SOUTH Africa’s coal producers desperately need an improvement in exports this year. The likelihood of this happening though is doubtful. Export coal sales through Richards Bay Coal Terminal, South Africa’s largest coal handling facility, were just over 50 million tons (Mt) last year. While this equalled 2022 it’s still a poor number, the lowest in three decades. Exports were 76.5Mt as recently as 2017.

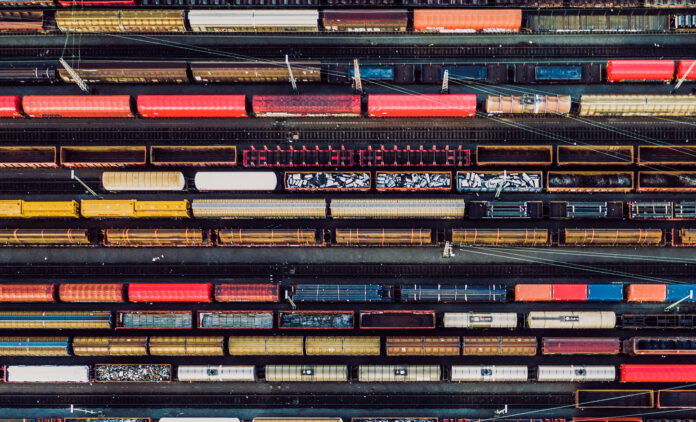

The difficulties encountered by South Africa’s state-owned Transnet Freight Rail (TFR), a division of Transnet, are the well documented issues of vandalism, corruption and a shortage of locomotives. The Minerals Council thinks TFR should be doing better nonetheless which is why efforts are underway to improve management capability, including an upgrade to digital systems, as one example.

Without an improvement in coal deliveries this year, Thungela Resources’ South African business will be barely cash flow positive at spot coal prices of around $95/t, according to a report by RMB Morgan Stanley. It downgraded the company’s share price to R100 this month.

Around the same time the bank was publishing its note, the stock shed a quarter largely on uninspiring coal prices. The share bottomed out on January 26 on the day RBCT reported its 2023 sales numbers. Morgan Stanley thinks the combination of Thungela’s subdued South African business, which yielded R1bn less cash at the half year than it expected, probably a function of a capital build, will lead to a disappointingly conservative dividend.

On the upside is Ensham, Thungela’s Australian mine which it bought last year. The deal, completed at R3.2bn, looks like smart business especially as it’s offsetting the South African export business. Another potential upside for Thungela is that it has major leverage to an improvement in TFR’s performance, should it happen.

A return to pre-2021 volumes would see more than a 50% positive revision to Thungela’s share earnings, said Morgan Stanley. “While steps are underway to liberalise the rail sector in South Africa, we are concerned about the timing and the continuing deterioration in Transnet’s performance,” it said. “Nevertheless there have been a few weeks of slightly better performance recently.”

According to a report by banking group UBS this month, thermal coal exports from South Africa showed a surprising recovery in December with volumes up 44% compared to November, equal to a run-rate of 61Mt for the first time in two years.