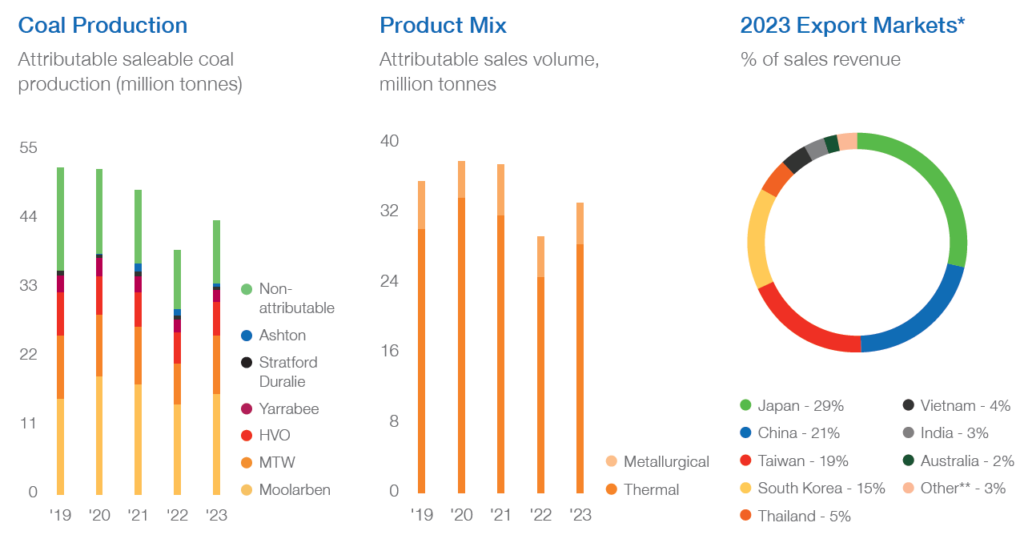

Yancoal reported consistent performance in Q2 2024, with run-of-mine (ROM) coal volumes holding steady compared to the first quarter. However, saleable coal volumes experienced a slight decline due to wet weather delays. Despite these challenges, attributable saleable production increased by 18% compared to the first half of 2023, underscoring a robust recovery over the past 12 months.

The overall realised coal price remained stable at A$181 per tonne for Q2 2024. This figure includes a 2% increase in realised thermal coal prices and a 5% decrease in realised metallurgical coal prices from Q1 2024. The realised thermal coal price aligned with coal index trends, while the realised metallurgical coal price outperformed relevant indices. This was attributed to higher-priced carryover tonnes from previous periods, along with effective product blending and optimisation strategies.

During Q2 2024, Yancoal’s attributable coal sales reached 8.6 million tonnes, exceeding attributable saleable coal production by 0.4 million tonnes. This helped counteract stockpile accumulation from earlier periods. Yancoal sells the majority of its thermal coal at prices linked to the Newcastle 6,000kCal NAR index (GCNewc) and the API5 5,500kCal index, with adjustments for energy content and other coal characteristics. Typically, thermal coal from the Hunter Valley aligns with the Newcastle index, while coal from west of the Hunter Valley aligns with the API5 index or falls between the two.

In Q2 2024, the API5 index averaged US$89 per tonne, down slightly from US$93 per tonne in Q1 2024. Conversely, the Newcastle index increased to US$136 per tonne from US$126 per tonne. Metallurgical coal indices remained stable, with the Low Vol PCI index averaging US$164 per tonne, unchanged from the previous quarter, and the Semi-Soft index rising to US$152 per tonne from US$150 per tonne. For Q2 2024, Yancoal recorded an average realised thermal coal price of A$163 per tonne and an average realised metallurgical coal price of A$318 per tonne. The overall average realised sales price was A$181 per tonne, compared to A$180 per tonne in the previous quarter and A$226 per tonne in Q2 2023.

Yancoal’s production performance was impacted by above-average rainfall in parts of eastern Australia. In New South Wales, Moolarben and Mount Thorley Warkworth (MTW) managed to offset some losses through mine schedule adjustments. Yarrabee experienced productivity impacts from geotechnical issues. Mitigation measures from previous exceptional rain events helped reduce losses and maintain forecast production volumes, though operations were occasionally suspended to ensure safety.

Specific site performances included a scheduled longwall move at Moolarben, impacting saleable coal output, but higher than projected production rates before and after the move. At MTW, shorter haul cycles and strong overburden movement supported ROM coal delivery, and higher yielding seams improved product coal volumes. Hunter Valley Operations (HVO) saw increased ROM coal production despite adverse weather and other hindrances. Yarrabee focused on improving fleet utilisation amidst challenging conditions, and Middlemount was ahead of plan until wet weather affected output in June.

The company maintained its 2024 production guidance of 35-39 million tonnes, with expected cash operating costs of $89-97 per tonne and capital expenditure of $650-800 million.