With strong natural gas-fired power generation required this summer to trim the US market’s huge storage surplus, high levels of coal stockpiles held by utilities pose a significant downside risk to gas prices, according to S&P Global Commodity Insights analysts.

Production cuts and coal-to-gas switching will be needed to alleviate the storage surplus and avoid “hitting storage injection constraints in September/October,” the analysts said March 21.

US gas storage capacity was 55% utilized as of March 15 with 2.332 Tcf of working gas in storage, 678 Bcf above the five-year average, US Energy Information Administration data shows. Storage inventories are expected to exit the withdrawal season at the highest level since 2016, the analysts said.

But gas can expect strong competition from coal this summer. Combined stocks of bituminous and subbituminous coal at power plants were 127.7 million st at the end of December 2023, the highest since November 2020.

EIA estimated there were 177 “days of burn” held at electric power plants that burn subbituminous coal by the end of December, the highest since at least 2010, and 154 days of burn at bituminous coal plants.

While coal burn likely picked up amid cold weather and gas price spikes in the middle of January, it quickly retreated in February. “We estimate coal burn at around 44 million st in January, falling to around 27 million-28 million st in February,” Wendy Schallom, senior coal and power analyst at S&P Global, said March 25. “We estimate stockpiles are now back up to around 130 million st.”

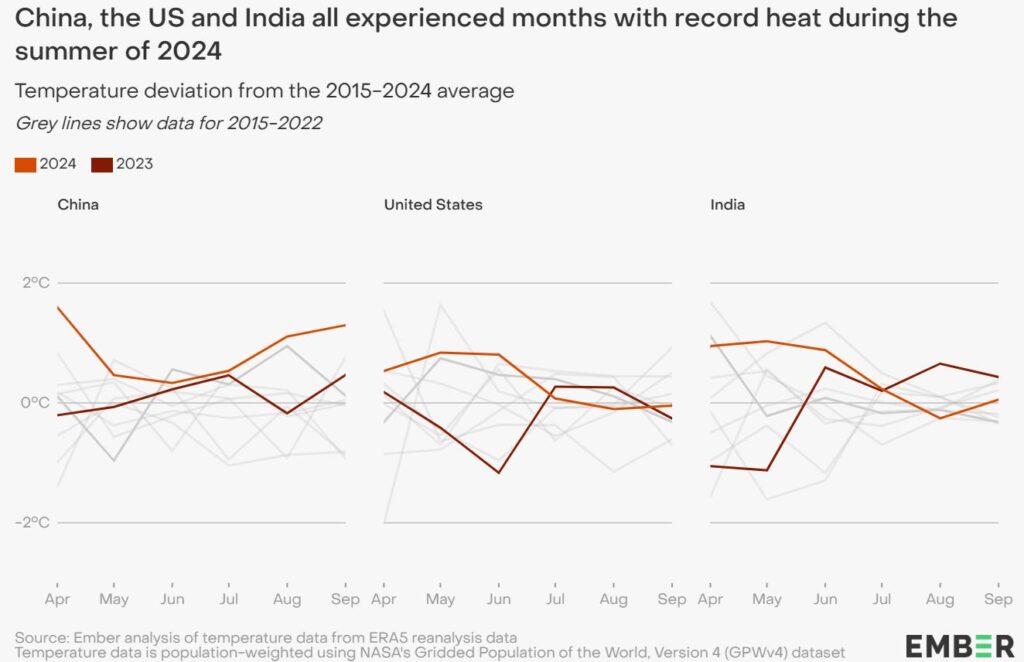

Coal and gas may be competing for a smaller share of the pie this summer, considering renewable capacity will be higher year over year. The EIA forecasts the US will add 36 GW of solar in 2024, in addition to 19GW added in 2023. “Renewable generation also was rather weak for parts of last summer, so if that output is now near-normal this would be another challenge for thermal generation,” Nikolay Filchev, director of gas, power and climate solutions at S&P Global, said March 25.

S&P Global analysts forecast power sector gas demand to be 37.7 Bcf/d in summer 2024, down by 500 MMcf/d year over year.

The strong storage levels are weighing heavily on gas prices. In their latest short-term outlook on March 21, S&P Global analysts reduced their forecast for average Henry Hub prices in summer 2024 to $2.21/MMBtu, down by 29 cents from the previous outlook a month earlier.

The analysts also reduced their forecast for summer gas production by 800 MMcf/d to an average of 101.5 Bcf/d, which would be 1.3 Bcf/d lower than in summer 2023. Producers have been scaling back output in response to weak prices.

.png)

Even with this reduced production, the analysts see more risk on the downside than the upside.

Risks include a delayed return of full capacity at the Freeport LNG facility, which is due to be at limited capacity until May, and milder-than-normal weather in summer.

“It is tough to be very bullish for summer gas prices even if summer turns out to be hotter-than-normal,” Filchev said. “Coal stockpiles are likely going to be high and gas prices will need to be even lower than last year to incentivize strong displacement.”

Any reprieve for prices appears more likely to come from further production cuts.

“Some producers have shown a willingness to adjust production, at least temporarily, to persistently depressed prices,” Matthew Piatek, director for gas, power and climate solutions said March 25. “We have adjusted production to expected market conditions this summer; however, it is possible that producers revise production schedules beyond our expectations which could moderate price weakness.”

Source: S&P Global