Technical Analysis Series – AMR

I don’t care for technical analysis much, but sometimes it is the best framework on which to build trade ideas. We examine that here, using AMR as an example…

I don’t care for technical analysis much, but sometimes it is the best framework on which to build trade ideas. We examine that here, using AMR as an example…

What to expect from the website and service over the next few months, and a

What to expect from the website and service over the next few months, and a

This seasonal pullback in PLV Futures has not caused such a bad commensurate pullback in met coal stocks.

Herewith the monthly technical analysis update along with some quick commentary on each coal producer.

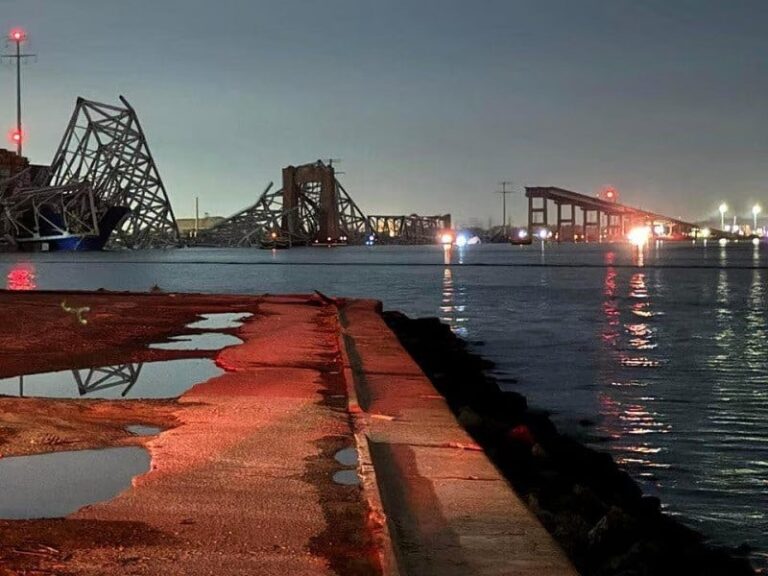

A vessel collision caused the Frances Scott Key bridge in Baltimore to collapse, suspending navigation in Baltimore Harbor.

Now that we’ve seen another annual rug pull in metallurgical coal markets, I thought it appropriate to revise forecasts and valuation comps

Alpha Metallurgical Resources Inc (AMR) leads the Coking Coal industry with an overall score of 57. AMR is up 96.74% so far this year

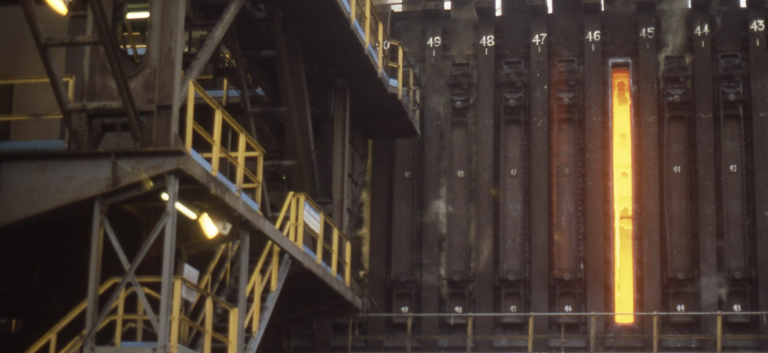

Alpha is the largest met producer in the US, and the dominant player in Central Appalachia.

Alpha Met a leading US supplier of metallurgical products for the steel industry, released its financial results for the fourth quarter

Earnings is tough to trade. It’s like betting against the spread in NFL or NCAA Football games, and Vegas is very smart and typically spot on.

Let’s start with the big overall trend, and for that we need to think in terms of thermal coal, generally when discussing US coal production.