India’s growing coal consumption is due to the surge in electricity demand and even a sharp rise in coal production is unable to cater to rising domestic demand, a significant part of which has to be met through imports. As the year draws to a close, SteelMint presents snapshots of India’s thermal coal market in CY’23.

Coal production

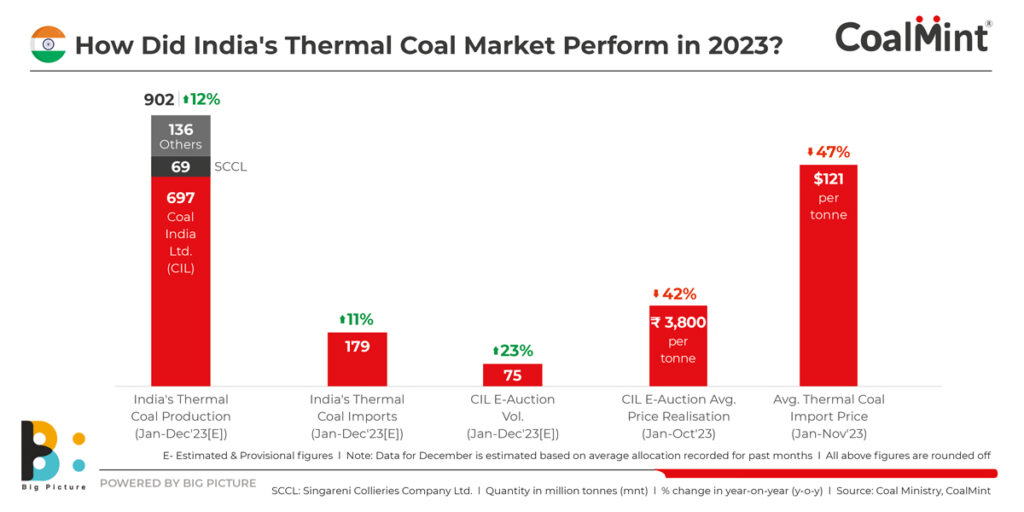

India’s thermal coal production is expected to rise significantly by about 100 million tonnes (mnt) y-o-y in calendar year 2023 (CY’23). Domestic coal output is expected to increase by about 12% in CY’23 to about 902 mnt as against 802 mnt in CY’22.

Out of the total production, CIL is expected to contribute an estimated 697 mnt, markedly higher compared to 634 mnt in January-December’22. Total Indian coal output was recorded at 816.69 mnt in January-November of this year, including CIL output at 630.89 mnt.

India aims to add 17 GW of coal-based power generation capacity in the next 16 months to deal with record rise in power demand. There are plans to build sufficient coal-fired plants to meet power demand of an estimated 384 GW by FY’32.

Imports

India’s thermal coal imports are expected to increase to 179.2 mnt in CY’23 as against 162 mnt in CY’22. Thermal coal import volumes in Jan-Nov’23 were recorded at 161.2 mnt compared with 151.10 mnt in Jan-Nov’22.

Why thermal coal imports ticked up?

ICB plants operate at full capacity:The power ministry extended emergency clause of the Electricity Act 2003, mandating imported coal-based power plants (ICBs) to run at full capacity till June, 2024. Also, all generation units are to import 6% of their fuel requirement for blending. This was a reaction against continued rise in electricity demand, inadequate supply of domestic fuel and lower hydro generation.

Imports from Russia, Mozambique increase:Coal imports from Mozambique surged 59% y-o-y to 8.9 mnt in January-November 2023 as against 5.7 mnt in the same period of last year. Moreover, imports from Russia rose by 20% y-o-y to 9.5 mnt in January-November as against 7.9 mnt in January-November 2022.

Indian buyers have augmented their procurement from Russia and Mozambique due to lower prices. Besides, uptick in sourcing from the US and Australia also contributed to import growth.

Import prices

Indonesian coal price for 4200 GAR dropped 34% y-o-y and was assessed at $71/t in November. Thermal coal price movement has followed a declining trend encouraging Indian buyers to increase purchases.

Major end-users such as cement plants took this opportunity to re-stock adequate material amid decline in prices. The global price decline also motivated imported coal-based (ICB) plants to replenish their inventory as they prepare to ramp up generation following government directives.

Simultaneously, small-scale traders are actively procuring material, recovering from setbacks caused by higher prices last year.

Surge in e-auction volumes

CIL’s e-auction volumes are expected at 74.69 mnt in CY’23 as against 60.51 mnt last year.

CIL has coal supply targets of 780/850/1,000/1,030/1,055 mnt for each year over FY24-28 (expected). The PSU major plans to model coal offtake of 764/795/810 mnt for FY24/25/26 (expected). To meet the 780 mnt production target for FY’24, the remaining fiscal production growth required rate is 10% y-o-y. FY’24 supply ttarget for the power sector is 610 mnt.

CIL has identified 37 closed/abandoned/discontinued underground mines for operation through the MDO route. Out of this, LoA has been issued for 10 mines.

Average prices fall in CIL auctions

Average e-auction prices have dropped significantly this year due to easing of supplies. Prices have fallen to about INR 3,807.7/t in CY’23 (January-October) as against INR 6,619.5/t in the year-ago period.

Last year, due to the Russia-Ukraine war, and market uncertainty, prices had picked up, while CIL’s e-auction volumes had been low due to its mandate to cater to the power sector. This had led to an abrupt rise in prices in CY’22.

However, easing supplies and rise in production volumes led to drop in prices, besides sufficient material was available to be put to auction.