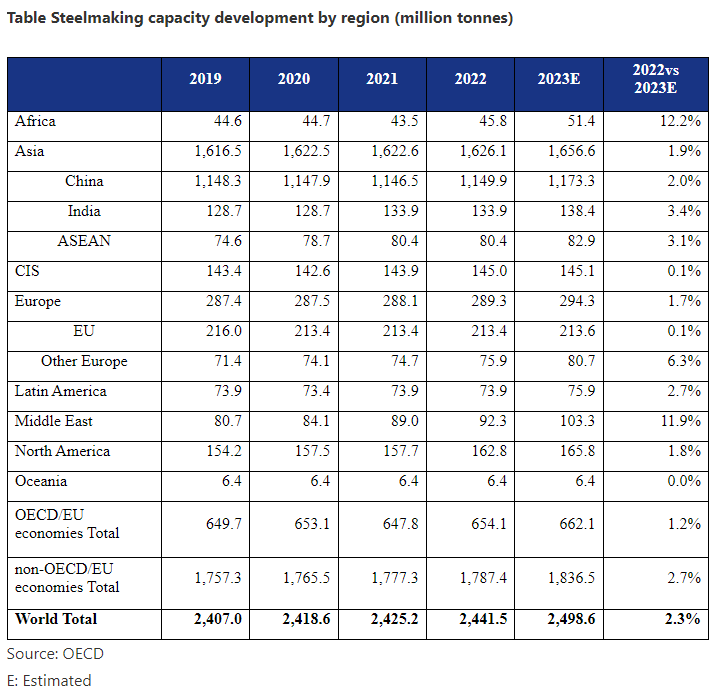

Despite increasingly challenging market conditions, global steelmaking capacity during 2023 grew for a fifth consecutive year to reach an all-time record high of some 2.5 billion tonnes, higher by 57.1 million tonnes or 2.3% from 2022, according to estimates in a new report from the Organisation for Economic Co-operation and Development (OECD).

Notably, the capacity growth in 2023 of 57.1 million tonnes translates into the highest annual volume increase in global capacity in a decade, being roughly equivalent to the existing level of capacity of a major steel-producing economy such as Brazil or Germany, the OECD report noted. In terms of the sources of this growth, Asia accounted for 53.3% of the increase, the OECD calculated.

The world’s two largest steel-producing economies – China and India – currently account for 47% and 6% of world capacity, respectively, with China’s capacity thought to have reached 1.17 billion tonnes in 2023, while India’s climbed to 138.4 million tonnes, the report indicated.

Although both production and capacity have increased in the last couple of years, growth in the former has slowed relative to the latter, the report observed. As a result, the gap between global steelmaking capacity and crude steel production most likely widened last year to 610.8 million tonnes from 556.1 million tonnes in 2022, reflecting renewed weakness in global steel demand and production.

This also means that the global steel capacity utilization rate declined for the second consecutive year in 2023, losing 1.7 percentage points to 75.6%, the OECD report added.

Regarding future capacity developments, 46 million tonnes of gross capacity additions are currently underway worldwide and are expected to come on stream during the next three-year period spanning 2024-2026. A further 78.2 million tonnes of capacity additions are currently in the planning stage for possible commissioning during the same period, the OECD remarked.

Of the world total of 124.2 million tonnes of capacity to be newly added in the next three years, basic oxygen furnace (BOF) projects account for 45.2 % of the total while electric arc furnace projects account for 50.5% of the total, according to the report.

In Asia, BOF plants account for more than 75.9 % of the tonnage volume of capacity additions. Most of the BOF installations will take place in India or ASEAN, it said.