Coal News & Price Data July 5, 2024 – Mine Fires Reignite Met Market Interest

Holy supply disruptions, Batman. Not one, not two, but these THREE separate incidents are going to tighten up metallurgical coal markets over the next month or so…

Holy supply disruptions, Batman. Not one, not two, but these THREE separate incidents are going to tighten up metallurgical coal markets over the next month or so…

I don’t care for technical analysis much, but sometimes it is the best framework on which to build trade ideas. We examine that here, using HCC as an example…

I don’t care for technical analysis much, but sometimes it is the best framework on which to build trade ideas. We examine that here, using AMR as an example…

What to expect from the website and service over the next few months, and a

What to expect from the website and service over the next few months, and a

This seasonal pullback in PLV Futures has not caused such a bad commensurate pullback in met coal stocks.

Herewith the monthly technical analysis update along with some quick commentary on each coal producer.

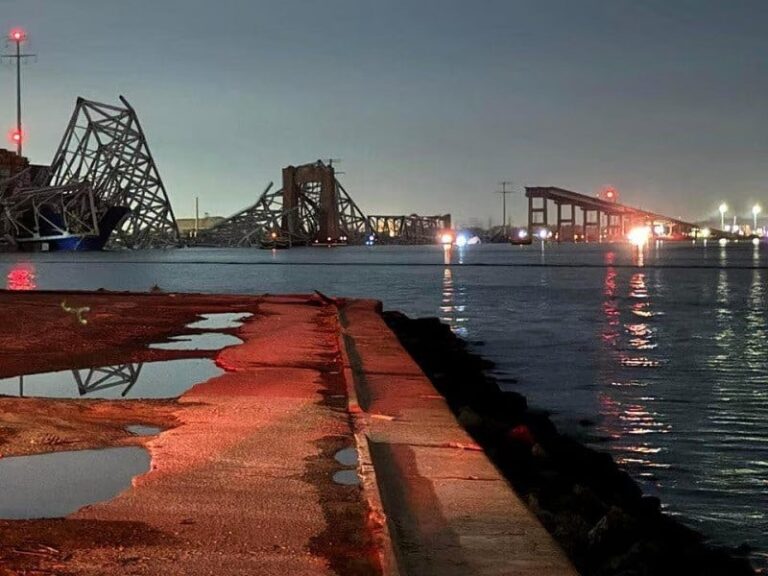

A vessel collision caused the Frances Scott Key bridge in Baltimore to collapse, suspending navigation in Baltimore Harbor.

Now that we’ve seen another annual rug pull in metallurgical coal markets, I thought it appropriate to revise forecasts and valuation comps

Alpha Metallurgical Resources Inc (AMR) leads the Coking Coal industry with an overall score of 57. AMR is up 96.74% so far this year

Alpha is the largest met producer in the US, and the dominant player in Central Appalachia.

Alpha Met a leading US supplier of metallurgical products for the steel industry, released its financial results for the fourth quarter