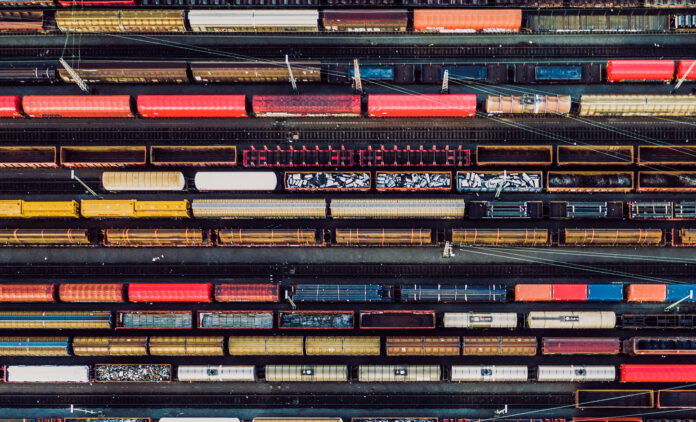

The labor dispute at South Africa’s port and freight rail operator Transnet began on October 6 and is apparently set to worsen as more unions join the protest. Transnet declared force majeure last Thursday as a result. “Thungela Resources Ltd., South Africa’s biggest shipper of thermal coal, has said a prolonged strike of two weeks would curtail as much as 300,000 tons of export production.”

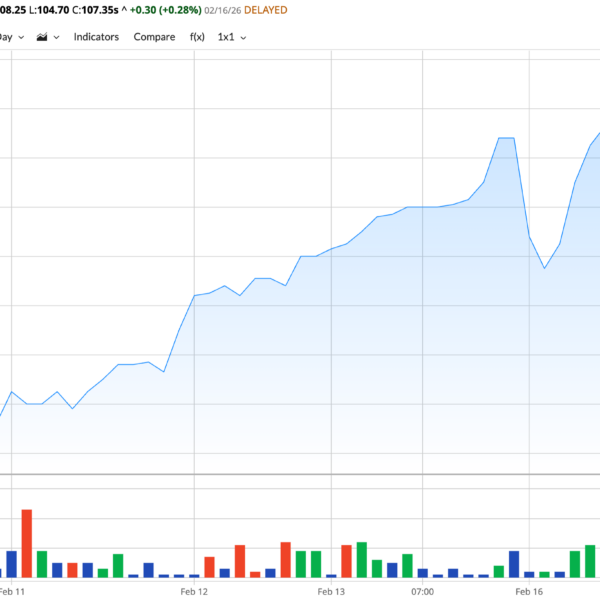

If there’s a positive spin on this, the reduced seaborne supply as a result of the strike should bolster API2 coal futures and alleviate the drybulk traffic and offshore inventory around ARA, Europe’s primary coal import terminal. ARA coal inventories reached capacity over the past month due high prices and demand ahead of winter in Europe. As inventories begin to fall, expect prices to remain elevated due to a lack of Russian imports which have been banned since August 10.

If you’d like to read more about the Transnet Strike and force majeure, there’s two articles linked here and here.

If you’d benefit from a deeper dive into the coal supply/demand situation in Europe, you should consider subscribing to The Coal Trader Newsletter here.

Recent Posts___________________________________________________________________

Met Coal Slips Again as Weather Clears and Mills Step Back