JFE Steel, Japan’s No.2 steelmaker, plans to buy more coking coal from the spot market to boost activity and make prices more transparent for the industry’s price benchmark setter, aiming to stabilize a rocky market, a senior official said.

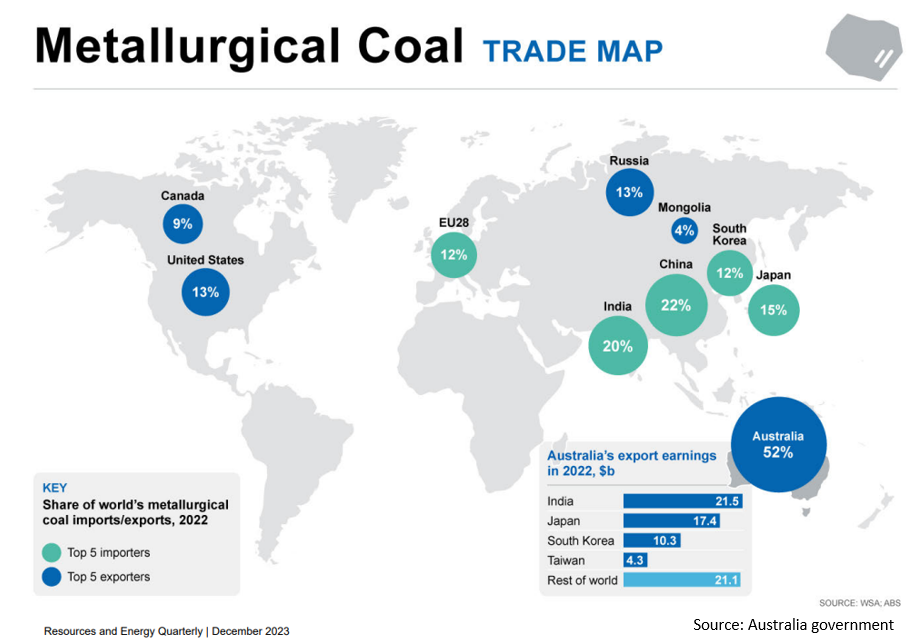

Spot trading for the key steel-making ingredient slumped and and prices turned volatile after the world’s top consumer China shut out coking coal from top producer Australia in 2020 and switched to less traceable, cheaper supplies from Russia and Mongolia.

JFE senior vice president Hiroshi Daimon said the lack of spot deals had helped drive up coking coal prices and put them out of line with the other key steelmaking ingredient, iron ore, pointing to possible trades intended to manipulate the coking coal benchmark.

“There are various factors such as China’s import ban, Russia’s invasion of Ukraine, but the (coking) coal market has a problem because there are very few transactions in the first place,” Daimon told Reuters in rare comments by a steelmaker on buying strategy.

“There are apparently some transactions that try to drive up the price,” he said.

The benchmark, S&P Global’s Platts Premium Low Vol FOB Australia, is used by the global steel industry to set prices for term coking coal supply deals, and is assessed using spot trades as well as bids and offers and other market indications. Asked about JFE’s concerns, S&P defended its assessments.

“Platts has a zero-tolerance policy toward any attempts to distort its assessments. We fully investigate all complaints with stringent internal processes and sector-leading transparency standards,” S&P Global said in emailed comments.

It said the drop in spot trading was due to declining coal exports from Australia amid mining and operational issues, while China was relying more on domestic production of coking coal.

“When output falls, producers typically reduce their allocation of spot sales in favor of maintaining supply into term contracts,” it said.

Drop in spot trade

Monthly spot trades for Australian hard coking coal at fixed prices have plunged to about 400,000 metric tons from around 2 million tons since China halted Australian coking coal imports, according to JFE.

That accounts for less than 5% of the annual 300 million tons of seaborne coking coal traded globally, JFE said, far below the 30% and 15% for spot thermal coal and iron ore volumes, respectively. Over the past three years, coking coal prices paid by JFE have jumped from $110 per wet metric ton in the July-September quarter in 2020 to as high as $526 in the April-June quarter in 2022 and $240 in the July-September quarter this year.

To tackle what it sees as an unsound market, JFE plans to buy more coking coal on the spot market.

“We want to increase our spot trading as much as possible to increase the liquidity of the market and to reflect true demand and supply, though it’s still like a drop in the desert,” Daimon said, without giving a specific volume figure.

JFE, a unit of JFE Holdings, began spot coking coal purchases at fixed prices in 2022, buying about 40,000-80,000 metric tons every quarter, with an annual target of around 500,000 tons. But that is only a fraction of its total procurement volume of 17 million tons. Bigger rival Nippon Steel also sees the lack of spot liquidity and price transparency as challenges.

Even with an increase in spot purchases by Indian companies, “the issue of low liquidity and transparency remains unchanged,” said Kichi Yamada, a Nippon Steel general manager, adding that the company uses both spot and term purchases. Key coking coal producer BHP said it is the joint responsibility of all market participants to contribute to spot market liquidity.

“We have been consistently selling part of our production into the spot market and are committed to continue to do so in the future,” a BHP spokesperson said.