The UK will implement its own carbon border adjustment mechanism (CBAM) by 2027, which will put a carbon charge on imports of iron, steel, aluminum, ceramics and cement into the UK, the government said Dec. 18. The introduction will come one year after the European Union will have set up its own CBAM.

The UK government said the move should support the country’s decarbonization efforts. The regulation is similar to the EU’s CBAM, under which the obligation to purchase CBAM certificates will apply from 2026. According to steel industry trade body UK Steel, the UK CBAM could potentially create a level playing field for carbon pricing but the timeline should match the EU’s.

“By confirming a CBAM from 2027 instead of matching the EU’s 2026 timeline, the Government risks high-emission steel being dumped in the UK from 2026 when the EU CBAM takes effect,” said UK Steel Dec.18.

The current timeline could mean that some of the high-emission steel currently exported to the EU will be diverted to the UK and put price pressure on UK steel prices while steel safeguard quotas on imports will end in 2026, “leaving the UK steel industry exposed to surges in imports”, said UK Steel. The Platts hot-rolled coil import assessment was assessed at GBP650/mt DDP West Midlands, up GBP32.5/mt on-month. Platts is part of S&P Global Commodity Insights.

UK Steel calls for a mutual recognition between the UK and EU CBAM policies and Emissions Trading System (ETS) to avoid any restrictions to trade. Around 75% of the UK steel industry’s exports, totaling 2.55 million mt, go to European markets.

“Without mutual recognition and linked emission trading schemes, UK-made steel will face a financial trade barrier when exported to our biggest export market,” said UK Steel.

The charge applied by the UK CBAM will depend on the amount of carbon emitted in the production of the good and the gap between the carbon price applied in the country of origin — if any — and the carbon price faced by UK producers. The specifics of the CBAM will be subject to further consultation in 2024, including the precise list of products in scope. The UK is also looking to establish a framework to measure the carbon emission content of goods. A CBAM will work alongside the UK Emissions Trading Scheme to mitigate the risk of carbon leakage.

“This levy will make sure carbon intensive products from overseas — like steel and ceramics — face a comparable carbon price to those produced in the UK, so that our decarbonization efforts translate into reductions in global emissions,” said UK finance minister Jeremy Hunt.

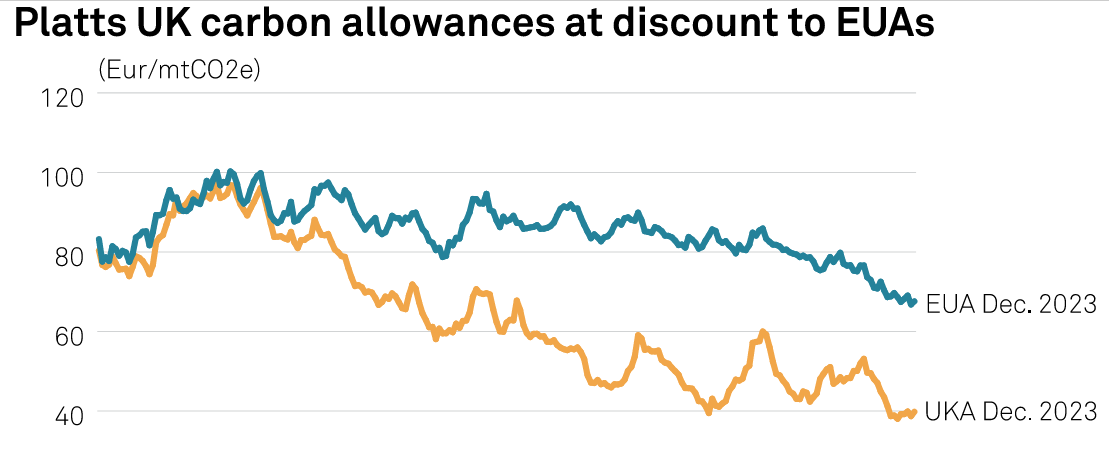

UK carbon allowance prices fell to a record-low just above GBP32/mtCO2e early December and were trading Dec. 18 around GBP36/mtCO2e on ICE. The discount of UKAs to EU carbon allowances also widened in 2023 despite EUA prices falling Dec. 18 to a fresh year-low of under Eur67/mtCO2e.Platts last assessed UKA Dec 2023 at Eur39.79/mtCO2e on Dec. 15 compared to Eur67.58/mtCO2e for EUA Dec. 2023.