Chinese prices of seaborne imported coking coal lost ground during April 22-26. Meanwhile, the pace of price increase for Mongolian coking coal delivered into China has also slowed during the same period.

As of April 26, the price for Russian K4 premium coking coal had remained stable at Yuan 1,800/tonne ($248/t) from a week earlier, contrasting with the Yuan 220/t surge observed in the prior survey week, according to Mysteel’s database. Prices for locally-mined Inagli and Elga fat coal had even decreased by Yuan 40/t and Yuan 10/t on week to reach Yuan 1,660/t and Yuan 1,400/t respectively, all on ex-warehouse basis at North China’s Jingtang port and including the 13% VAT.

The demand for imported coking coal from most domestic steelmakers remained relatively good last week, while some of them started to show reluctance toward high-priced coal resources, aiming to maintain reasonable costs. This cautious stance towards pricy coal prompted port traders to slightly reduce their offers to stimulate sales, Mysteel Global learned.

In the same period, domestic coke producers opted to purchase only enough import coking coal to meet current production needs, as they continued to face losses despite managing to persuade steelmakers to accept two price increases totalling Yuan 200-220/t on April 22 and April 26 respectively.

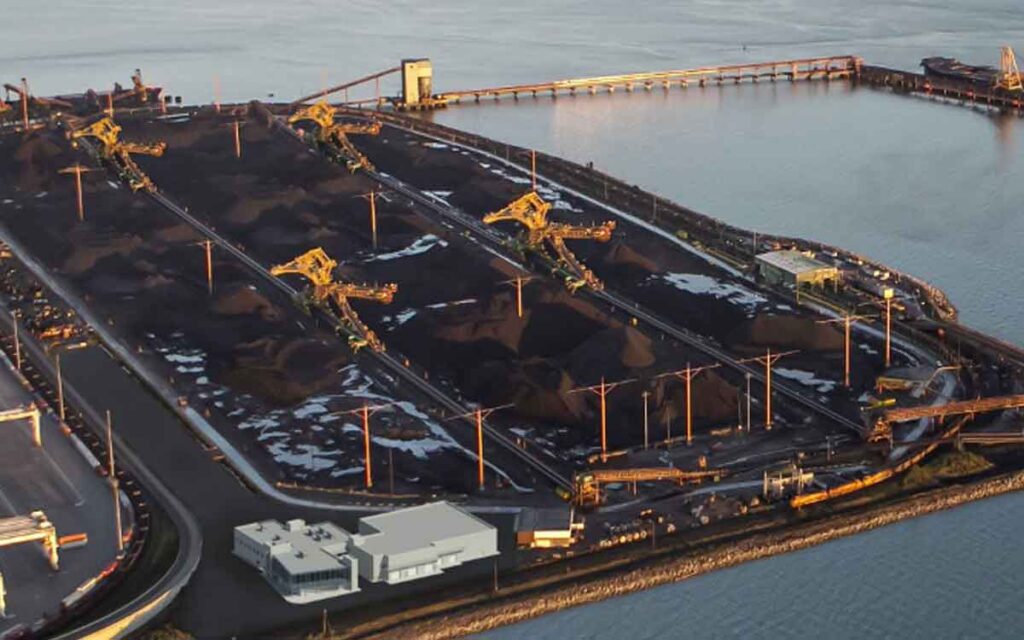

As of April 26, total stocks of all imported coking coal at the five major Chinese ports under Mysteel’s monitoring – Rizhao, Jingtang, Qingdao, Lianyungang and Zhanjiang – had climbed to about 2.2 million tonnes, higher by 176,500 tonnes on week.

During the same period, the growth in prices of Mongolian coking coal also slowed due to subdued trading activities. As of April 26, the price of Mongolian 5# raw coal (ash 18%, VM 23-28.5%, sulfur 0.6%, GRI 80-85) inched up by Yuan 10/t on week to Yuan 1,360/t including VAT, slowing clearly from the previous week’s Yuan 105/t increase, on ex-warehouse basis at the Ganqimaodu border crossing in North China’s Inner Mongolia, according to Mysteel’s tracking.

In terms of Mongolian coal shipments, the number of trucks moving coal from Mongolia to Ganqimaodu averaged 895 units/day over April 22-26, down by about 14% from the prior week, according to Mysteel’s survey.

Over the same period, truck traffic delivering Mongolian coal to China via the other key border-crossing points of Ceke and Mandula (also in Inner Mongolia) reached 593 units/day and 293 units/day on average, with the former down by 8% while the latter up by 30% on week, Mysteel’s survey showed.

Written by Winnie Han