There’s no doubt BHP’s move on Anglo American is focused on long-term copper demand, but it would be a mistake to think there’s nothing else of value in the rest of Anglo’s portfolio.

Take Anglo’s Minas-Rio iron ore assets, for example.

Taken in proportion with the underlying earnings delivered by each division, BHP is effectively offering $US3.3bn to acquire Minas-Rio, which is producing about 24 million tonnes of high grade Brazilian iron ore a year.

Compare that to Rio’s decision to invest $US6.2bn in its share of the costs of building the giant Simandou operation in Guinea. Under the complicated joint venture arrangements for the deposit, Rio’s equity share of production will be about 26 million tonnes a year of iron ore – with production still some time away.

Acquiring Minas-Rio will come as BHP weighs the long-term future of its Pilbara iron ore assets. They still generate eye-watering levels of cash, and will do so for years to come. But BHP is also hitting the point in its own investment cycle where new hubs will need to be built, and that is no longer the easy option in the current environment.

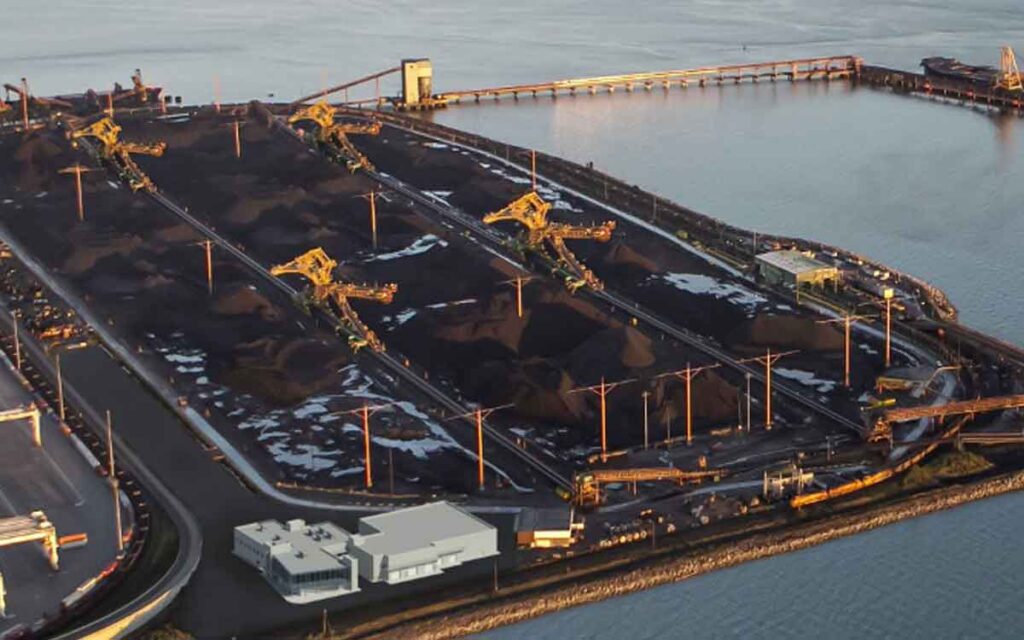

It may seem odd that BHP decided to sell its Daunia and Blackwater mines in Queensland and then buy back that production through Anglo. But the synergies between Anglo’s coking coal mines and their nearby BHP counterparts created the kind of obvious synergies that deliver real returns to shareholders – and a clear play to dominate a lucrative region of the Bowen basin.

And combined those assets are a relatively easy prospect for a coking coal spin-out, if and when BHP decides it wants to get out of coal completely.

The outlier might be the De Beers diamond operations in Africa, which don’t sit easily with Mike Henry’s future-facing mantra. But BHP is still looking for new assets in Africa and the relationships that come with long-established businesses such as De Beers are worth real money, if BHP can capitalise on its stewardship of the venerable diamond producer.

BHP said on Thursday De Beers would be subject to a strategic review after the acquisition.

But the prestige attached to the diamond trade is a often a fillip for public relations in the corporate world. Rio Tinto made hay for decades out of its Argyle diamond mine in the Pilbara – financially marginal, but a photo of a large sparkly object under auction will get a good run on a quiet news day anywhere in the world.

Even Anglo’s most controversial asset might find a good home in BHP’s long-term portfolio. Analysts and investors have never been keen on Anglo’s 2020 decision to spend £405m on buying out Sirius Minerals and take on the multibillion-dollar task of building a potash mine deep underground in England.

Anglo chief executive Duncan Wanblad’s decision to push ahead with the development of the mine, now known as Woodsmith, was also unpopular with the market.

But sources close to Anglo say the company’s commitment to the development of Woodsmith is unwavering for good reasons. The mine will produce a fertiliser based on polyhalite mineral, little used in the agricultural sector to date.

But Woodsmith’s proximity to European markets could play well into BHP’s broader strategy in potash, sources say, particularly given the mine is due to deliver its first product in 2027, around the same time BHP expects to begin ramping up production from its Jansen potash project in Canada.

If anything, it is acquiring Anglo’s copper assets that will generate the most external opposition to the deal.

BHP is already on the verge of eclipsing Chile’s Codelco as the biggest copper producer in the world. Relations between Anglo and Codelco are friendly and BHP also has pleasant relations. The prospect of a friendly compact between the major players in the world’s biggest copper producer, Chile, would not be welcomed in China, for example.

By Nick Evans, The Australian