The coal brigade is back to kick tyres at London-listed miner Anglo American’s Australian mines. Street Talk understands a handful of private capital players reached out to Anglo American’s Australian outpost recently, keen to see if the company would be interested in selling its Queensland coal mines.

Of note, the inbound interest was unsolicited, there is not an offer on the table and a sell-side adviser had not been appointed to shake out a deal. A spokesperson for the company declined to comment.

Anglo American’s Queensland coal mines, especially Moranbah and Grosvenor, are profitable assets that have helped the company become the third-largest exporter of steelmaking coal in the world. The unit, which also includes smaller assets like Dawson and Aquila, contributed $US615 million EBITDA in first half of 2023.

The coal giant’s share price fell nearly 18 per cent within a week in December and is 48 per cent lower than 12 months ago. This, combined with BHP’s divestment of its Blackwater and Daunia coal mines for $6.2 billion in October, has spurred tyre kickers into action, sources said.

While there is no certainty the preliminary interest will progress, Anglo American’s exit from metallurgical coal has been on the cards for almost a decade. It ran a sale process in 2015 that culminated in exclusive talks with a consortium comprised of private equity giant Apollo Global Management and exporter Xcoal Energy & Resources. However, it pulled the brakes on the sale the following year.

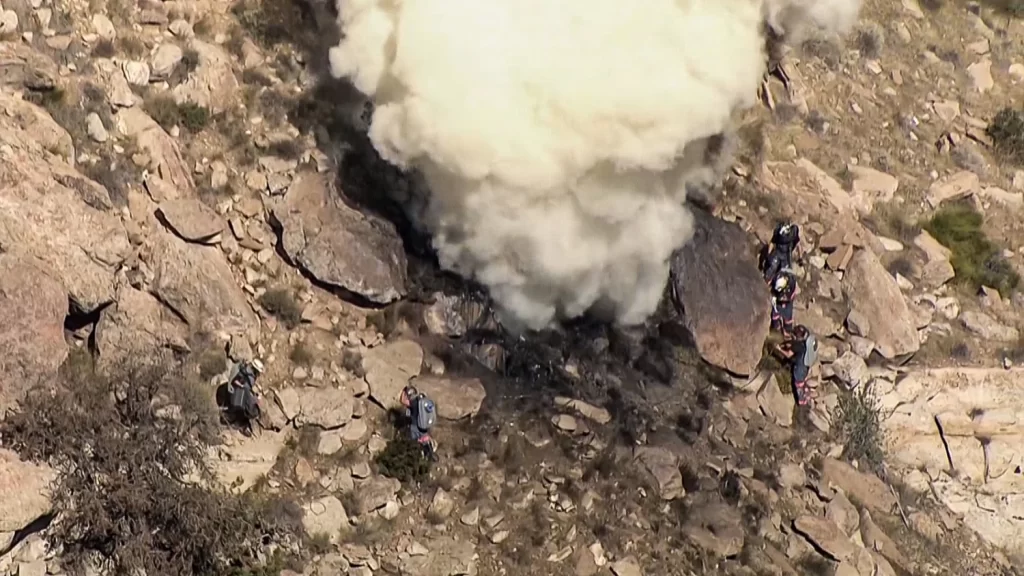

Front of mind for potential suitors would be the underground geology of Anglo’s Queensland mines, which come with complexity in operations as well as a much higher carbon footprint.

Coal heart

The movement at Anglo American comes at a time when Whitehaven Coal has shown there’s no shortage of lenders willing to bankroll coal acquisitions even as big banks withdraw from the sector.

As reported by Street Talk on Sunday, Whitehaven’s $US900 million ($1.3 billion) credit facility to finance its acquisition of the BHP assets drew commitments from global credit juggernaut Ares Management, Josh Friedman’s Los Angeles-based hedge fund Canyon Partners, and multi-strategy hedge fund Farallon Capital Management.

Next on the auction block is South32’s Eagles Downs, for which sell-side adviser Macquarie Capital began investor meetings last year. It is expected to serve as a precursor for a sale of the miner’s much bigger Illawarra metallurgical coal mine.