Indonesia’s coal production hit a record high of 775.2 million mt in 2023, exceeding the target of 694 million mt set earlier by the government, according to MINERBA One Data (MODI) made public Jan. 19, amid an increase in demand for global seaborne coal.

On a year-on-year basis, output rose 12%, the data showed. Exports stood at 508 million mt in 2023, also reaching a record high, with the fourth quarter seeing the highest shipments at 143.50 million mt compared with the previous quarters, data from S&P Global Commodities at Sea showed. Exports to China were at 215.7 million mt, followed by India at 108.40 million mt in 2023.

“For domestic needs (Domestic Market Obligations) we could meet the needs of 213 million mt and then for exports we could reach 518 million mt,” Minister of Energy and Mineral Resources (ESDM) Arifin Tasrif had said earlier at a press conference on the achievements of ESDM in 2023.

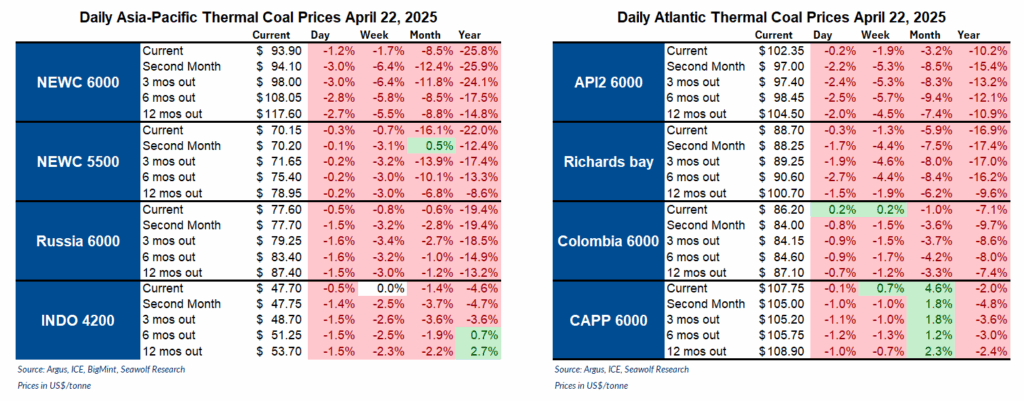

According to S&P Global Commodities Insights data, the prices of FOB Kalimantan 4,200 kcal/kg GAR averaged $63.05/mt in 2023. The prices slid from $90/mt at the beginning of the year to $58/mt by end-year. This led to more exports in Q3 and Q4 compared with the previous two quarters, with buyers making the best of the falling prices. Platts, part of S&P Global Commodity Insights, last assessed the grade at $58/mt Jan. 22.

Historically, the world’s largest coal exporter had sold 462.2 million mt to foreign countries in 2022, according to CAS data.

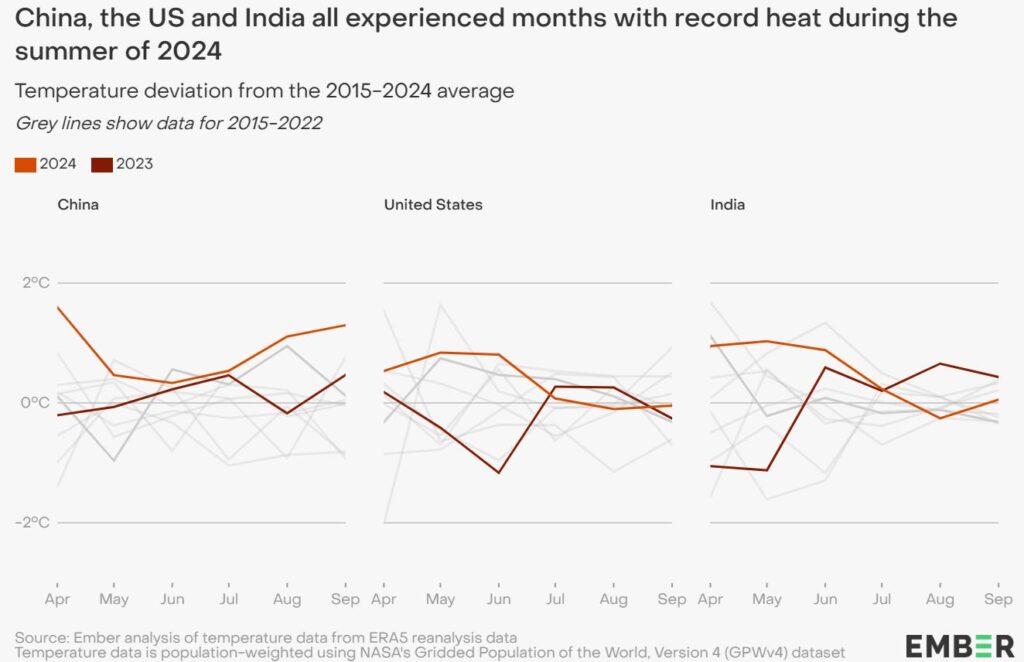

In 2024, “We are expecting that Indonesian miners will jointly produce at least 30 million mt more than 2023’s output,” an Indonesia-based trader said. “The upcoming election will support the production in the first quarter, as power demand will rise in the country. Moreover, domestic supply will see an uptick in the pre-election period. But, once production ramps up, export is likely to rise along with domestic as a cascading effect.”

An India-based trader monitoring the Indonesian market closely further echoing similar views added that the demand from Indonesian local power plants and steel factories will also aid in increased domestic production in the current year. Indonesia has set a target of 710 million mt in the current year.

Some of the market participants on a different note said that although historical data suggests a rise in output and exports, declining demand from major consumers, coupled with miners’ cautiousness about their output targets for the current and next two years, suggests that their overall production might exceed government’s 2024 target. However, this is unlikely to surpass the production levels of the previous year, they added.

“Since the Indonesia general elections are coming, it is possible that some miners might shift some of the portion of their exports to the domestic market instead,” another Indonesia-based trader said. “This means there will be less export quota but more domestic supply and same level of output.”

Indonesian thermal coal supply remained unhindered in 2023 except for a few instances. In September, several miners refrained from offering cargoes due to a delay in the approval of a revised production quota, but supply smoothened in November as the authorities started clearing the applications. In December, the miners were heard to be catering to the demand of domestic smelters and fulfilling their DMOs.