The Suez Crisis is a pivot point of a unipolar world turning on its axis as it fractures into new bloc formations in a post-Covid continuum, not unlike pre-globalised trade affiliations, and dragging markets along into unfamiliar supply chain territory.

Speaking during a webinar on the shipping disruption that has resulted from Yemen’s Houthi rebels attacking maritime traffic in the Red Sea and the Gulf of Aden, effectively paralysing Egypt’s biggest GDP contributor, maritime security expert Dr Moritz Brake said: “We’re not just talking about the disruption of shipping lines.”

Brake, who heads up maritime consultancy Nexmaris in Köln and is a senior fellow of CASSIS Think Tank at the University of Bonn, said the situation at the Suez is a symptom of a much bigger disruption of the current global economic order. He said as noticeable as disruptions of important waterways such as the Suez are, its current destabilisation is “part of an overall plan – it’s intentional.

“You have to realise that this is not an accident. We’re not just dealing with another Ever Given scenario,” Brake said, referring to the March 2021 incident when an ultra-large container vessel got stuck in the southern channel of the Suez.

“We’re looking at major geopolitical actors causing a disruption here which doesn’t just attack shipping.

“It’s also a major test in the challenge and competition between Russia and Iran via the Houthis as a proxy, against the West, with at least the tacit backing of the Chinese.”

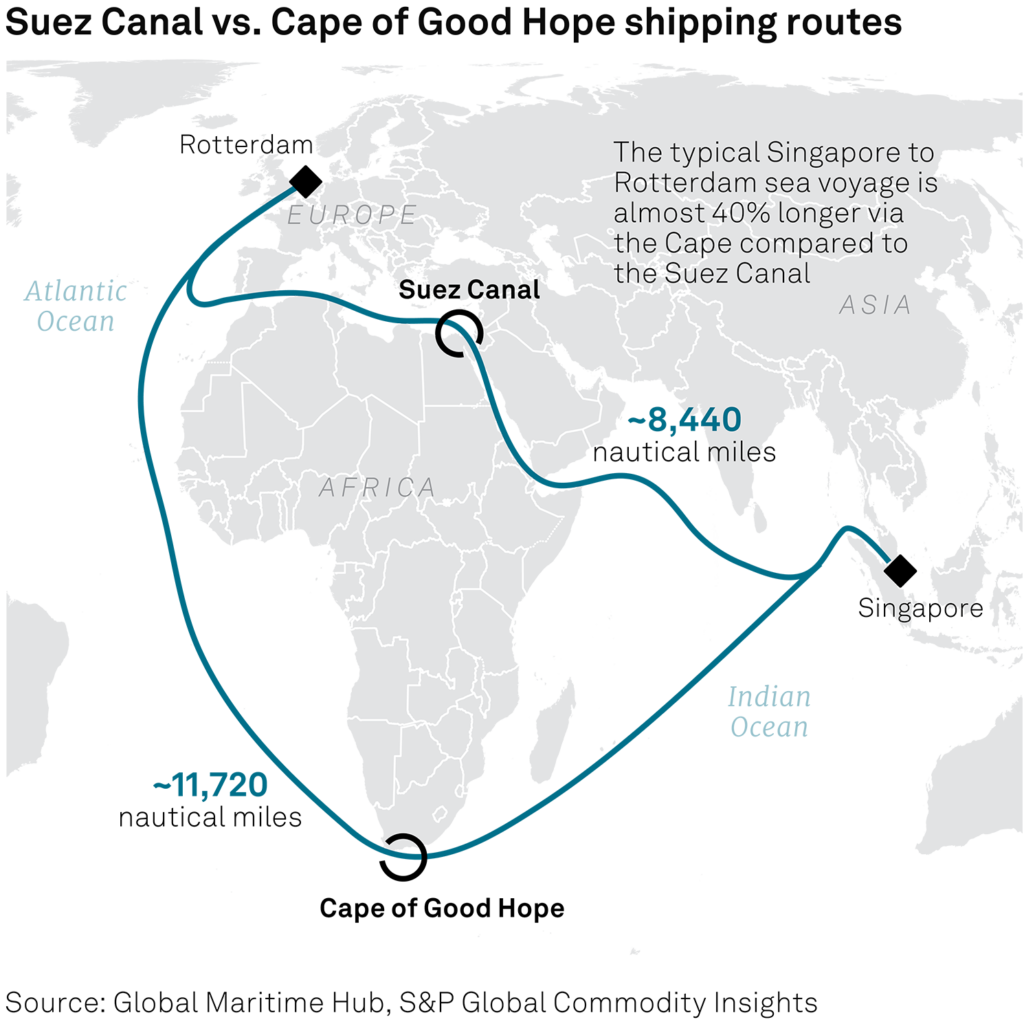

In responding to the Suez Crisis and its impact of leading lines sailing around Africa instead of using the risk-heavy shorter passage between Europe and Asia, the US and Europe must act accordingly, he said. On the surface, the Houthi attacks and counter-attacks by combined naval forces have grabbed the world’s attention, impacting markets as far away as Germany, where industrial shutdowns have led to layoffs and increased economic pressure. Ultimately there’s much more at play than headline-grabbing waterway disruption.

“It leads to a noticeable danger of solidifying blocs,” Brake said.

“Because of these attacks, certain trade structures will become more favourable than others. Existing competition between East and West is, in one way or another, supported by these attacks and the building of blocs.”

Caught in between, Brake warned attendees of the webinar organised by South Africa’s Maritime Business Council (MBC), are smaller countries dragged along in the wake of bigger economies increasingly hostile to one another.

“It cannot be in the interest of many countries finding themselves in between. Who do they align with?”

He said as deplorable as it is that maritime traffic is targeted by countries with ulterior motives and agitating for de-globalised multipolarity, the missile strikes around the Horn of Africa should be seen for what is – a distraction.

“There is a bigger picture here,” Brake said.

By: Eugene Goddard