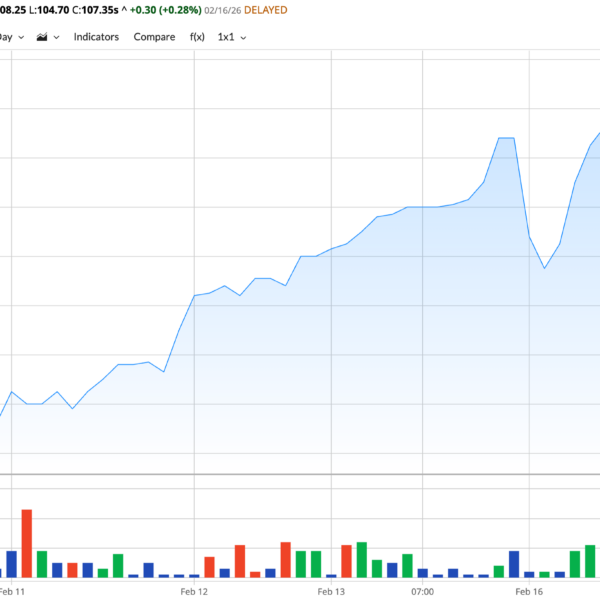

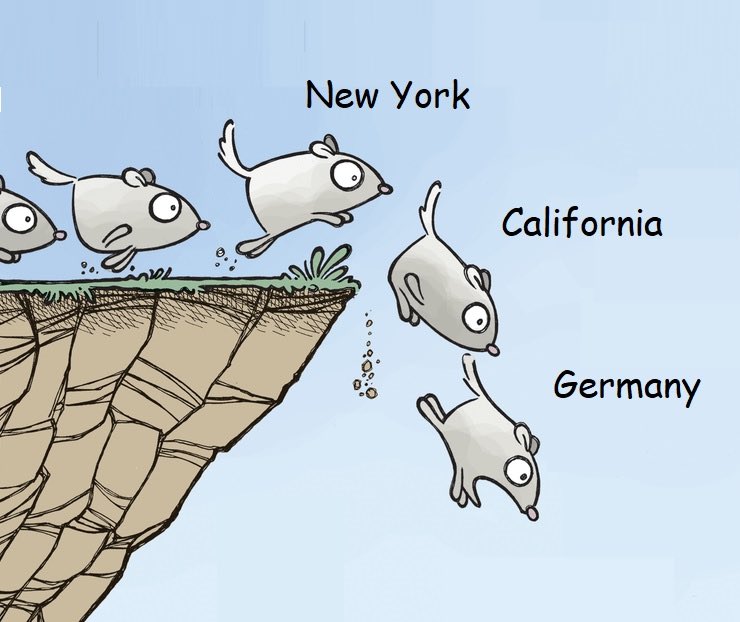

South32 has decided NOT to invest in the expansion of the Dendrobium coking coal mine at its Illawarra met coal complex in New South Wales (NSW). This comes after they decided not to proceed with the Eagle Downs coking coal mine in Queensland (QLD) last year. The ESG risks have clearly moved the IRR hurdle rate for a go/no investment decision higher in recent years. This comes despite the recent positive pricing environment for metallurgical coal, and despite the positive long term demand outlook for the steel making raw material.

This is wildly bullish for incumbents as the apparent cost of capital for new projects has increased significantly. Next time you contemplate where the incremental supply is going to come from, you can think back to cancelled projects like these as examples of supply constraints and reasoning for much higher coal prices in the future.

You can read more in the article titled “South32 shows the bar is high, even for the ‘good’ coal” linked here, and below:

https://www.afr.com/chanticleer/south32-shows-the-bar-is-high-even-for-the-good-coal-20220823-p5bc63

If you need help bypassing the paywall, be sure to check out the Tools and Resources page linked here.

Recent Posts___________________________________________________________________

Met Coal Slips Again as Weather Clears and Mills Step Back