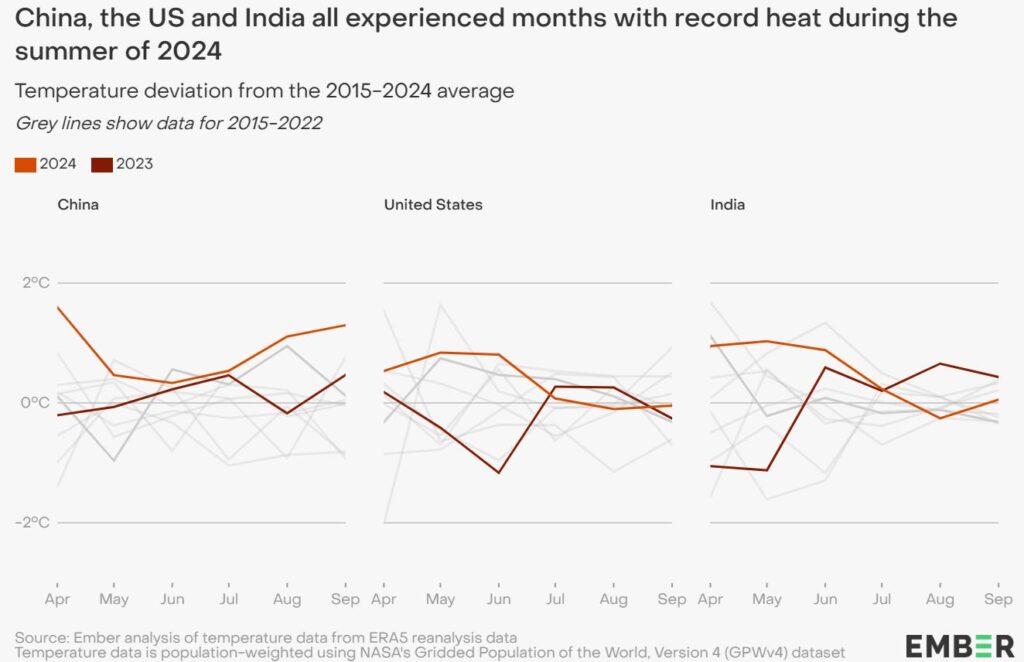

India aims to add 17 gigawatts of coal-based power generation capacity in the next 16 months, its fastest pace in recent years, to avert outages due to a record rise in power demand, according to government officials and documents. The expansion drive comes ahead of this week’s U.N. climate summit COP28, where France and the United States are expected to clamp down on financing for coal plants, a move that India, dependent on coal for 73% of power generation, plans to oppose.

The world’s fastest growing major economy has added an annual average of 5 gigawatts of coal-based electricity generation capacity over the last five years, but it is also ramping up renewable energy. Yet it will fall short of satisfying power demand if it does not expand the number of its coal plants, said two government officials, who did not want to be named as they are not authorised to speak to media.

In the next four months, India plans to add nearly 3 gigawatts of coal-fired generation, while the following fiscal year, starting from April 1, 2025, will see it add 14 gigawatts, or its highest level in eight years, according to internal government documents seen by Reuters. The power ministry did not immediately respond to queries from Reuters.

To ensure completion of projects, New Delhi has begun a review of 38 coal generation plants whose construction has been held up for years, moving to resolve issues over equipment and land acquisition delays, the two officials said. The government expects 28 of these projects to become operational in the next 18 months, it told power producers in a presentation at a meeting on Nov. 21.

Such projects include state-run power company NTPC’s 660-megawatt unit in the eastern state of Bihar which has been delayed for 13 years, and two in the neighboring state of Jharkhand held up for five years.

At the meeting, Power Minister R. K. Singh told public and private power generators that India would “have to add coal-based thermal capacity,” to meet requirements growing at an unprecedented rate, said the two officials, who also attended. He also urged private companies to set up fresh coal-based power generation capacity to meet night-time demand and assured them of financial assistance.

Industry officials said such a call was being made for the first time in a decade since most private investments in the coal-fired power sector had stopped around the year 2012, partly because of India’s green energy push.

While the coal expansion drive aims to meet an expected rise of 10% in demand during peak hours in fiscal year 2024-25, India will still meet a national commitment of half of fuel generation capacity from non-fossil fuels by 2030, the two officials said. Since adding 22 gigawatts of capacity in the fiscal year 2015/16, India cut back on plans to expanding coal-fired plants as the government opted for alternate energy capacity, officials have said.

Now India wants coal-fired plants sufficient to meet power demand of 384 gigawatts by the fiscal year 2031/32, revised up 5% from an earlier projection of 366 gigawatts, the government documents showed. The government consequently revised up its estimate of coal-based power requirement by 9%, to 283 gigawatts.

“We have now modelled a stressed scenario factoring in a below-normal monsoon and a corresponding demand spike, such as we experienced in Aug-Oct this year,” one of the government officials said.

That stress accounts for delays in the commissioning of 86 gigawatts of non-fossil capacity by fiscal 2031/32. In the lead-up to Thursday’s climate summit in Dubai, the European Union, U.S. and UAE have rallied support for a deal to triple global renewable energy installed by 2030. More than 100 countries have backed this deal, officials told Reuters, but countries including China and India are not yet fully on board.