Peabody (NYSE: BTU) has announced the closing of a new $320 million senior secured revolving credit facility maturing in January 2028, subject to certain conditions relating to the company’s outstanding Convertible Senior Notes due March 1, 2028. Revolving loans under the facility bear interest at a rate of SOFR plus an applicable margin ranging from 3.50% to 4.25%, depending on the company’s total net leverage ratio. At Peabody’s current total net leverage ratio, the margin would be 3.50%. Letters of credit under the facility are subject to a fee equal to the applicable margin. The facility will be guaranteed by certain of Peabody’s subsidiaries.

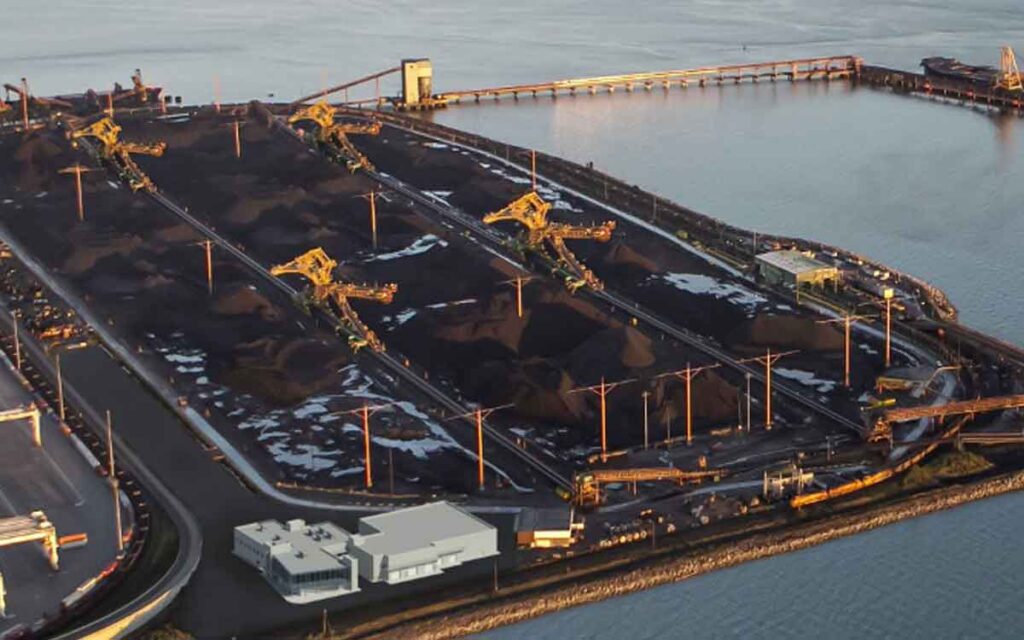

“This new revolving credit facility is intended to further enhance our financial resiliency during the period of investment at the Centurion Mine as part of our strategy to reweight Peabody’s long-term production and revenue toward premium Australian metallurgical coal,” said Mark Spurbeck, Peabody’s Chief Financial Officer. “Over the past two years, we have strengthened our balance sheet and implemented an initial $1.0 billion share repurchase program. We are now taking the next steps to achieve our goal of making the Centurion Mine a global leader in the metallurgical coal market.”

PNC Bank, National Association is the administrative agent for the revolving credit facility, and PNC Capital Markets LLC acted as lead arranger and bookrunner in connection with the closing of the facility.

Peabody is a leading coal producer, providing essential products for affordable, reliable energy and steel. Our commitment to sustainability underpins everything we do and shapes our strategy for the future. For further information, visit PeabodyEnergy.com.