Russia’s presence in China thermal coal market on decline

Russian thermal coal’s presence in China has been dwindling in recent months, with the country’s thermal coal shipments taking smaller shares

Russian thermal coal’s presence in China has been dwindling in recent months, with the country’s thermal coal shipments taking smaller shares

India is reinforcing its commitment to increased coal-fired power generation ahead of COP28.

ARCH Resources & Peabody Energy reported Q3 earnings this morning. Earnings calls will take place at 10 and 10:30 am.

I’ve been hearing about US power plant retirements in the pipeline and although I knew it would hit the Powder River Basin (PRB) the hardest.

India’s crude steel output for January-September increased14% compared to the previous year, mainly due to infrastructure growth.

Teck CEO Price expressed confidence in the company’s stake sale to India’s JSW despite geopolitical tensions between Canada and India.

Met names got a lift yesterday with an update of the B Riley price deck and flow through share price target upgrades.

HCC is set to release earnings tomorrow (Aug. 2) after the bell.

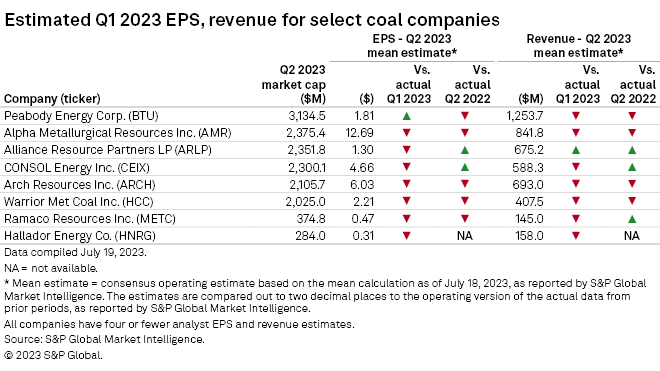

Most US coal companies are expected to report lower second-quarter earnings compared to the same period last year and the previous quarter due to lower coal prices.

I had lunch with a met producer sales guy yesterday and while discussing the upcoming domestic sales negotiating season, he mentioned that met buyers (North American end-users) seemingly “have all the power.”

Australian metallurgical coal prices were stable, while CFR China strengthened on higher domestic & increased interest in prompt cargoes.

Bidders in the auction for BHP’s Blackwater and Daunia, are vying to attract five Japanese commodities houses to join their ranks.