A boom in data centers and factories is straining electric grids and propping up fossil fuels.

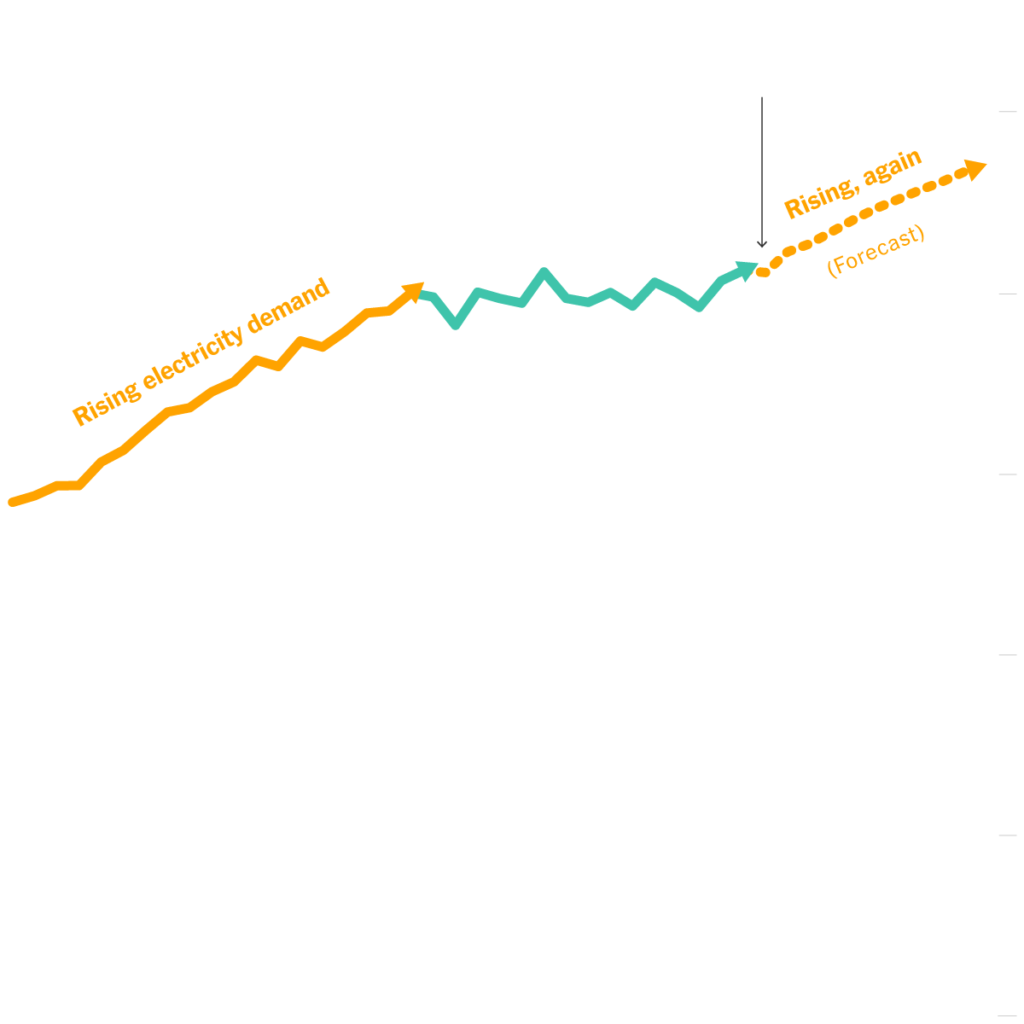

Something unusual is happening in America. Demand for electricity, which has stayed largely flat for two decades, has begun to surge.

Over the past year, electric utilities have nearly doubled their forecasts of how much additional power they’ll need by 2028 as they confront an unexpected explosion in the number of data centers, an abrupt resurgence in manufacturing driven by new federal laws, and millions of electric vehicles being plugged in.

Many power companies were already struggling to keep the lights on, especially during extreme weather, and say the strain on grids will only increase. Peak demand in the summer is projected to grow by 38,000 megawatts nationwide in the next five years, according to an analysis by the consulting firm Grid Strategies, which is like adding another California to the grid.

“The numbers we’re seeing are pretty crazy,” said Daniel Brooks, vice president of integrated grid and energy systems at the Electric Power Research Institute, a nonprofit organization.

In an ironic twist, the swelling appetite for more electricity, driven not only by electric cars but also by battery and solar factories and other aspects of the clean-energy transition, could also jeopardize the country’s plans to fight climate change.

To meet spiking demand, utilities in states like Georgia, North Carolina, South Carolina, Tennessee and Virginia are proposing to build dozens of power plants over the next 15 years that would burn natural gas. In Kansas, one utility has postponed the retirement of a coal plant to help power a giant electric-car battery factory.

Burning more gas and coal runs counter to President Biden’s pledge to halve the nation’s planet-warming greenhouse gases and to generate all of America’s electricity from pollution-free sources such as wind, solar and nuclear by 2035.

“I can’t recall the last time I was so alarmed about the country’s energy trajectory,” said Tyler H. Norris, a former solar developer and expert in power systems who is now pursuing a doctorate at Duke University. If a wave of new gas-fired plants gets approved by state regulators, he said, “it is game over for the Biden administration’s 2035 decarbonization goal.”

Some utilities say they need additional fossil fuel capacity because cleaner alternatives like wind or solar power aren’t growing fast enough and can be bogged down by delayed permits and snarled supply chains. While a data center can be built in just one year, it can take five years or longer to connect renewable energy projects to the grid and a decade to build some of the long-distance power lines they require. Utilities also note that data centers and factories need power 24 hours a day, something wind and solar can’t do alone.

Yet many regulated utilities also have financial incentives to build new gas plants, since they can recover their costs to build plants, wires and other equipment from ratepayers and pocket an additional percentage as profit. As a result, critics say, utilities often overlook, or even block, ways to make existing power systems more efficient or to integrate more renewable energy into the grid.

“It is entirely feasible to meet growing electricity demand without so much gas, but it requires regulators to challenge the utilities and push for less-traditional solutions,” Mr. Norris said.

The stakes are high. If more power isn’t brought online relatively soon, large portions of the country could risk blackouts, according to a recent report by the North American Electric Reliability Corporation, which monitors the health of the nation’s electric grids.

“Right now everyone’s getting caught flat-footed” by rising demand for electricity, said John Wilson, a vice president at Grid Strategies.

For much of the 20th century, America’s electricity use increased steadily and utilities built plenty of coal, gas and nuclear plants in response. But starting in the mid-2000s, demand flattened. The economy and population kept expanding, but factories, lightbulbs and even refrigerators became much more energy efficient.

Now demand is rising again, for several reasons.

The growth of remote work, video streaming and online shopping has led to a frenzied expansion of data centers across the nation. The rise of artificial intelligence is poised to accelerate that trend: By 2030, electricity demand at U.S. data centers could triple, using as much power as 40 million homes, according to Boston Consulting Group.

In Northern Virginia, one of the nation’s largest data center hubs, at least 75 facilities have opened since 2019 and Dominion Energy, the local utility, says data center capacity could double in just five years.

At the same time, investment in American manufacturing is hitting a 50-year high, fueled by new federal tax breaks to lift microchip and clean-tech production. Since 2021, companies have announced plans to spend at least $525 billion on factories for semiconductors, batteries, solar panels and more.

In Georgia, where dozens of electric vehicle companies and suppliers are setting up shop, the state’s largest utility now expects 16 times as much growth in electricity demand this decade as it did two years ago.

Millions of Americans are also buying plug-in vehicles and electric heat pumps for their homes, spurred by recent federal incentives. In California, one-fifth of new cars sold are electric, and officials estimate that E.V.s could account for 10 percent of power use during peak hours by 2035.

On top of that, record heat fueled by global warming is spurring people to crank up air-conditioning, causing summer demand in Arizona and Texas to rise faster than forecast.

Many worry the grid won’t keep up.

PJM Interconnection, which oversees the nation’s largest regional grid, stretching from Illinois to New Jersey, is now expecting an additional 10,000 megawatts of demand by 2030 that wasn’t forecast last year. That’s akin to adding another New York City to the system.

“To see that come on all of the sudden, even for a system as big as ours, that’s significant,” said Ken Seiler, who leads system planning for PJM.

Finding enough power could be a challenge, since PJM’s process for connecting renewable energy projects to the grid has been afflicted by delays. Utilities in PJM have been preparing to retire roughly 40,000 megawatts of mostly coal, gas and oil-burning power plants this decade as states seek to transition away from fossil fuels. PJM has already approved an additional 40,000 megawatts of mostly wind, solar and batteries as partial replacements. But many of those projects have been stalled by local opposition or trouble getting vital equipment like transformers.

“We have a huge concern about that,” Mr. Seiler said. “Folks aren’t building.”

Nationwide, just 251 miles of high-voltage transmission lines were completed last year, a number that has been declining for a decade.

So far, one state that has kept pace with explosive demand is Texas, where electricity use has risen 29 percent over the past decade, partly driven by things like bitcoin mining, liquefied natural gas terminals and the electrification of oil fields. Texas’s streamlined permitting process allows wind, solar and battery projects to get built and connected faster than almost anywhere else, and the state zoomed past California last year to lead the nation in large-scale solar power.

“Texas still has problems, but there’s a lot to learn from how the state makes it easier to build clean energy,” said Devin Hartman, director of energy and environmental policy at the R Street Institute.

Soaring demand has provoked major fights over the future of natural gas.

In North Carolina, regulators had ordered Duke Energy, the state’s biggest utility, to slash its planet-warming carbon dioxide emissions by 70 percent by 2030.

But in January, Duke warned it could miss that target by at least five years under a new plan to build up to five large gas-burning power plants and five smaller versions by 2033, more than previously proposed. Even though Duke is planning a major expansion of solar and offshore wind power, the company says it needs additional gas plants because demand from industrial customers is rising faster than expected.

“The growth we’re seeing is historic in scale and speed,” said Kendal Bowman, president of Duke Energy’s operations in North Carolina. “But it’s also going to be a challenge, particularly in the near term, to see carbon reduction at the same time we’ve got this unprecedented growth.”

Similar revisions are occurring elsewhere. In Virginia, Dominion Energy has proposed to meet rising demand for data centers with a mix of renewables and gas generation in a plan that could increase its overall emissions. Georgia Power has asked permission to build three new gas- and oil-burning turbines and is evaluating whether to postpone the planned retirement of two older coal plants.

“It’s completely at odds with what we need to do to” to fight climate change, said Greg Buppert, a senior attorney at the Southern Environmental Law Center, which has identified at least 33,000 megawatts worth of gas projects being proposed by utilities across the Southeast, plants that could stick around burning fossil fuels for decades.

In interviews, utility executives say gas is needed to back up wind and solar power, which don’t run all the time. Gas plants can sometimes be easier to build than renewables, since they may not require new long-distance transmission lines. Eventually, alternative sources of clean power may emerge (both Duke and Dominion want to build smaller nuclear reactors) but those are years away.

“We need to meet our customers’ needs at all times, even when renewable resources might not be providing energy,” said Aaron Mitchell, vice president of planning and pricing at Georgia Power. “It’s going to take a diversified fleet.”

Mr. Mitchell noted that Georgia Power was planning a large build-out of solar power and batteries over the next decade and would offer incentives to companies to use less power during times of grid stress. But, he added, “gas has to be a near-term part of our fleet.”

Critics say that regulated utilities often default to building gas plants because it’s a familiar technology and because, in many states, they earn a guaranteed profit from capital projects. They don’t always have the same incentive to adopt energy-efficiency programs that reduce sales or to plan transmission lines that can import cheaper wind power from elsewhere.

“The big utilities are typically most comfortable with one way of doing things: building those big, conventional power plants,” said Heather O’Neill, president of Advanced Energy United, a trade group representing low-carbon technology companies.

There are other ways to meet rising demand that require burning fewer fossil fuels, some experts say. Utilities could get more creative about helping customers use less electricity during peak hours or make better use of batteries, reducing strains on the grid. Advanced sensors and other technologies could push more renewable energy through existing transmission lines. Some utilities are pursuing these options, but many are not.

Over the coming months, environmentalists and other groups aim to challenge utility plans at state regulatory proceedings. In some cases, they’ll argue that the utility has overestimated future demand growth or neglected alternatives to gas. While these debates can get technical, they could have a significant impact on the nation’s energy future.

The tech companies and manufacturers that are driving up electricity demand could also play a big role. Many firms have pledged to use clean electricity for their operations, and it remains to be seen how hard they actually push power companies to provide it.

“A big question,” said Brian Janous, a former vice president of energy at Microsoft who now focuses on ways to clean up the grid, “is how much outside pressure utilities and state regulators will face to do things differently.”

By Brad Plumer and Nadja Popovich

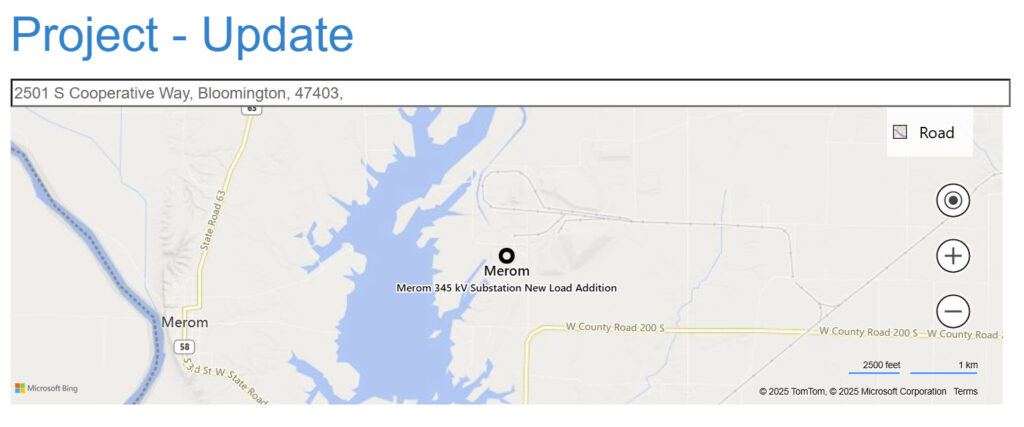

Source: NYT