Production and Sales Milestones

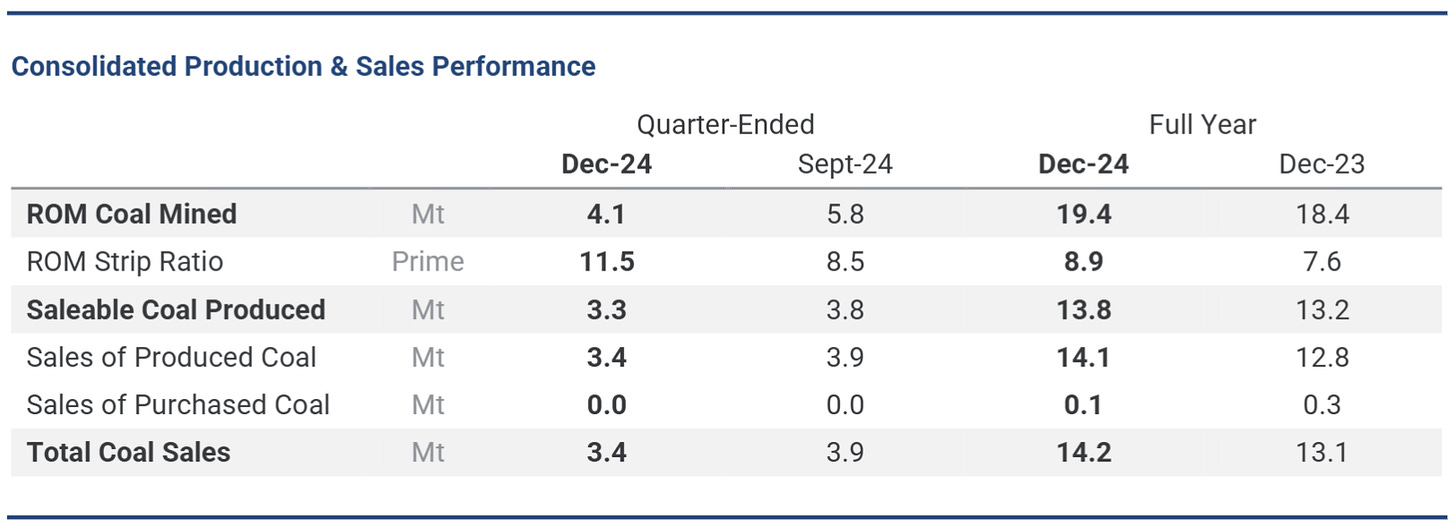

Stanmore Resources Limited has capped off a solid year in 2024, achieving record production across its key metallurgical coal assets despite operational challenges, including adverse weather and the planned closure of the Millennium mine earlier in the year. The company reported a full-year saleable coal production of 13.8 million tonnes, surpassing the upper range of its 2024 guidance of 12.8–13.6 million tonnes.

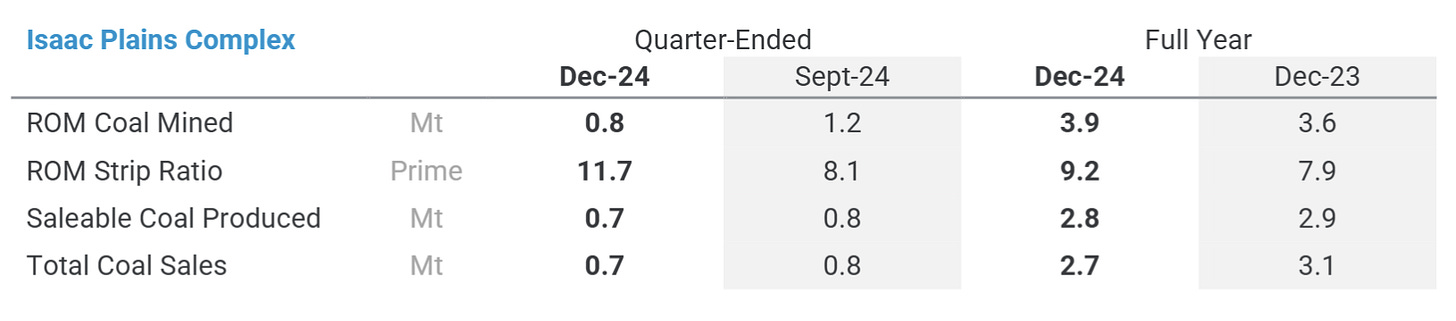

This achievement was driven by record performances at its South Walker Creek, Poitrel, and Isaac Plains Complex mines. The December quarter alone saw 4.1 million tonnes of Run-of-Mine (ROM) coal mined and 3.4 million tonnes sold.

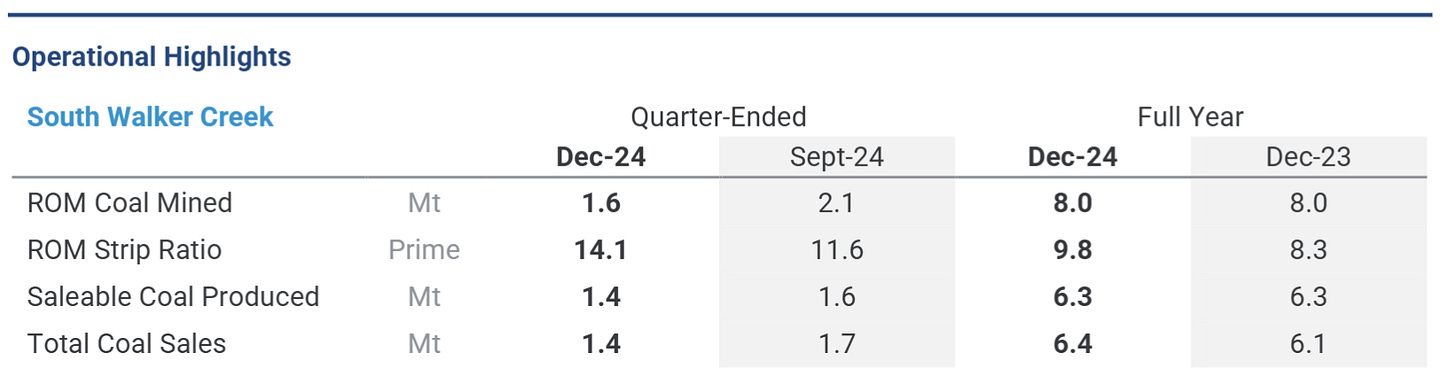

South Walker Creek achieved 6.3 million tonnes of saleable production in 2024, with a notable ramp-up of its expanded Coal Handling and Preparation Plant (CHPP). The plant’s throughput capacity is set to rise to 1,200 tonnes per hour by March 2025, further boosting production efficiency.

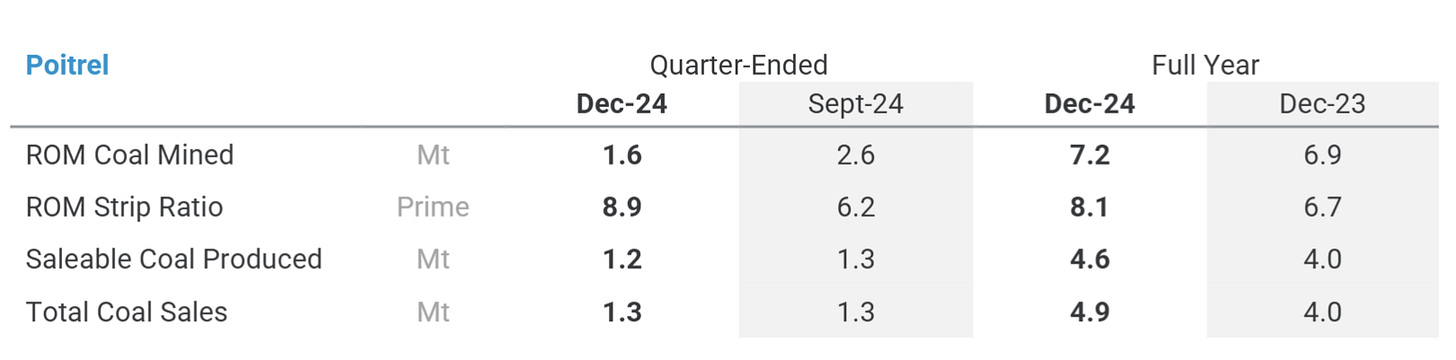

Poitrel mine followed with 4.6 million tonnes, setting records for both production and sales volumes, supported by optimized processing schedules.

And finally Isaac Plains contributed 2.8 million tonnes, benefiting from improved utilization of its crushing unit and focused recovery efforts after weather disruptions.

Strong Financial Foundation

Stanmore concluded 2024 with $289 million in cash and over $500 million in total liquidity, bolstered by a $50 million increase in its revolving credit facility. The company’s balance sheet strength positions it well to manage commodity cycles and pursue growth opportunities. Notably, $24 million in capital expenditures supported key projects like the South Walker Creek expansion and other operational improvements.

Development and Exploration Progress

Stanmore made significant progress in advancing its development and exploration initiatives. The South Walker Creek expansion project was completed ahead of schedule, increasing the site’s ROM capacity to 9.4 million tonnes per annum. The company also advanced its Isaac Downs Extension project with environmental surveys, groundwater monitoring, and preparations for an Environmental Impact Statement submission in early 2026. Exploration activities across key sites concluded successfully, with $5 million invested during the quarter.

Market Dynamics and Outlook

As we have duly noted here, metallurgical coal market faced mixed conditions in 2024. Prices for prime hard coking coal traded within a narrow range, starting the quarter at $205 per tonne and closing at $197 per tonne. High steel exports from China and weak ex-China steel demand weighed on prices, but late in the quarter, India’s introduction of metallurgical coke import quotas provided some relief, and will likely support current pricing dynamics heading into 2025. While weather disruptions in Queensland affected production and exports in some regions, overall export volumes remained stable.