Warrior Met Coal (NYSE: HCC) was upgraded by research analysts at Citigroup from a “neutral” rating to a “buy” rating in a research note issued to investors on Thursday, Marketbeat Ratings reports. The brokerage presently has a $75.00 target price on the stock, up from their previous target price of $60.00. Citigroup’s target price indicates a potential upside of 20.02% from the company’s current price.

Separately, UBS Group assumed coverage on Warrior Met Coal in a report on Tuesday, January 16th. They issued a “neutral” rating and a $68.00 target price for the company. Two analysts have rated the stock with a hold rating and three have assigned a buy rating to the stock. Based on data from MarketBeat, the stock presently has an average rating of “Moderate Buy” and an average price target of $63.60.

Shares of Warrior Met Coal stock opened at $62.49 on Thursday. The company has a market cap of $3.27 billion, a PE ratio of 6.79 and a beta of 1.09. Warrior Met Coal has a 52 week low of $31.97 and a 52 week high of $69.97. The business has a 50 day moving average price of $58.42 and a 200-day moving average price of $56.78. The company has a quick ratio of 5.99, a current ratio of 7.24 and a debt-to-equity ratio of 0.10.

Warrior Met Coal (NYSE: HCC) last issued its quarterly earnings data on Wednesday, February 14th. The company reported $2.49 EPS for the quarter, missing the consensus estimate of $3.16 by ($0.67). The company had revenue of $363.80 million during the quarter, compared to analysts’ expectations of $393.04 million. Warrior Met Coal had a return on equity of 28.99% and a net margin of 28.55%. The business’s revenue for the quarter was up 5.5% compared to the same quarter last year. During the same period last year, the company earned $1.90 earnings per share. Equities analysts anticipate that Warrior Met Coal will post 8.41 earnings per share for the current fiscal year.

Insider Activity

In related news, Director Alan H. Schumacher purchased 2,000 shares of Warrior Met Coal stock in a transaction dated Friday, February 23rd. The stock was bought at an average cost of $58.15 per share, for a total transaction of $116,300.00. Following the completion of the transaction, the director now owns 30,270 shares in the company, valued at $1,760,200.50. The acquisition was disclosed in a filing with the Securities & Exchange Commission, which is available through this hyperlink. 1.00% of the stock is owned by company insiders.

Institutional Investors Weigh In On Warrior Met Coal

Several large investors have recently added to or reduced their stakes in the business. Vanguard Group Inc. boosted its stake in Warrior Met Coal by 0.9% during the third quarter. Vanguard Group Inc. now owns 7,023,009 shares of the company’s stock valued at $199,734,000 after buying an additional 63,814 shares during the period. KGH Ltd lifted its stake in Warrior Met Coal by 11.2% during the third quarter. KGH Ltd now owns 2,590,000 shares of the company’s stock worth $132,297,000 after purchasing an additional 260,091 shares during the last quarter. FMR LLC lifted its stake in Warrior Met Coal by 1.0% during the third quarter. FMR LLC now owns 2,325,535 shares of the company’s stock worth $118,788,000 after purchasing an additional 22,730 shares during the last quarter. Renaissance Technologies LLC lifted its stake in Warrior Met Coal by 74.7% during the first quarter. Renaissance Technologies LLC now owns 2,125,379 shares of the company’s stock worth $78,873,000 after purchasing an additional 909,000 shares during the last quarter. Finally, State Street Corp lifted its stake in Warrior Met Coal by 0.4% during the third quarter. State Street Corp now owns 1,901,231 shares of the company’s stock worth $54,071,000 after purchasing an additional 6,976 shares during the last quarter. Institutional investors own 92.28% of the company’s stock.

About Warrior Met Coal

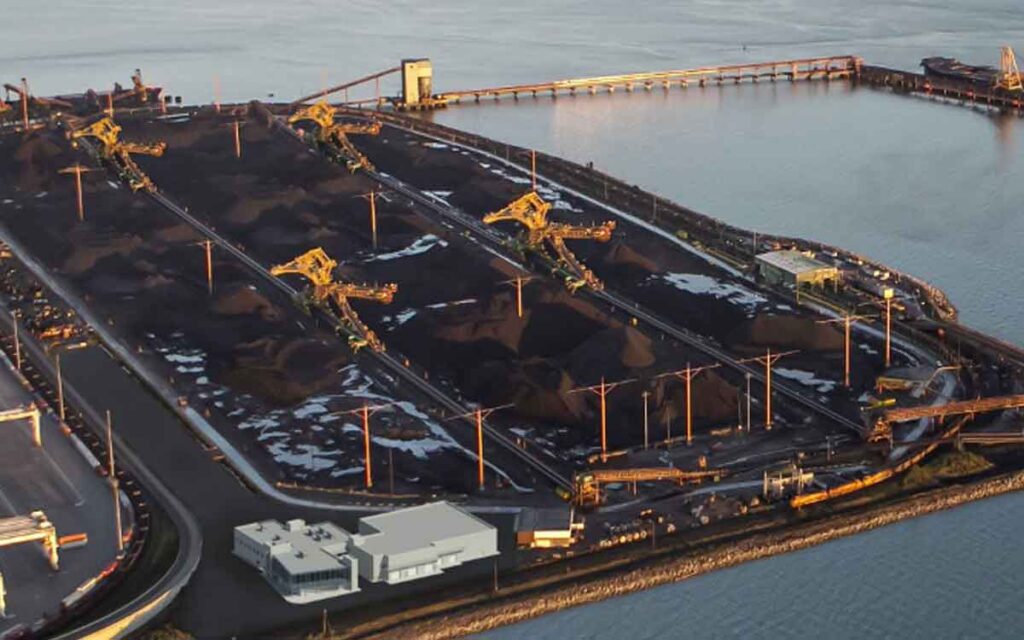

Warrior Met Coal, Inc produces and exports non-thermal metallurgical coal for the steel industry. It operates two underground mines located in Alabama. The company sells its metallurgical coal to a customer base of blast furnace steel producers located primarily in Europe, South America, and Asia. It also sells natural gas, which is extracted as a byproduct from coal production.