German exit path from coal power looking doubtful

Germany’s path away from coal-fired power production is growing harder to see the longer it takes for the government to form a strategy,

Germany’s path away from coal-fired power production is growing harder to see the longer it takes for the government to form a strategy,

I’ve been hearing about US power plant retirements in the pipeline and although I knew it would hit the Powder River Basin (PRB) the hardest.

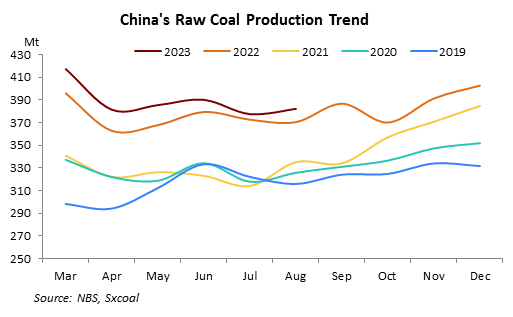

China’s coal production is projected to continue growing this year, albeit at a slower pace due to increased emphasis on cleaner energy.

Teck CEO Price expressed confidence in the company’s stake sale to India’s JSW despite geopolitical tensions between Canada and India.

It’s important to think about Chinese policy and ask ourselves why their actions don’t quite line up with their rhetoric.

China’s coal production growth is anticipated to slow in 2023 due to increased safety checks following a surge in fatal coal mine accidents.

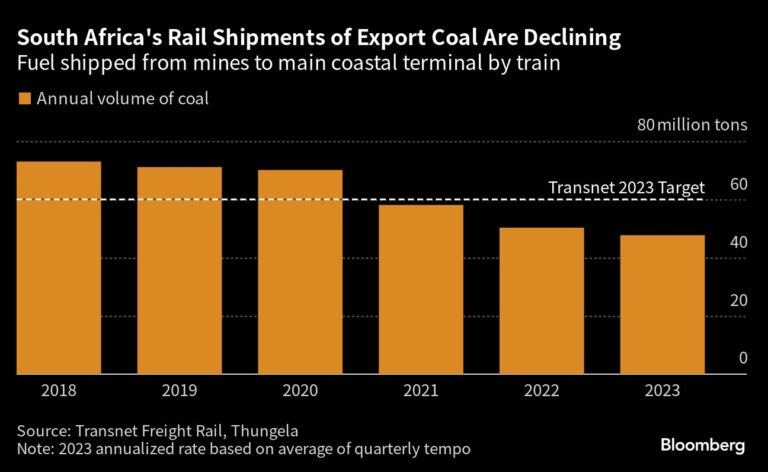

Glencore & Seriti to potentially cut jobs in South Africa due to challenges faced by Transnet, in transporting coal.

Sev.en Global Investments expressed interest in acquiring more Australian power assets to manage the gradual exit from coal.

Chevron hasn’t reached an agreement with unions regarding strike action at the Gorgon and Wheatstone LNG facilities.

Whitehaven Coal is considering using $1.1bn to $1.8bn in debt to purchase BHP’s coal mines in Queensland, as suggested by UBS analysts.

Thermal coal prices strengthened, surpassing $125 USD/ton, attributed to increased consumption and a sharp rise in gas prices.

Haul truck operations at Peak Downs might be suspended for two more weeks after two trucks slid over 100 meters during an overnight shift.