Japan’s reliance on Russian thermal coal continues to decline, with December 2023 imports dropping 71% year-on-year. This reflects a broader trend of diversification towards other suppliers, as the country aims to reduce its dependence on Russia following the Ukraine conflict.

Key Points:

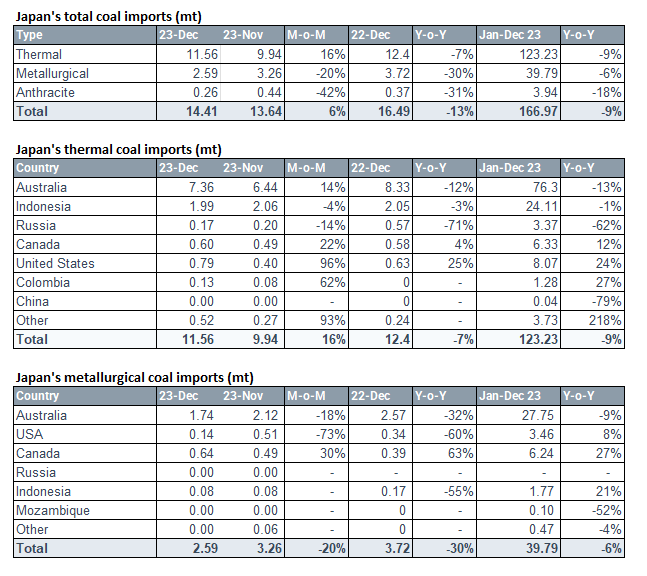

- Overall coal imports: December 2023 intake increased 16% month-on-month but decreased 7% year-on-year to 11.56 million tonnes.

- Full-year 2023: Imports fell 9% to 123.23 million tonnes compared to 2022.

- Russian coal: December imports from Russia plummeted 71% year-on-year to 0.17 million tonnes. Full-year 2023 imports dropped 62% to 3.37 million tonnes.

- Market shift: Sources indicate that Japanese customers are letting Russian term contracts expire without renewal.

- Australian coal: December imports decreased 12% year-on-year to 7.36 million tonnes. Full-year 2023 imports fell 13% to 76.30 million tonnes.

- Indonesian coal: Imports remained stable at around 24.11 million tonnes for the full year 2023.

- Growth from other sources: Japan imported more coal from Canada (up 12%), Colombia (up 27%), and the US (up 24%) in 2023.

- “Other” origins: Imports from unspecified sources skyrocketed by 218% to 3.73 million tonnes in 2023, potentially reflecting increased South African exports.

Analysis:

Japan’s move away from Russian coal aligns with international efforts to isolate Russia economically due to the Ukraine war. The increase in imports from other sources demonstrates efforts to diversify energy supplies and ensure stability. The significant rise in “other” origins warrants further investigation, potentially signaling a growing role for South African producers in the Japanese market.

Additional details:

- The Ministry of Finance provided the data mentioned in the article.

- Market sources were cited to explain the trend of expiring Russian term contracts.