Australian coal firm Whitehaven Coal Ltd. drew 17 private credit providers and one bank for a $1.1 billion loan to buy two mines, the latest example of direct lenders benefiting from banks’ tighter scrutiny of environmentally less friendly projects.

Hong Kong-based hedge fund Asia Research & Capital Management Ltd. leads the syndicated deal with $185 million, followed by private lender Farallon Capital Management LLC’s $150 million and alternative asset management firm Sona Asset Management Ltd.’s $125 million, according to a person familiar with the matter who requested anonymity discussing private matters.

Other direct lenders include Alpha Wave Global LP, Washington H. Soul Pattinson & Co., Davidson Kempner Capital Management LP, Marathon Asset Management LP, Challenger Investment Management, King Street Capital Management LP, Ares Management Corp., Canyon Partners Real Estate LLC, and Singapore’s sovereign wealth fund GIC Pte. Bank of America Corp. is the only participating bank.

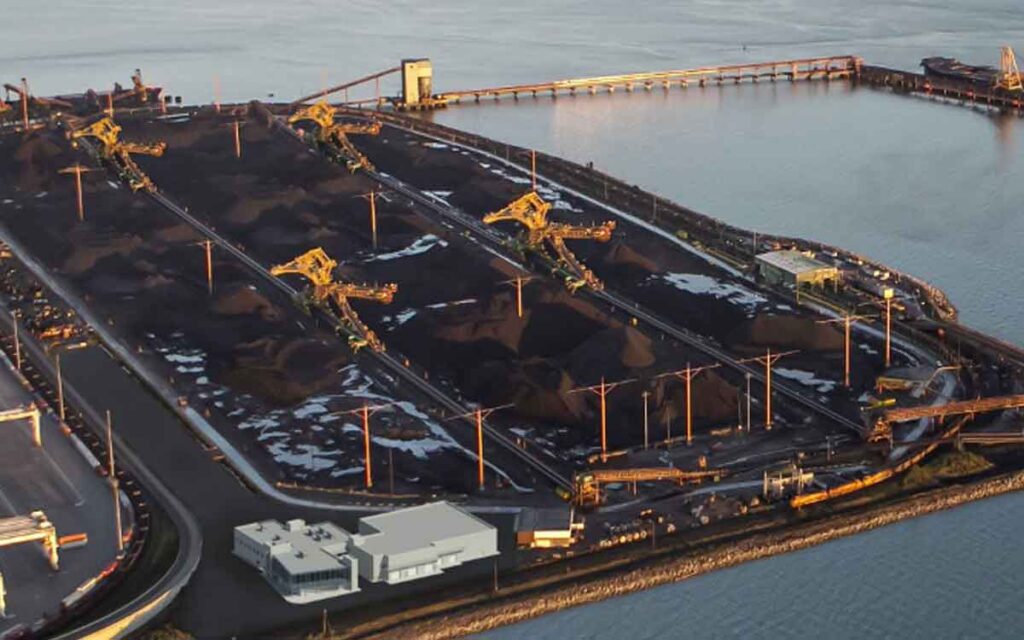

The five-year loan seeks to refinance a $900 million bridge loan announced in October to back Whitehaven’s acquisition of the Daunia and Blackwater coal mines in Queensland from BHP Group Ltd. Funding is expected in March, said the person.

The overwhelming dominance of direct lenders in Whitehaven’s loan is a fresh reminder of banks’ reluctance since the 2015 Paris climate pact to shun projects that may trigger environmental, social and governance concerns. Filling the void left by them are private credit providers that have seen phenomenal growth in recent years via bets on riskier projects and better returns.

Whitehaven, ARCM, Sona Asset, GIC, Ares, Davidson Kempner, Canyon Partners, Challenger, King Street, Bank of America declined to comment. Farallon, Alpha Wave, Washington H. Soul Pattinson, and Marathon were not immediately available for comment.

Private credit loans typically come with floating rates of interest that are higher than bank debt. The market had ballooned to $1.7 trillion as of June, from around $500 billion at the end of 2015, according to investment data firm Preqin Ltd.

By Megawati Wijaya