India’s coking coal imports in November 2023 rose by 19% m-o-m to 4.88 million tonnes (mnt), as per CoalMint data. Imports surged by 23% y-o-y to 4.88 mnt in November 2023 as compared to 3.98 mnt in November 2022.

Imports rose m-o-m on India’s soaring industrial needs and the urgency to secure coking coal supplies, especially with depleting stocks at ports. India sought steady coking coal supplies from Australia in an effort to help steel mills from falling supplies and rising prices of raw products.

State-run miner Coal India Ltd (CIL) recorded a rise in coking coal production during November. Production rose by 2% m-o-m to 5.06 mnt in November 2023 as against 5 mnt in October.

India: SAIL to raise coking coal procurement from Russia

SAIL is planning to increase coking coal purchase from Russia due to inexpensive prices compared to Australian coal. Four shipments of 75,000t each is expected to arrive in December 2023. Since, April 2023 SAIL has imported eight shipments from Russia.

PCI imports

India’s PCI coal imports in November 2023 dropped by 17% m-o-m to 1.03 mnt, as per CoalMint data. Imports dropped nearly 23% to 1.03 in November 2023 as compared to 1.35 mnt in November 2022.

Prices of Australian low-volume PCI dropped 7% m-o-m to $201.29/t CFR India in November 2023 as against $216.44/t CFR India in October.

Country-wise imports

India’s coking coal imports from Australia stood at 2.51 mnt in November, largely stable m-o-m compared with 2.57 mnt in October.

Prices of Australian PHCC dropped by 6% m-o-m to $340.15/t CFR India in November 2023 as against $360.86/t CFR India in October.

Due to soaring Australian coking coal prices, end-users now favour imports from Russia. The cost-effectiveness of Russian coal has become a prominent factor influencing consumer preference.

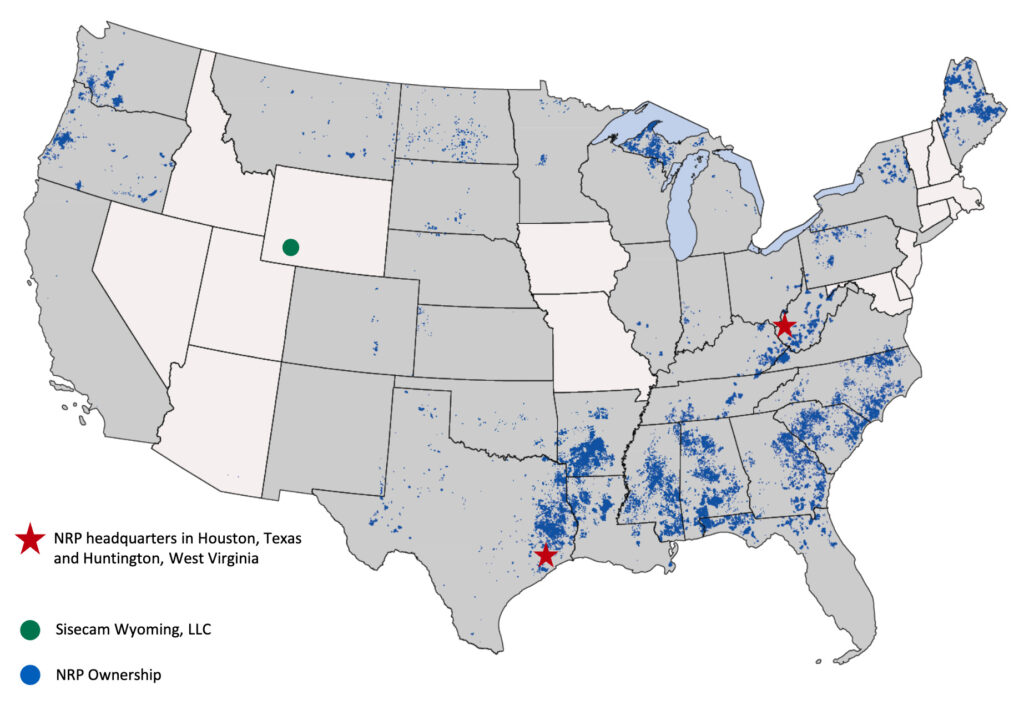

Shipments from Russia rose by two folds m-o-m to 0.56 mnt in November 2023 as against 0.18 mnt in October. Shipments from the US surged by 18% m-o-m to 0.80 mnt in November 2023 as compared to 0.68 mnt in October. Coking coal deliveries from Indonesia recorded a significant surge of around 94%, reaching 0.46 mnt in November 2023 as compared with 0.23 mnt in October.

Moreover, shipments from Canada rose by 77% in the month under review. Exports from Mozambique witnessed a drop of 20%, reaching 0.18 mnt in November 2023, up from 0.23 mnt in October.

Company-wise coking coal imports

SAIL recorded the highest imports at 1.13 mnt in November 2023, up 11% m-o-m as against 1.02 mnt in October. JSW recorded a drop of 14% in monthly import volumes at 0.92 mnt followed by Tata steel at 0.79 mnt (up by 41%). RINL recorded a significant rise of two folds to 0.27 mnt in November 2023, whereas Visa steel imported 0.16 mnt in the month under review.

Port-wise coking coal imports

Paradip port received the highest imported cargo volumes of 1.1 mnt in November 2023, Gangavaram recorded a significant rise of around twofold at 0.81 mnt. Haldia and Dharma ports received 0.75 mnt and 0.61 mnt, respectively. Mormugao port recorded a rise of 29% in import volumes at 0.55 mnt in the month under review.Jaigarh recorded a drop in import volumes by 13%.

Outlook

It is anticipated that imports may rise due to strong buying interest from steel mills. Additionally, end users are shifting towards sourcing more coal from Russia, attracted by its cost-effectiveness. However, maintenance shutdown of Hunter Valley Railway line in Australia might exert minor pressure on imports.