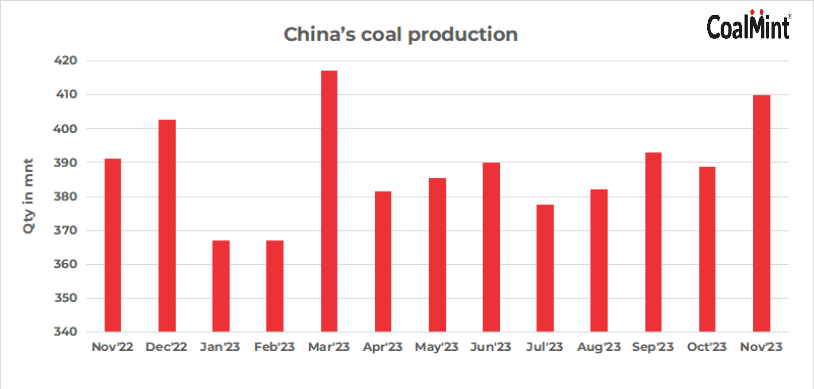

The latest data released by the National Bureau of Statistics on December 15 showed that in November 2023, the country’s raw coal output was 414 million tons, a year-on-year increase of 4.6%, and the growth rate expanded by 0.8 percentage points compared with October. An increase of 25.25 million tons compared with October, an increase of 6.50%. The average daily output in November was 13.799 million tons, an increase of 1.259 million tons from 12.54 million tons in October.

From January to November 2023, the country’s cumulative raw coal output was 4,238.77 million tons, a year-on-year increase of 2.9%, and the growth rate was 0.2 percentage points narrower than the previous 10 months.

China’s crude steel output maintained the on-year rise over the first eleven months of this year, with the total tonnage reaching 952.1 million tonnes, higher by 1.5% from the same period last year, according to the latest release by the country’s National Bureau of Statistics (NBS) on Friday morning.

For November alone, China produced 76.1 million tonnes of crude steel, up 0.4% on year, the NBS data showed, while the daily crude steel output averaged 2.54 million tonnes/day, edging down 0.6% compared with that for the previous month, Mysteel Global calculated based on the NBS data.

The sustained on-month fall in daily crude steel output was mainly due to the fact that blast furnace mills in China continued to slow their production pace in November to ease market pressure from the supply side, Mysteel Global learned.

Mysteel’s weekly survey showed that over November 24-30, capacity utilization among the 247 Chinese BF mills under its tracking reached 87.63%, down for the fifth consecutive week by another 0.33 percentage point on week, or lower by 2.6 percentage points on month.

Meanwhile, Chinese finished steel prices recovered last month, mainly thanks to the positive sentiment in domestic market and the relatively steady demand from downstream users, Mysteel Global noted.

As of November 30, the national price of HRB400E 20mm dia rebar, a bellwether of domestic steel-market sentiment, was assessed by Mysteel at Yuan 4,052/tonne ($569/t) including the 13% VAT, higher by Yuan 174/t compared with the end of October.

For November, the daily trading volume of construction steel comprising rebar, wire rod and bar-in-coil among the 237 traders Mysteel regularly surveys averaged 151,523 t/d, only down 2,408 t/d on month during the traditional off-season for steel consumption.

Last month, China’s production of finished steel came in at 110.4 million tonnes, increasing by 4.2% on year and taking the total output for the first eleven months of this year to 1.25 billion tonnes, up 5.7% on year, according to the NBS data.

China produced 64.8 million tonnes of pig iron in November, down 4.8% on year, and the total production over January-November reached 810.3 million tonnes, higher by 1.8% from the same period last year, the NBS data showed.

China’s steel output over Jan-Nov

| Nov 2023 | Jan-Nov 2023 | |||

| Volume (mln t) | YoY (%) | Volume (mln t) | YoY (%) | |

| Crude steel | 76.1 | 0.4 | 952.14 | 1.5 |

| Finished steel | 110.44 | 4.2 | 1,252.82 | 5.7 |

| Pig iron | 64.84 | -4.8 | 810.31 | 1.8 |