Peabody reported strong financial results for Q2 2024, beating estimates by a wide margin with a net income attributable to common stockholders of $199.4 million, or $1.42 per diluted share, and adjusted EBITDA of $309.7 million. The company reached a significant insurance settlement for $109.5 million, covering property and business interruption losses at Shoal Creek, which contributed significantly to the outperformance.

The company’s balance sheet remains robust, with $622 million in cash at the end of June. This financial strength enabled Peabody to announce an additional $100 million for opportunistic share repurchases and maintain its $0.075 per share dividend for the sixth consecutive quarter.

Operational Highlights

CEO Jim Grech emphasized Peabody’s commitment to safety, noting that five mines reported zero injuries. The company’s operational performance met expectations across all segments, with notable achievements in its Seaborne Thermal and Metallurgical segments.

Seaborne Thermal Segment: The Wilpinjong mine continued to perform well, benefiting from improved equipment availability and strong demand in the Asian thermal market. The segment recorded $104 million in adjusted EBITDA, a $10 million increase from the previous quarter, with an adjusted EBITDA margin of 34%.

Seaborne Metallurgical Segment: This segment generated $144 million in adjusted EBITDA, including the insurance settlement. While the CMJV experienced delays due to significant rain and challenging geotechnical conditions, overall volumes, costs, and realized prices were as expected.

U.S. Thermal Segment: The PRB shipments exceeded expectations as the company exited the shoulder season, and the segment demonstrated strong cash performance with improved margins. The segment produced $53 million in adjusted EBITDA, with a combined U.S. thermal operations adjusted EBITDA margin of $2.73 per ton for Q2.

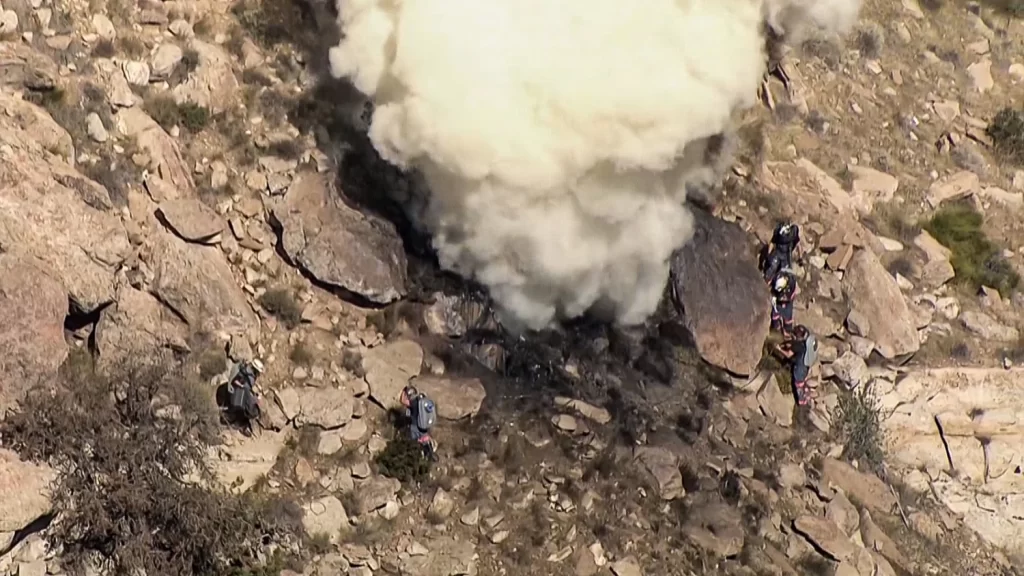

Centurion Project Progress

Peabody’s Centurion project, a world-class hard coking coal growth initiative, is progressing well. The initial underground development rates exceeded expectations, with the first development coal mined in June. The project remains on budget, with shipments to customers expected in Q4 2024 and longwall coal production targeted for Q1 2026. The recent acquisition of the Wards Well deposit has extended the mine life to over 25 years, with an average annual production of approximately 4.7 million tons.

Market Outlook

Malcolm Roberts, CMO, provided an outlook on market conditions. The Seaborne Thermal coal market remains balanced, with increased demand from China and Vietnam supporting higher imports. The Seaborne Metallurgical coal market saw stable demand despite supply side disruptions, with premium hard coking coal prices averaging $242 per metric ton during the quarter.

Future Guidance

CFO Mark Spurbeck provided detailed guidance for the second half of 2024. The company expects strong free cash flow despite challenges such as high customer inventories and low natural gas prices. Peabody adjusted its full-year guidance to reflect increased Seaborne Thermal volumes, reduced Seaborne Metallurgical volumes due to geological conditions at CMJV and lock outages, and lower PRB volumes.

Peabody remains focused on creating shareholder value through disciplined capital allocation, maintaining a strong balance sheet, and investing in organic growth opportunities. The company plans to provide a comprehensive update on the Centurion project, including an integrated mine plan, in the second half of 2024.

Q&A Session Highlights

Capital Allocation Strategy

CEO Jim Grech emphasized that Peabody’s policy of returning at least 65% of available free cash flow to shareholders remains flexible, allowing for increased buybacks in favorable market conditions. CFO Mark Spurbeck highlighted the company’s resilient balance sheet and strong free cash flow outlook for the second half of the year, which supports opportunistic share repurchases. This strategy aims to maximize shareholder value, particularly as Peabody approaches key milestones in the Centurion project.

Organic Growth vs M&A

Jim Grech reiterated that Peabody’s primary focus is on maintaining financial stability, returning capital to shareholders, and investing in organic growth. The Centurion project is a central component of this strategy. While the company evaluates potential acquisition opportunities, the emphasis remains on creating long-term shareholder value through disciplined investment in existing operations and strategic growth projects.

Operational Challenges and Mitigation

Addressing operational challenges, Grech explained that recent geological issues at the Coppabella mine were more significant than anticipated but are being effectively managed. For the Holt Lock outage, Peabody is implementing alternative transportation routes to mitigate the impact on Shoal Creek shipments, with the overall cost impact expected to be relatively small and manageable.

Centurion Project Details

Peabody provided updates on the Centurion project’s development, noting significant achievements in June and confirming that the project remains on budget. The company expects to ship 60,000 to 70,000 tons of development coal by the end of 2024 and approximately 200,000 tons in 2025. The integration of the Wards Well deposit has extended the mine life and increased annual production estimates, highlighting the substantial long-term value of the project.

Market and Pricing Dynamics

Improved PCI prices, partly due to reduced Russian supply, have positively impacted Peabody’s pricing outlook. Despite the challenges posed by geological conditions and lock outages, Peabody’s diversified product mix and strategic market positioning are expected to support stable price realizations and operational resilience. Peabody’s leadership expressed cautious optimism for the remainder of 2024, anticipating strong free cash flow and continued operational efficiency.