Editors Note: This article was originally posted on Substack, located here.

I’ll start off by saying that had I known Alpha’s CEO Andy Eidson was a reader of this substack, I would’ve definitely owned some AMR shares going in to this meeting… he sure did call me out on it!

The management team at Alpha deserves commendation for their transparency and genuine interest in hearing investors’ perspectives regarding their stock. Spending most of the day with them was a pleasure, and as I got to know them better they really seem like good people, the type you could trust your kids, and your money with.

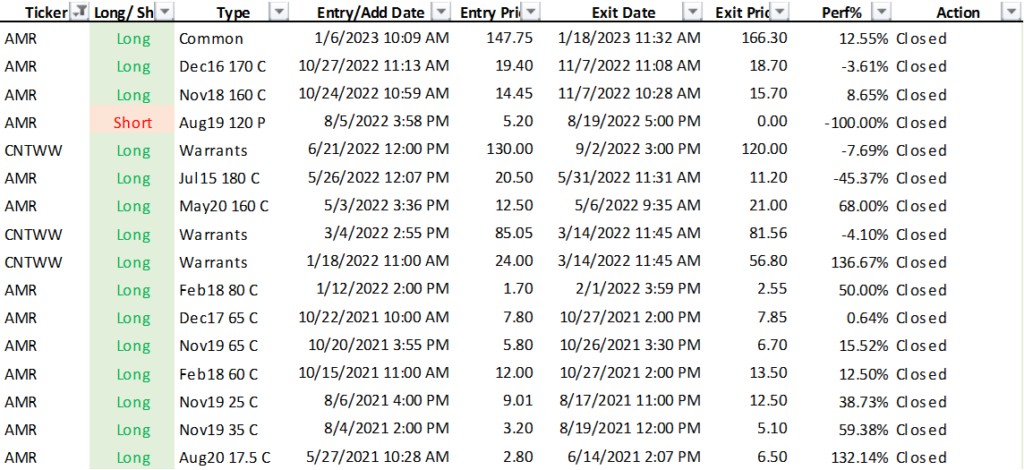

You can say that perhaps I drank the Cool-Aid yesterday driving around Southern West Virginia with Andy and the maverick team of MinTwit heavy hitters, led by the Koala, but I’d like to clarify for the record that I’ve been on the Alpha Train since the bottom of this cycle. I bought AMR at $4.93 in early October 2020 and sold it (like an idiot) in January at $11.38 – thinking I was a genius. After that I mostly played the AMR rally with options and warrants. You can see all of the related trades I’ve made since starting this substack in July of 2021, below:

The lone time I bet against them I was actually just hedging an enormous and illiquid warrant position going into an earnings announcement – and the hedge went to zero. Lesson learned.

In the sections below, I’ll give a quick overview of Alpha’s management team and then attempt to describe how I see this situation playing out over the next few years. Oh, and did I mention a helicopter ride?

Management

The management dynamic at Alpha seems to be that Andy takes on the public facing role while solidifying the cultural work ethic among Alpha’s almost 4000 employees. Meanwhile, he lets the two experts, Jason Whitehead (COO) and Dan Horn (CCO), do their thing. Jason is the engineering master and Dan is the coal markets guru, and I tried to soak up as much information as I could talking to them. Both of these guys were very impressive.

The strategic vision for the company seems to have come from the Chairman and former CEO David Stetson. Andy is continuing to steer Alpha down the tracks laid by David and it’s evident that everyone is highly content with the synergy among the management team and aligned with the strategic vision and direction the company is heading. I didn’t see any big ego’s in the room and I felt comfortable asking the team anything I could think of.

How this plays out…

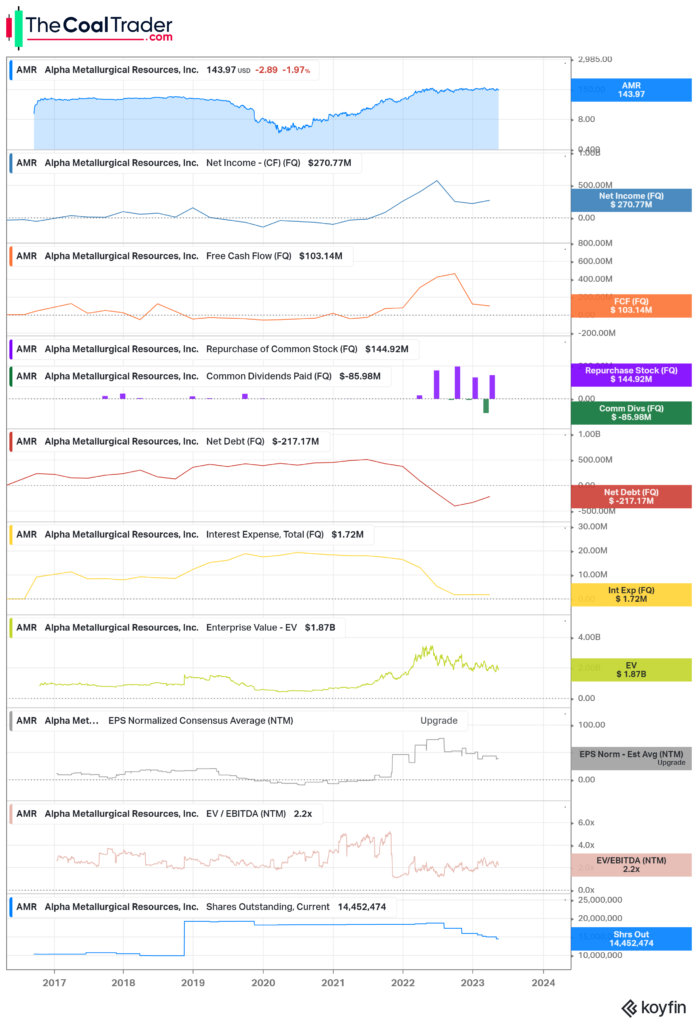

Since starting its share buyback program 5 quarters ago, Alpha has repurchased 23% of total shares outstanding. Read that line again, its absolutely ridiculous.

Their buyback program is facilitated with a 10b5 plan, also known as a Rule 10b5-1 plan, which is a structured method of buying shares in a prearranged manner even during blackout periods. The prearranged program buys up to 20% of daily volume while hugging the volume weighted average price (vwap).

Despite the recent selloff in met markets, Alpha’s profit margins remain comfortably high. I think the long term average for the next few years is $250/mt. That means we’ll be see some nice periods of $300+ and some periods less than $200, but I don’t think prices will go much below $175/mt for very long. That’s a floor that has already been tested once, and it may get tested again if we see continued economic manufacturing pressure in Asia and increasing supplies from Russia and Mongolia. With that being said, my outlook is for positive profit margins for the foreseeable future, although we may see a period of more weakness over the next few months.

Given these assumptions, Alpha should easily be able to buyback $500 million worth of shares annually. Given the buyback alone, that’s a 27% yield on the current enterprise value of $1.84 billion. But let’s project this out into the future to see what happens. At today’s price of $142/sh, the $500 million buys about 3.5 million shares per year, or about 24% of shares outstanding now and climbing sequentially thereafter. For simpletons like me, let’s map it out:

- Current: 14.4 million shares outstanding

- In 1 year: 10.9M SO

- In 2 years: 7.4M SO

- In 3 years: 3.9M SO

So in 2-3 years we’re looking at approx. 5 million shares outstanding as long as the market hasn’t re-rated the stock price higher. And if the market re-rates the stock higher, great! Otherwise Alpha is basically like a private enterprise which is slowly buying out its partners over time, securing a forever higher sequential yield on its equity over time.

Eventually they’ll be left without anyone wanting to sell. But as that illiquidity frontier approaches, the indexes and institutional investors who require minimum daily trading volumes on their positions will be forced sellers. Alpha would therefore be buying shares back from Blackrock and Vanguard and various Russell 2000 index funds and associated small cap etf’s.

As this process unfolds, Alpha will simply not be able to utilize all of its cash allotted for buybacks due to the daily volume limits. At that point, Alpha can start to increase its dividend in order to continue distributing capital to shareholders. As the buyback shrinks, the dividend increases, and perhaps the stock price re-rates somewhere in this continuum due to the increasing dividend yield. Again, that would be great! If not however, shareholders eventually receive enormous div yields every year until the market eventually figures it out, or not, but who cares at that point.

I’ll let you do the math, but think about three years from now if there’s only 3.9M shares outstanding, the stock price is still $142/sh, and Alpha has $500M to distribute to shareholders… Pop quiz, what’s that yield?

Further Discussion…

I thought about discussing mining costs and/or the pros and cons of Alpha vs Arch in this concluding section, but I think I’d prefer to give readers the floor here. You guys have been asking lots of good questions lately, so lets take the discussion wherever you’d like. Please leave a comment or question below!

Note: Comment section can be found only on the original Substack post, located here.

Nothing in this Site constitutes professional and/or financial advice, nor does any information on this Site constitute a comprehensive or complete statement of the matters discussed or the law relating thereto. The author of this Site is not a fiduciary by virtue of any person’s use of or access to this Site or its Content.