The blocking of two coal terminals in the key Baltimore US coal export hub this morning following a bridge collapse will mostly hinder North Appalachian coal exports to India for the brick kiln industry.

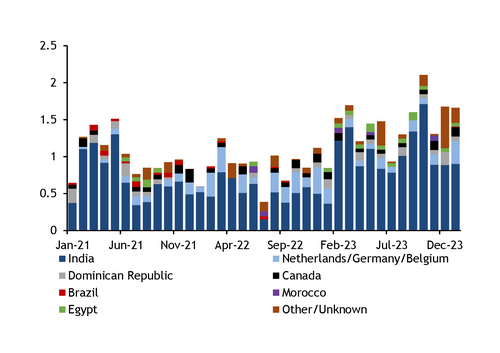

Most thermal coal exports from Baltimore’s two coal terminals, Consol Marine Terminal (CNX) and Curtis Bay Piers, flow to India, with 12.4mn t shipped last year and 6.3mn t in 2022, US customs data show. Baltimore exported just over 900,000t to India in January, up from 364,000t a year earlier.

The port did not provide a timeline as to when the terminals may resume coal exports as of 26 March.

Suspended North Appalachian shipments will probably raise prices in India, as brick kilns enter the peak production season in the summer, an India-based trader said. The brick kiln industry typically consumes very-high calorific value NAR 6,900 kcal/kg North Appalachian coal.

Buyers could look to petroleum coke as a substitute, but the higher sulphur content may not be appealing to some users despite the higher calorific value.

US petroleum coke is currently more competitive than coal for Indian buyers, based on Argus spot price assessments. The price of cfr India 6.5pc sulphur coke averaged $3.74/mn Btu over 4-25 March, compared with $4.16/mn Btu for high-sulphur Illinois basin coal, the next cheapest alternative. North Appalachian coal averaged $4.86/mn Btu over the same period, down from $5.02/mn Btu in January.

Some US coal is sold to India under term contracts on an API 2 index-linked price basis.

Europe

The Netherlands, Germany and Belgium are the second-largest market for North Appalachian coal, with close to 310,000t sent there from Baltimore terminals in January, up from just above 200,000t a year earlier.

April API 2 futures rose sharply this morning to $115/t but had eased slightly to $114.50/t by noon. The incident has added a “level of volatility [which] could have big implications”, a European paper broker said.

In the physical market, an April-arrival 50,000t multi-origin cargo was bid at $125/t des Amsterdam-Rotterdam today, flat on yesterday.

But most US material does not trade on these terms because of varying calorific value, sulphur and chlorine levels. Only around 50,000 t/month of US Scota coal is available, a European physical broker said, but this may be exported from Gulf coast ports, a different broker said.

Scota — the standard coal trading agreement — is a set of terms and specifications used to trade NAR 6,000 kcal/kg coal in Europe.

Some US North Appalachian cargoes were blended with metallurgical coal a year ago to reduce the calorific value and meet Scota contract specifications, but the high free-swelling index (FSI) content caused problems for power plants because this made it harder to burn as some particles do not ignite, creating more ash.

Logistics

North Appalachian coal producers could rail volumes around 250km south to the Hampton Roads port complex in Virginia, but this would add to railing costs. Hampton Roads typically handles Central Appalachian coal.

Some North Appalachian coal is barged south to New Orleans when the eastern terminals at Baltimore and Hampton Roads become congested, according to a barge operator.

The CNX Marine Terminal can store up to 1mn t and exported 19mn t of metallurgical and high calorific-value thermal coal last year, according to its full-year 2023 results.

The 79,000t Klara Oldendorff is currently loading thermal coal at CNX Marine Terminal and the 79,000t Jy River is loading coal at Curtis Bay Piers.

Some 22 ships are currently inside the port, of which 13 are expected to load coal.

By Evan Millard

Baltimore thermal coal exports mn t

Source: Argus Media