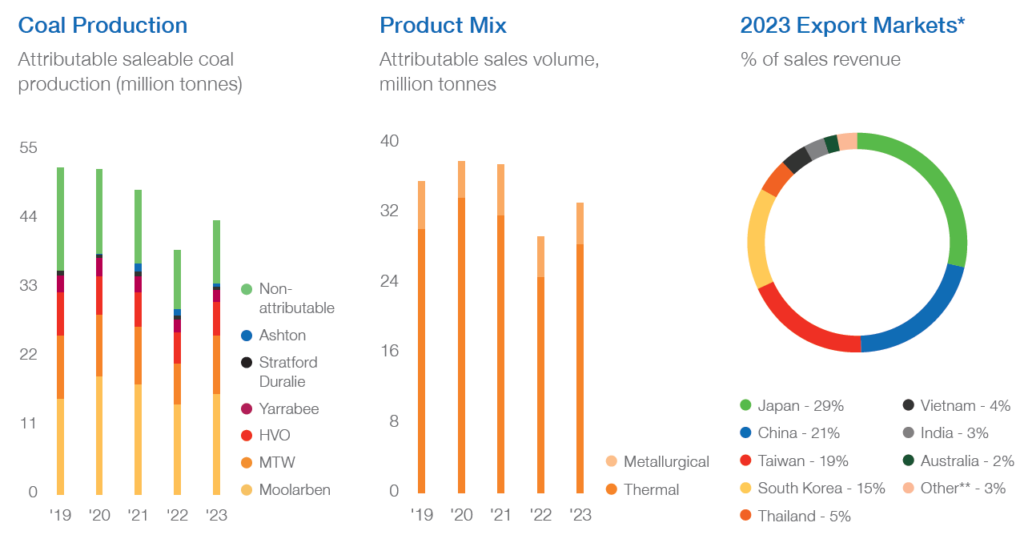

Yancoal Australia, the Australian arm of Chinese mining giant Yancoal, capped off a successful 2023 with a powerful fourth quarter, exceeding production targets and setting the stage for further growth in 2024.

Production Soars on Recovery Initiatives:

- Saleable production for October-December surged 52% year-on-year to 12.9 million tonnes (mt), marking the company’s best quarterly performance in three years.

- This brought Yancoal Australia’s full-year saleable production to 43.6 mt, up 12% from 2022 and comfortably within the target range of 31.0-36.0 mt (equity basis).

- CEO David Moult attributed the success to ongoing recovery initiatives implemented after weather disruptions in 2022, which improved output for the fourth consecutive quarter.

Cash Operating Costs Stay on Target:

- Yancoal Australia expects its cash operating costs for 2023 to fall within the guided range of A$92.00-102.00/t ($60.40-67.00/t), with the final figure to be disclosed in February’s financial results.

Sales Reflect Shifting Market Dynamics:

- Thermal coal sales in October-December rose 58% year-on-year to 8.7 mt, while metallurgical coal remained steady at 1.4 mt.

- For the full year, thermal coal sales climbed 15% to 28.4 mt, while met coal sales held steady at 4.7 mt.

- Moult noted a balanced thermal coal market, with increased exports from Australia and Indonesia offsetting reduced supply from Russia and South Africa.

Moolarben Mine Overcomes Challenges:

- Yancoal Australia’s Moolarben mine in New South Wales saw its saleable production jump 55% to 4.8 mt in the fourth quarter, despite a major train derailment disrupting operations for 11 days in December.

- This highlights the success of the company’s recovery program, with other mines like Mount Thorley Warkworth and Hunter Valley Operations also experiencing significant production jumps.

Ashton Mine Restarts, Cash Position Strengthened:

- The Ashton met coal mine in New South Wales resumed production in January after completing water ingress remediation works.

- Yancoal Australia ended the year debt-free, with a cash balance of A$1.4 billion, up $0.4 billion from September. Moult emphasized the company’s strong cash flow generation capabilities.

Looking Ahead:

- Yancoal Australia aims to consolidate its 2023 performance and pursue efficiency gains in 2024.

- With a successful year behind them and a focus on further optimization, the company appears well-positioned for continued growth in the coming year.