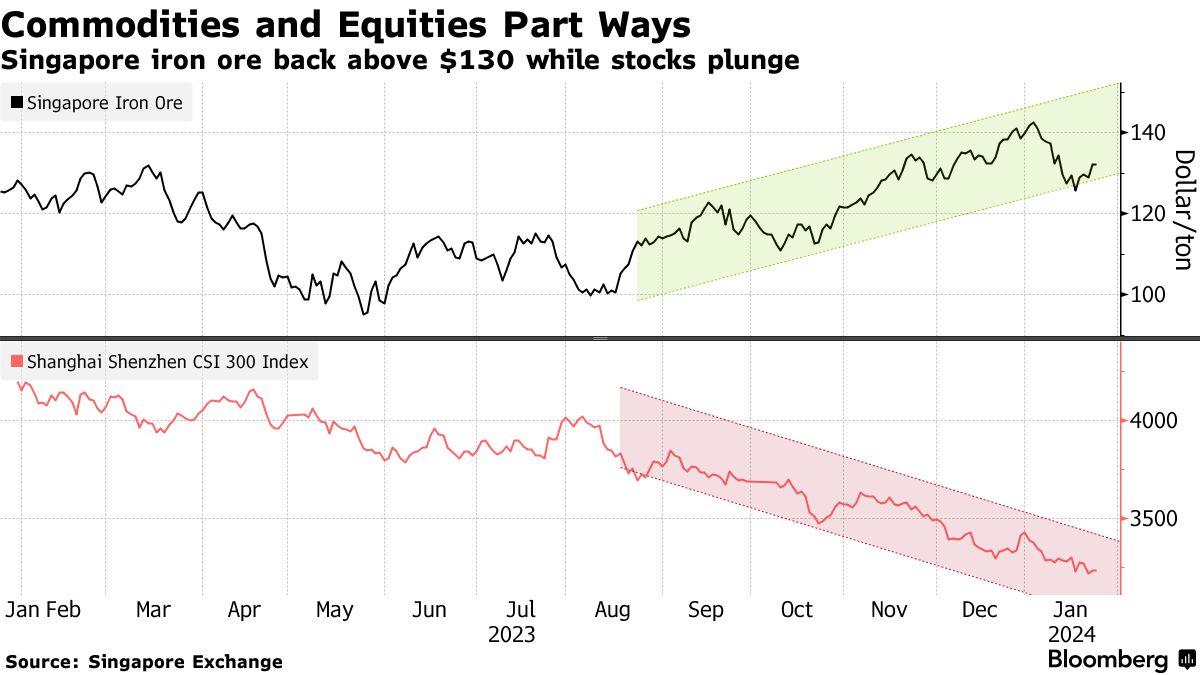

The rout in Chinese equities isn’t showing up in industrial materials markets, another risk asset that often moves in tandem with stocks. So why the resilience?

Both are keyed to China’s fragile economic conditions, particularly the protracted crisis in the commodities-intensive real estate sector. And China remains by far and away the world’s biggest buyer of raw materials. But while the benchmark CSI 300 stock index has plunged to five-year lows, metals’ bellwethers are holding up rather well.

Copper’s stuck in the same range that it’s been in for months, and iron ore, the main feedstock for steel, has risen back above $130 a ton, a threshold that typically has the authorities itching to intervene and cool prices.

The last big equities selloff in 2015 was certainly contagious, sending a host of commodities lower as investors liquidated positions to meet margin calls as the stock market cratered, or to raise cash in case the wider economy tanked.

But this time round, commodities are dancing to their own tune, seemingly unaffected by the collapse in confidence that’s afflicting stocks and worrying the government. For one, China’s economy has been in the pits for a while, and state infrastructure spending to counter the collapse in the property sector is having an effect. Moreover, the deflationary pressures that have garnered headlines on the consumer side of the economy are starting to ease at the factory gate.

“Industrial commodities have received key support from China’s PPI, which is generally recovering,” said Chi Kai, chief investment officer at Shanghai Cosine Capital Management Partnership. He also said that some funds may be rotating from equities into commodities.

In any case, the worse economic conditions get, the more likely it is that Beijing bites the bullet and delivers the massive stimulus it has so far been reticent in unleashing.

Interest Rates

That’s one reason why steel mills in China have been unwilling to cut production – December’s figures aside — despite awful margins. “Not many mills have been willing to budge an inch for fear of losing market share – just in case stimulus measures take effect sooner rather than later,” said Atilla Widnell, managing director at Navigate Commodities Pte in Singapore.

Then there are global factors supporting the market: the probability that interest rates in the West have peaked, which should juice demand outside China, and supply issues that are putting a floor under commodities prices.

Turmoil in the Middle East is keeping the oil market steady, which underpins global energy prices and the cost of producing commodities. The copper market, meanwhile, is tightening as global ore supplies deplete and green demand for the metal booms.

“In contrast to the uncertain equities landscape, commodities might be seen as a safe haven by some investors,” Henry Hao, senior China economist at CRU International Ltd., said in emailed comments.

On the Wire

Chinese authorities boosted messages of policy support in a bid to stabilize market confidence, underscoring the heightened concern to stem the rout in stocks.

For veteran hedge fund investor Chua Soon Hock, 2024 was supposed to herald a multi-year rise in Chinese stocks and the opportunity of a lifetime. Instead, his fund’s sudden demise sends a warning to fellow China bulls: stick to your guns at your peril.

The yuan looks set to become a key beneficiary of China’s plan to stem a stock-market rout, as the equities rescue package would exacerbate a scarcity of the currency overseas, putting a squeeze on short-sellers.

China’s domestic investors are abandoning the nation’s equities for the safety of bonds as concerns mount about the deteriorating economic outlook.