Five steel products that had their import tariffs reduced in 2022 will return to paying the original rates to enter the country. The Executive Committee of the Foreign Trade Chamber’s Management (Gecex-Camex) approved the measure on Thursday (8) in Brasília, partially addressing requests from domestic producers who claimed unfair competition.

Two years ago, the government unilaterally lowered the Import Tax by 10% for a range of industrial inputs. According to Gecex-Camex, today’s decision represents a restoration. The agency continues to review requests to restore the tariff on other products covered by the tariff reductions.

The five products that will face increased tariffs to enter the country are as follows:

- Hot-rolled, non-alloy iron or steel bars, not further worked than forged, hot-rolled, or twisted after rolling, with indented surfaces, ribs, grooves, or other deformations produced during rolling;

- Seamless iron or steel pipes and hollow profiles used for oil or gas pipelines;

- Alloy steel tubes, uncoated, seamless, for well casing;

- Welded circular cross-section iron or steel pipes;

- Welded square or rectangular cross-section iron or steel pipes.

According to Gecex-Camex, the Import Tax for one of these products will rise from 10.8% to 12%. The tariff on two items will increase from 12.6% to 14%. For the remaining two products, it will go up from 14.4% to 16%. The agency did not specify which rate applies to each product, only emphasizing that the tariffs will return to the Mercosur Common External Tariff (TEC).

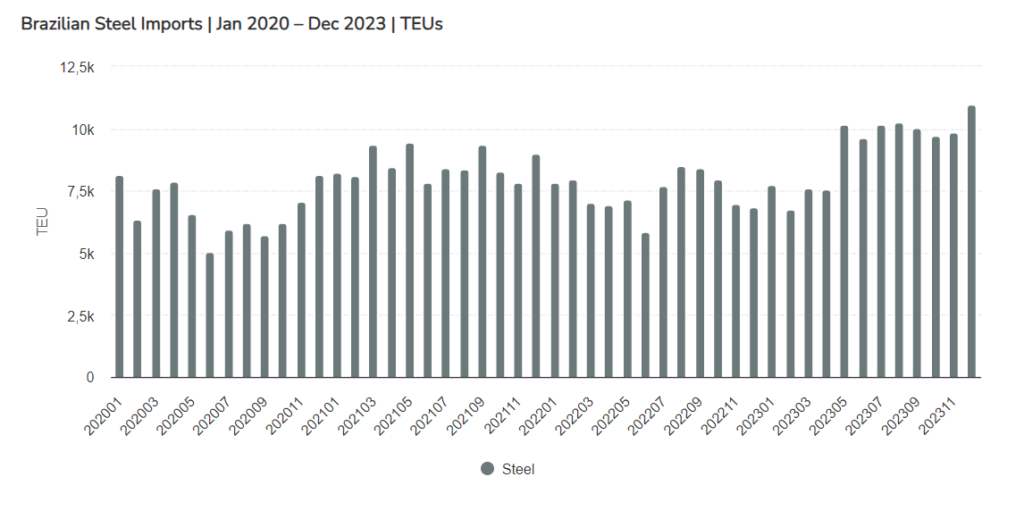

The chart below shows Brazilian steel imports between Jan 2020 and Dec 2023. The data is from DataLiner.

Too Little Too Late?

The Brazilian government’s recent steel tariff increase faces criticism as inadequate. Import duties on five steel products rose by 1.20-1.60%, deemed insufficient by the industry. Brazil’s steel sector demands higher tariffs, currently at 10-13%, to counter rising Chinese imports. In 2023, Brazilian steel imports surged 47% to nearly 5 mt, with 57% from China, while domestic steel production fell 7% to around 32 mt.