Teck reported its unaudited results for the first quarter of 2024, highlighting significant strides in copper production alongside a steady performance in its steelmaking coal segment. With the completion of major construction at the QB operation and the successful shipment of its first concentrate, Teck continues to strengthen its position in the global mining sector.

Financial and Operational Highlights

- Adjusted EBITDA: Reached $1.7 billion in Q1 2024, influenced by robust pricing in steelmaking coal and copper.

- Steelmaking Coal Performance: The segment generated $1.4 billion in gross profit before depreciation and amortization, with sales volumes of 5.9 million tonnes and an impressive average realized price of US$297 per tonne.

- Copper Production Surge: Increased by 74% to 99,000 tonnes, with the QB operation contributing 43,300 tonnes as it progresses through its ramp-up phase.

- Shareholder Returns: Teck returned a total of $145 million to shareholders through share repurchases and dividends.

- Liquidity and Cash Flows: Reported strong liquidity of $7.1 billion and operational cash flows of $1.4 billion, maintaining a healthy cash balance of $1.3 billion after significant tax payments.

Strategic Developments in the Steelmaking Coal Segment

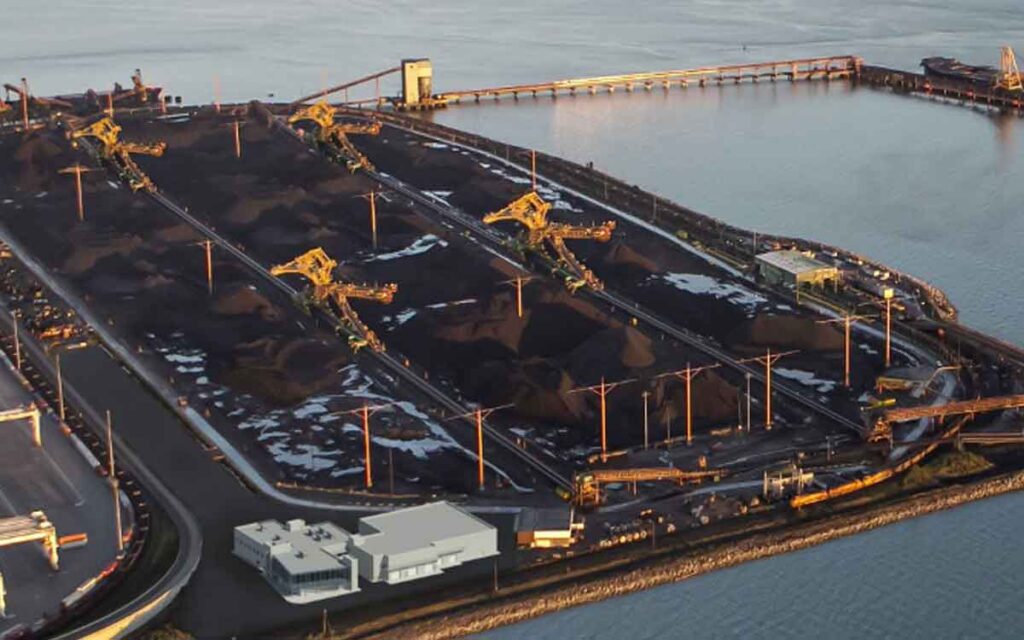

The first quarter of 2024 marked a notable period for Teck’s steelmaking coal business. The company successfully closed the sale of a 20% minority interest in Elk Valley Resources (EVR) to Nippon Steel Corporation (NSC), enhancing its strategic partnerships and securing significant capital through this transaction. This move underscores Teck’s ongoing commitment to optimizing its asset base and reinforcing its market position in steelmaking coal.

Despite facing challenges such as fluctuating market demands and logistical constraints, Teck managed to maintain strong sales volumes and exceptional pricing levels in the steelmaking coal sector. The average realized price of US$297 per tonne highlights the premium quality of Teck’s coal and its critical role in global steel production.

Looking Ahead: Focus on Expansion and Sustainability

As Teck continues to ramp up operations at the QB site, the company is poised for increased production capacity, especially in its copper segment. The successful completion of construction and the operational launch of the shiploader and molybdenum plant are significant milestones that are expected to contribute to further operational efficiencies and increased output in the upcoming quarters.

In addition to operational growth, Teck remains committed to leading the industry in sustainability practices. The company’s latest sustainability report details significant progress in decarbonization efforts, diversity initiatives, and a push towards a nature-positive future. These efforts are integral to Teck’s corporate ethos and are reflected in its operational practices and strategic objectives.

Market Outlook and Future Projections

Teck’s leadership in steelmaking coal and copper production positions it well to capitalize on expected improvements in market conditions. With steelmaking coal prices stabilizing at high levels and copper prices reaching two-year highs, Teck is strategically positioned to benefit from global economic trends and the increasing demand for infrastructure and technology materials.

As the company moves forward in 2024, it remains focused on maximizing value from its existing operations while strategically expanding its production capacity to meet the growing global demand. This balanced approach aims to ensure sustainable growth and robust returns for shareholders in a dynamic market environment.

By Coal Newswire, AI generated