Disappointing China Stimulus Puts Downward Pressure on Coal Stocks

A rundown of today’s price action and an updated view on re-entry levels…

A rundown of today’s price action and an updated view on re-entry levels…

A rundown of recent coal stock price performances and setups heading into next week…

A quick rundown on today’s continued rip in coal stocks and actions I took…

A quick rundown of the post-China stimulus rip in coal stocks, and how to think about positioning using some advice from our Substack and Twitter friend Le Shrub…

First up for the US coal boys on Q2 earnings is ARCH -0.85%↓ who reports tomorrow (7/25/24) and will likely set the tone that the rest of the industry will have to meet or improve upon…

The company experienced a decrease in net income and adjusted EBITDA compared to the same period last year, with revenues also showing a decline.

Herewith a quick note before earnings season kicks off tomorrow morning with Arch Resources results before the bell and earnings call at 10 am.

This seasonal pullback in PLV Futures has not caused such a bad commensurate pullback in met coal stocks.

Citi has raised its rating on April 11 for Warrior Met Coal to ‘Buy’ from ‘Neutral’ and increased the target price to $75

Herewith the monthly technical analysis update along with some quick commentary on each coal producer.

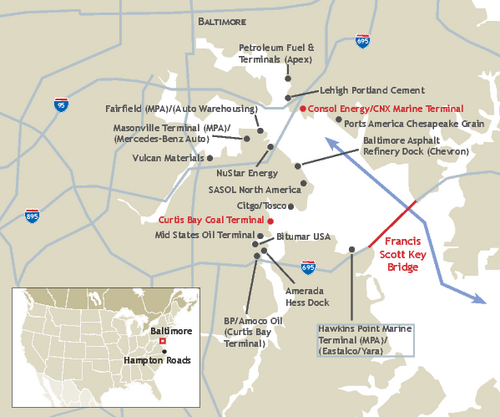

The Port of Baltimore will be partially reopened to a depth of 35ft by the end of April and will fully reopen by the end of May

The first train was delivered today to the railroad’s Lambert’s Point terminal in Norfolk, Va., as Norfolk Southern works on alternate ports.