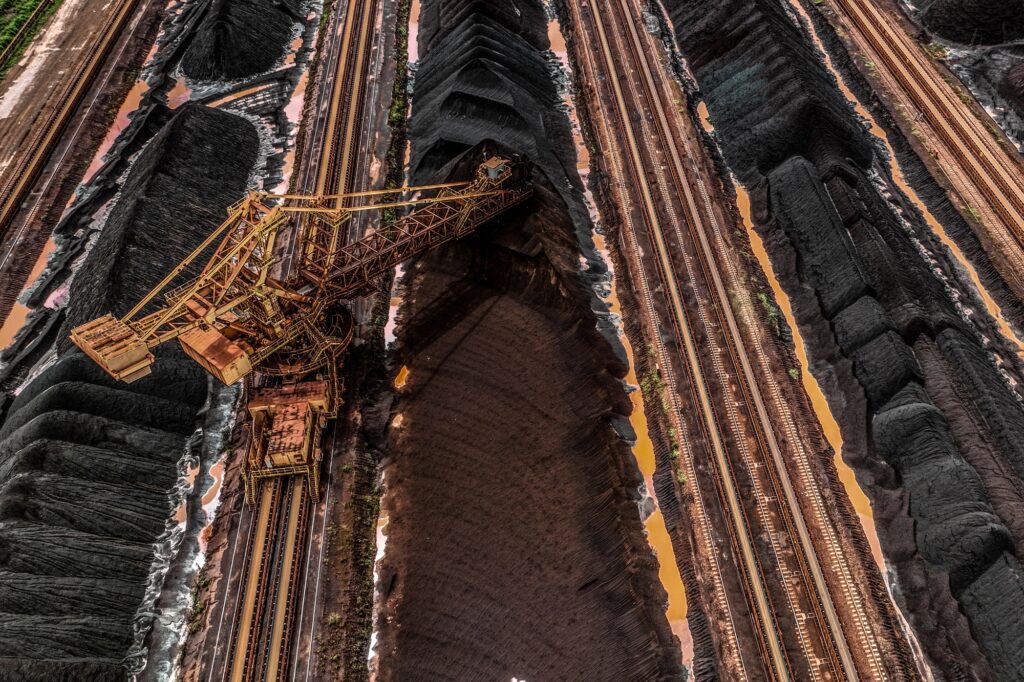

From the supply side, China’s iron ore imports in January-February climbed 8.1% from the previous year to reach 209.45 million mt, customs data showed.

Steel mills booked ample cargoes in late-2023 when iron ore prices surged on fears of high prices, as well as to build up stock ahead of Lunar New Year holidays to meet anticipated demand.

The iron ore weekly discharge volumes at 47 major ports in China surpassed 28 million mt in the past two weeks, the highest since Oct. 9, S&P Global Commodities at Sea data showed.

Meanwhile, inventories at key ports crossed 130 million mt in recent weeks, almost a one-year high, data from research agency CEIC showed.

Steelmakers’ restocking activities after the break were slower than market expectations. This led to inventory accumulating at the ports.

From the demand side, reducing iron ore demand from steel mills was attributed to blast furnace maintenance.

According to an S&P Global Commodity Insights survey of Chinese steel mills in January, multiple mills planned to have blast furnace and production line maintenance works from mid-February to early-March.

The current negative production margins could continue and weak steel demand expectations may further squeeze mills’ margins, sources said. Therefore, some ongoing maintenance was extended and more mills have planned works in March.

Chinese domestic rebar margin was at minus $53.23/mt March 11 and HRC margin was at minus $34.90/mt, according to an analysis by S&P Global.

A Jiangsu steel mill has started a four-month maintenance in mid-February for its 5,800 cu m furnace that would end in July. It will affect 15,000-20,000 mt/d of molten iron output, a steel mill source said.

China’s daily molten iron output volume was around 2 million mt the week to March 8, compared with 2.2 million mt in the same period last year, according to market sources. The daily molten iron output volume was unlikely to increase further in March, especially under the possibility of continued negative margins.

Sluggish finished steel demand

China’s cumulative steel exports in January-February reached 15.91 million mt, a year-on-year increase of 32.6%, customs data showed.

Total crude steel output at major Chinese steel companies dropped 3.38% to 20.58 million mt over March 1-10 from the last 10 days in February, while finished steel inventory rose 8.35% over the same period, China Iron and Steel Association data showed.

The crude steel output decrease and absolute export volume increase, along with finished steel inventory continuing to pile up, point toward a bearish domestic steel market.

A potential demand increase in spring would not gather sufficient volumes to support prices, some market participants said.

The Platts 62% Fe Iron Ore Index, or IODEX, fell to $110.30/dry mt CFR North China March 12 from $143.95/dmt CFR on Jan. 3, a decline of 23.4%, S&P Global data showed.

China did not release incentives for property and infrastructure investment but stressed developing new quality productive forces at the Two Sessions meeting.

These productive forces are unlikely to be enough to replace the old ones, especially in the case of the property sector, market sources said.

The central government plans to issue Yuan 1 trillion ($139 billion) of ultra-long special bonds in 2024. Given their extended maturity, the bonds are directed toward foundational, large-scale infrastructure projects.

In general, it would take three-six months from entities receiving financial support to reflecting in steel demand. Hence, a further increase in domestic steel demand could only happen in the second half of the year.

China is implementing a replacement program for used cars, outdated equipment and consumer goods, in a bid to help boost economic activity.

The China Association of Automobile Manufacturers’ production and sales data showed that in February, automotive production and sales were at 1.51 million units and 1.58 million units, respectively, a month-on-month decrease of 37.5% and 35.1% and a year-on-year decrease of 25.9% and 19.9%.

Any impact on the steel market from the replacement program would take time. Steel usage in new energy vehicles is lesser than in internal combustion engine vehicles while buyers would tend to prefer NEVs as a replacement due to their cost-effectiveness. The largest steel demand increase would likely be in engineering machinery replacement in 2024, market sources added.

By: Chelsea Ye

Source: S&P Global