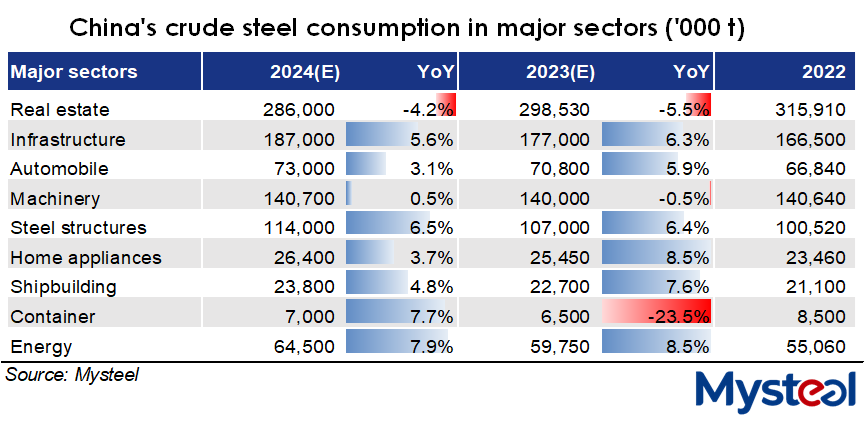

In 2024, the manufacturing industry is poised to be the focal point of China’s economic development, which will also offer substantial support to the country’s domestic steel demand, according to Mysteel’s report on February 19. Many local governments of China have designated manufacturing as the core sector to drive economic growth for the current year, focusing on key fields of emerging industries, energy, and transportation and water conservancy. Steel consumption from these fields is expected to become the impetus for domestic steel demand this year, Mysteel pointed out in the report.

Among downstream steel consuming industries, crude steel consumption in energy, containers and steel structures may experience robust growth this year, while the expansion of steel demand from shipbuilding, automobiles and home appliances is likely to slow down somewhat after rising rapidly over the previous year, according to the report. Specifically, crude steel demand from the energy industry may rise 7.9% on year in 2024, mainly driven by the country’s energy strategies for transformation and upgrading of energy structure, as well as for energy security and green development, Mysteel estimated.

As the energy industry transits to clean and low-carbon development, manufacturing for renewables will maintain steady momentum this year, supporting both domestic and overseas steel demand. China has witnessed a surge in its exports of the new three – electric vehicles, lithium batteries and solar panels – in the past year, as reported.

This year, steel consumption in the container industry is also expected to increase by 7.7% on year thanks to the recovering container demand with the improved global trade and the onset of a renewal cycle for containers. China’s container sales are expected to reach 2.5-3 million TEU (twenty-foot equivalent unit) in 2024 as against the 1.7 million TEU for 2023, among which about 70% will come from the renewal need of old containers, the report showed.

Benefiting from the persistent policy support, steel structure demand in China may keep rising this year, with the crude steel consumption in this segment increasing by 6.5% from the prior year, according to Mysteel’s prediction.

The rise in steel demand in the automobile industry, on the other hand, may decelerate to 3.1% on year in 2024 from the previous year’s 5.9%, as the country’s auto exports are expected to slow the pace this year with reduced demand and more frequent restrictions on China’s steel exports in global markets, Mysteel estimated in the report.

Crude steel consumption in the home appliances industry is estimated to grow further in 2024 thanks to the development in smart home appliances and green home appliances, though the rate may drop sharply to 3.7% from the 8.5% for 2023 as a result of increasing export challenges as well.

China’s shipbuilding industry is likely to maintain a steady development too thanks to the gradual recovery in shipping demand worldwide. However, steel demand from shipbuilding may grow slower by 4.8% on year this year, as the completed vessel may touch a new high while new ship orders may shrink somewhat compared with last year.

In 2024, China’s infrastructure sector will continue to serve as a cornerstone for the country’s steel market. while the on-year rise of crude steel consumption in this sector may slow slightly to 5.6% from the previous year’s 6.3% due to local governments’ excessive debt burden, the report showed.

For China’s real estate market, major steel consumer of the country, may remain depressed this year, and the crude steel use of this sector is likely to decline by 4.3% on year to about 286 million tonnes, as the property investment and sales are likely to continue the downtrends, though the on-year falls may narrow to some extent.

Written by Nancy Zheng