Major shipping companies paused transiting the Middle East’s critical Bab al-Mandeb chokepoint for seaborne trade Dec. 15 after repeated attacks by Yemen’s Houthi militants threatened to upend global trade flows.

Danish shipping giant A.P Moller-Maersk — which accounts for 15% of the global container freight market — suspended voyages passing through the Bab al-Mandeb until further notice. Hapag-Lloyd — which controls 7% of the container market — also paused traffic through the Red Sea until at least Dec. 18 after one of its ships was attacked by Houthis.

Hapag-Lloyd’s Liberia-flagged Al Jasrah containership caught fire in the Red Sea on Dec. 15 after being hit by a missile from Houthi rebels in Yemen. The attack came a day after the Houthis attacked the Maersk ship Gibraltar on Dec 14 in a near-miss by a cruise missile.

The suspensions are the latest sign major ship charterers who in recent weeks have deployed armed guards to safeguard transit through Bab al-Mandeb are beginning to reconsider using the narrow strait through which 10% of global seaborne oil flows. The Houthis have threatened to attack any ships with Israeli ownership or bound for one of the country’s ports. As a result, all commercial ships have come under attack, from car carriers to tankers and dry bulkers, including many with no obvious connection to Israeli trade.

“The pattern I see [in the] last few days is more attacks on all these container line big boys like MSC, Maersk, NYK Line, Hapag-Lloyd. If you scare them, then you stop hundreds of their ships,” Luv Menghani, a shipbroker with Dubai-based BluePeak Commodities and Shipping, said. Maersk’s instruction to its ships to avoid the Red Sea “suggests an escalation in the response to the Houthi attacks,” Gregory Brew, an analyst with Eurasia Group, said.

“Yesterday’s attacks suggest the Houthis are broadening their attacks are becoming more indiscriminate, rather than focusing just on ships owned by Israeli companies or bound for Israeli ports,” he added.

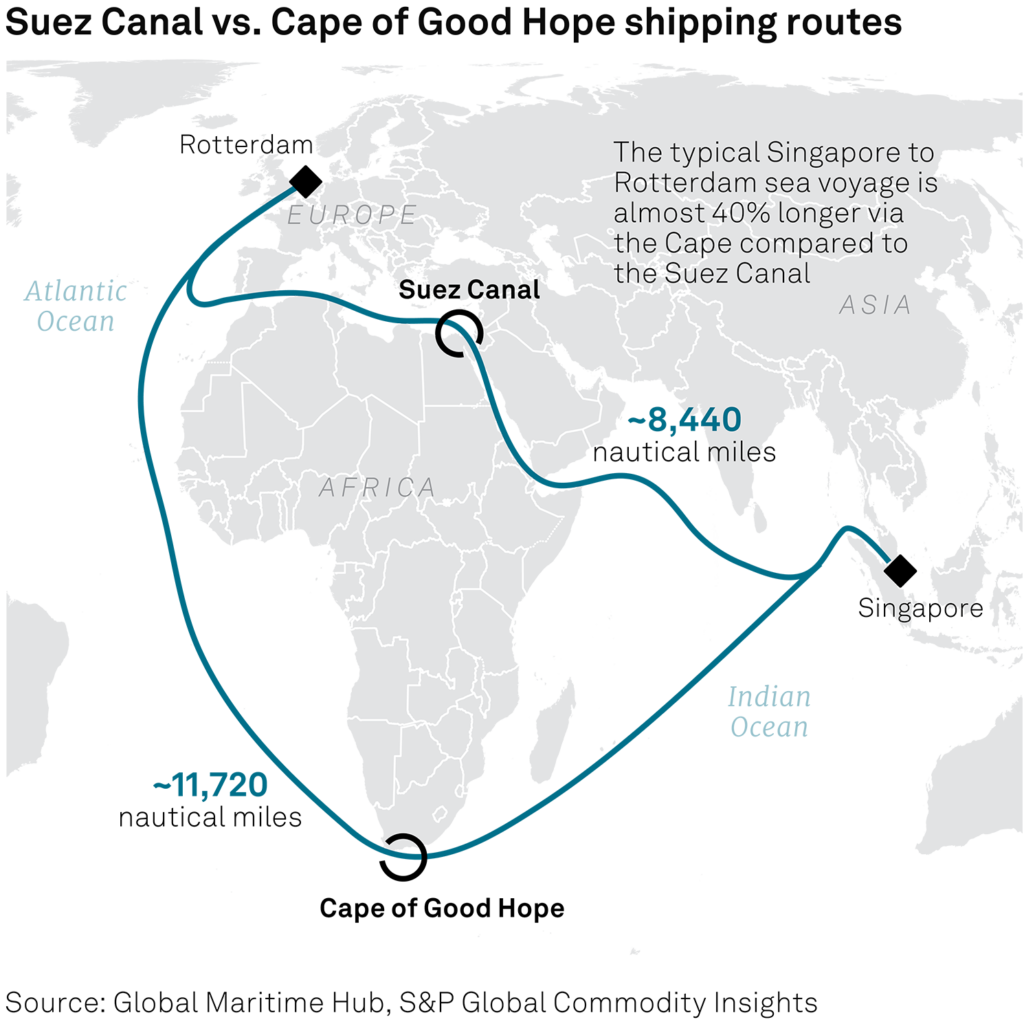

Trade flowse 20-mile-wide Bab al-Mandeb — which lies between the Horn of Africa and Gulf peninsula — connects the Red Sea to the Gulf of Aden and the Arabian Sea. It accounted for 8.8 million b/d of total oil flows in the first half of 2023, according to the US Energy Information Administration. LNG shipments through the strait were 4.1 billion cf/d during the same period, EIA data showed. The suspension of the Red Sea route by the two shipping companies followed a notice to their fleets on Dec. 14 to use the longer Cape of Good Hope as an option, a move that adds 40% to the voyage distance.

The ongoing conflict in the Middle East had already caused some carriers in the past few weeks to avoid the Suez Canal in the interest of security, with the accumulation of attacks from Yemeni rebels leading liner companies to re-route ships via the Cape of Good Hope (CGH) to avoid hostilities impacting container ship traffic in the Red Sea. According to live AIS data tracking from S&P Global Commodities at Sea, Eastbound vessels MSC Diana and Zenith Lumos have traveled via the Cape of Good Hope as of Dec. 12, having trans-shipped in Tangier and Algeciras respectively.

On Westbound trade, the Maersk Camden, Maersk Campton and MSC Virgo have all diverted via the CGH, despite recent historical vessel tracking showing previous movements have been through the Red Sea and the Suez Canal. With the Maersk and Hapag-Lloyd announcement, other carriers could be primed to follow suit in making public their stance against further Red Sea shipments whilst the situation is still volatile.

“Despite the complications it would cause with our shippers in terms of delivery and transit times, what is most important is the dialogue we have with our crew in our ships,” a carrier source told S&P Global Commodity Insights.

War risk

Freight forwarders are also increasing rates on shipments. For example, a container bound for the Middle East will now attract a war risk surcharge of $100/teu on dry and reefer cargo, according to a document seen by S&P Global.

Several carriers have begun to accrue war risk surcharges on passages through the Red Sea. Zim Integrated Shipping Services (Zim) — an Israeli carrier based in Haifa — has increased freight rates on its Asia-Mediterranean service to cover the rising costs of securing its vessels.

Container rates for key shipping lanes from North Asia westbound will likely be given increased support should more carriers follow suit. An estimated additional 10-15 days for delivery times could be seen in the market, stripping out already weak supply due to carriers pursuing aggressive blank sailing strategies in the build-up to the Lunar New Year period where demand increases.

Container rates for shipments from North Asia to the UK — a route which uses the Red Sea and Suez Canal — have hit record highs for 2023, according to assessments by S&P Global Platts. The recent surge in attacks on the oil product tanker and container vessels moved the needle on oil prices. Platts-assessed Dated Brent up at $77.085/b on Dec. 15, up just under 1% on week.

Vandana Hari, founder of Singapore-based Vanda Insights said “shipping will often be the canary in the coalmine” with geopolitical tensions set to remain center-stage for 2024.

LPG flows

The threat to shipping has also impacted charterers bound on shorter routes for Yemen.

Sources told S&P Global that ship charterers contracted to deliver liquefied petroleum gas to Yemen — which has increased shipments of the fuel — are reluctant to set sail due to fear of attack.

For example, an LPG vessel carrying a 44,000-ton cargo bound for Yemen and chartered by a Dubai-based company recently refused to set sail amid safety concerns from the crew, said the sources.

The crew’s refusal to sail to Yemen comes amid an uptick in LPG buying by the war-torn country. Yemen received 46,000 tons of LPG in December, entirely from Iran, according to S&P Global Commodities at Sea. The LPG import is nearly double the volume of the last shipment Yemen received in July, shipping data showed.

With the latest escalation, tanker rates for Yemen are also rising, a shipbroking source said.

“One vessel below 15,000-ton dead weight, old built, transporting gasoline from the UAE to Hodeidah in Yemen used to charge $12,000-$13,000 per day. Now they charge $16,000-$17,000 per day,” said the source.