Met & Thermal Coal Producer Valuations:

I finally got around to developing thermal forecasts in order to rank all of the US coal producers on the same valuation metrics. In this article, I’ll start by providing an updated price deck for met and thermal, along with some price commentary. Then I’ll provide the producer profitability metrics on a per ton basis for met and thermal, along with EV/EBITDA and FCF Yield information. I’ll finish by providing a theoretical framework on how I think about valuing coal companies.

Price Deck

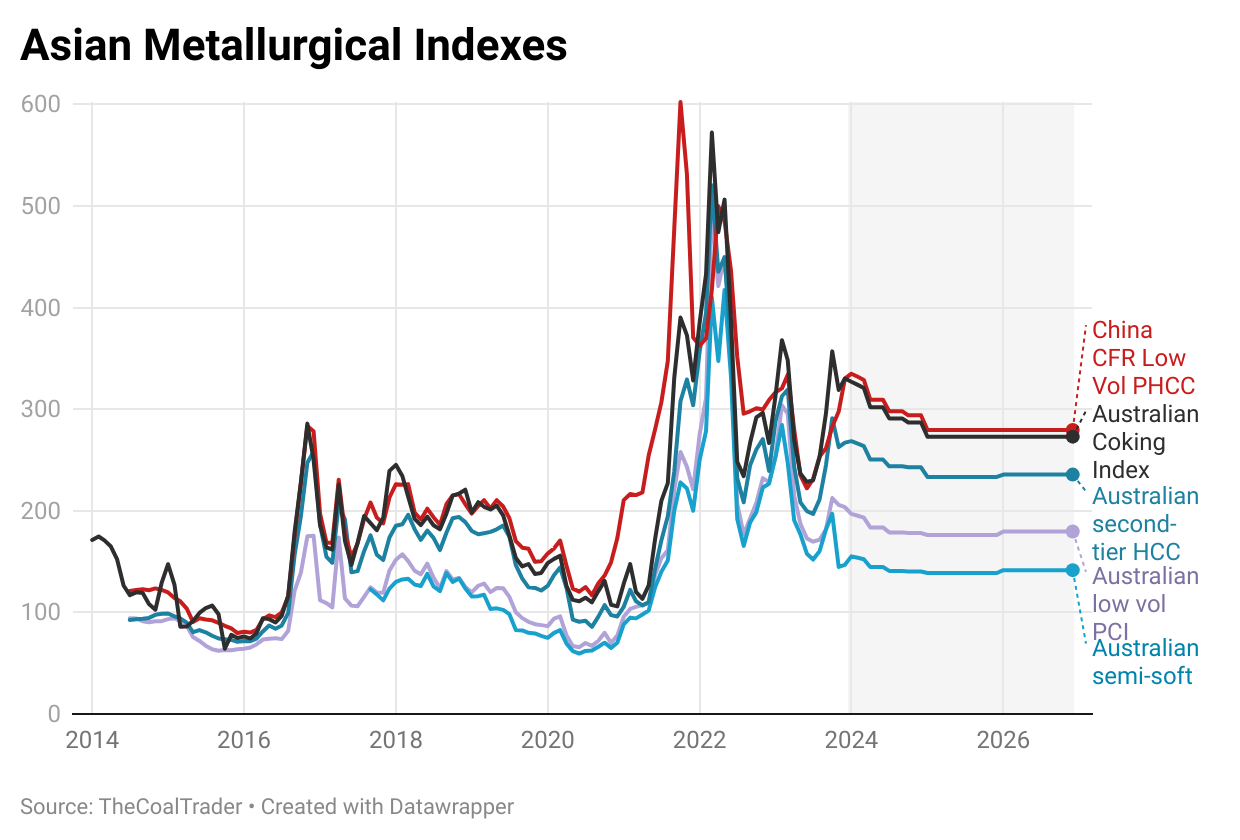

Herewith the metallurgical price forwards. The spreads for Aussie PCI and semi-soft are very wide by historical norms. I think this is due all of the lower quality Russian and Mongolian met supply which has been increasingly growing for Chinese and Indian end-markets. The reinstatement of Chinese tariffs on non ASEAN & Aussie coal may help these spreads a bit, but it’s driven by supply/demand fundamentals which I don’t see changing anytime soon.

This is one of those nuances where you could’ve been right, but still got the big picture wrong. For example, some pundits saw the growth of Mongolian met supply and anticipated the demise of global met pricing. However, the quality nuance is particularly important here, as you know. High quality coking coal supply has at best been flat, perhaps only growing slightly in China and the USA. Whereas in the primary market, Australia, it has been shrinking for the past few years. This is something to be watchful of going forward, and I think these spreads will be with us for a while.

Editors note: you can see these interactive charts and a price table on thecoaltrader.com, here and here.

For US East Coast indexes, the quality spread is probably “about right.” However, the market maker over at Platts has low vol about $3/mt lower than high-vol A, and it doesn’t make a lot of sense to me. All of the incremental supply throughout the world has been from the high(er)-vol category, even in China. In terms of supply and demand, the low-vol price should be higher than high-vol, not lower. I show the high-vol A vs low vol spread closing going forward, but so far the market makers have not agreed with me.

In terms of seaborne thermal prices, this winter has been very bearish in terms of weather, at least so far. If it continues in this manner, all of 2024 will be wrecked from a supply vs demand standpoint. I would really like to see some harsh winter weather in order to make the BUY recommendation on Peabody, for example, easier. But the weather is what it is. Nevertheless, the Chinese tariff situation probably helps Australian thermal producers at the margin.

Forecasts:

The met unit economics are below. In terms of sales price, Peabody is out in the lead which is surprising. I’ve scrubbed the figures and I believe the Australian vs US spreads are the explanation for Peabody’s anticipated outperformance here, despite mostly lower-quality met production. Warrior is next in line, which is not surprising given it’s generally higher quality and Aussie benchmarks.

Nothing stands out in terms of costs. The longwalls are lower relative to room and pillar operations as we should be used to by now. Warrior takes the lead in terms of profit margins due to higher qualities, Aussie benchmarks (which are better at the moment vs US East Coast indexes), and significant transportation advantages.

For thermal unit economics, Alliance and CONSOL are basically neck in neck in terms of sales price. CONSOL outperforms on cash costs between the two, as the PAMC is simply a world class asset with competitive advantages that show up on the bottom line. Arch and Peabody are closer comps due to the PRB exposure, but Peabody’s ‘seaborne thermal’ and ‘other US’ segments makes the comparison wonky at best. Despite this, you can see how the PRB operations are really a different kind of business model, one that is undifferentiated and volume based as opposed to having competitive advantages and pricing power.

Valuation Comps

Throwing it all together, you can see the valuation differences pretty clearly in the table below:

In terms of FCF Yield, the ranking from “cheapest” to “most expensive” is as follows:

- Peabody – 24.1%

- Warrior – 21.7%

- Arch – 16.8%

- Ramaco – 14.1%

- CONSOL – 13.3%

- Alpha – 11.7%

- Alliance – 9.7%

Commentary

In terms of theoretical valuations. I still firmly believe the metallurgical segments/companies should be valued around 6.5x. This is approximately in-line with metals miners. The difference between the 6.5x target and where met names are trading today is simply due to a perceived carbon discount in the market. This discount is our opportunity.

There’s always a reason things are mispriced in markets, and if you can pinpoint those reasons and be okay with them, then its to your advantage. In this case, the reason isn’t really a disadvantage, at least for the foreseeable future. It would be a different story if the carbon discount was causing associated demand destruction in metallurgical markets – but it isn’t. Metallurgical coke capacity on a global basis continues to grow whereas metallurgical coal supply continues to struggle.

The market is therefore providing us with the opportunity to buy these companies at a significant discount. And since I personally do not have an ESG or carbon mandate, I’m going to continue sinking as much personal capital into these names as possible.

Taking this logic a step further helps to answer the age old question, “when should we take profits?” Based on the above paragraph, we should start to trim when the met producers are trading at 6.5x.

Let’s see how well you understand this concept by giving you a pop quiz:

- Should you sell Alpha today since it’s the most expensive of its peer group?

Hopefully you answered NO. Alpha is a unique situation where management and the board are all-in on the capital return strategy – buybacks – and its definitely benefiting the share price. Why would you get off that train?

So, my general recommendation is to hold Alpha and resist the urge to trim, despite your gains. Instead, focus on allocating new capital towards the cheaper names like Warrior and Peabody. Don’t sell Alpha to fund new purchases. Instead put more money in your account to buy Warrior or Peabody, or sell something else, perhaps a different position your portfolio, one where everyone isn’t fighting to be the last shareholder!

Now let’s apply this framework to the thermal coal segments/companies. Is the carbon discount associated with real world demand destruction? I think the answer is yes. As long as there’s cheap and plentiful natural gas to back up intermittent renewables, the world is going to go along with the “coal is bad” mantra. Sure, China and India are adding coal-fired capacity, but they’re also growing supply in order to mitigate the need for imports. This is much different dynamic compared to met markets. I therefore think thermal coal multiples should trade lower, probably around 3.5-4x.

Question #2 on your pop quiz:

- Should you sell CONSOL given the above valuations?

The answer is probably YES. I know CONSOL wants to be like Alpha and buyback every last share, but they’re running into significant headwinds in 2024. And if you owned it from lower levels, you already got the rerate from 1.5x up to 4.5x. You won, so ring the register.