The most-traded coking coal futures contract on the Dalian Commodity Exchange for delivery in May ended the morning trading session on Wednesday at Yuan 1,769/tonne ($245.9/t), with the contract rising by 7.44% from Tuesday’s settlement price after hitting limit up. The quick jump in coking coal futures reflected growing concerns among participants regarding supply amid market chatter that some major coking coal groups in North China’s Shanxi, the country’s largest mining province for coking coal, will reduce production this year. The miners are said to be responding to a provincial government campaign to rein in mine overproduction to enhance safety, Mysteel Global learned.

According to a latest notice issued by the Shanxi government, coal mines in the province should not lift their output of raw coal this year by more than 10% above their approved production capacity, while the same 10% maximum was also set for their monthly output. In response, Lu’an Chemical Group, a key state-owned coal mining company administrated by the Shanxi provincial government, was heard to be planning to reduce total coal output by 17 million tonnes in 2024, meaning that its annual coal output would decline to 86 million tonnes from its previous plan of 103 million tonnes, sources revealed.

According to the sources, the firm’s output cuts will not affect the coal volumes it is committed to supplying to domestic end-users under long-term contracts this year. This could signal that Lu’an Chemical’s output of saleable coal to non-contract buyers will see a notable decline this year, a market watcher commented.

Meanwhile, Shanxi Coal International Energy Group Co., Ltd, the listed arm of China’s top coking coal miner Shanxi Coking Coal Group, will also curtail its coal production by 8 million tonnes this year, the miner has indicated, though as of noon Wednesday neither coal firm had released official statements regarding their production policies.

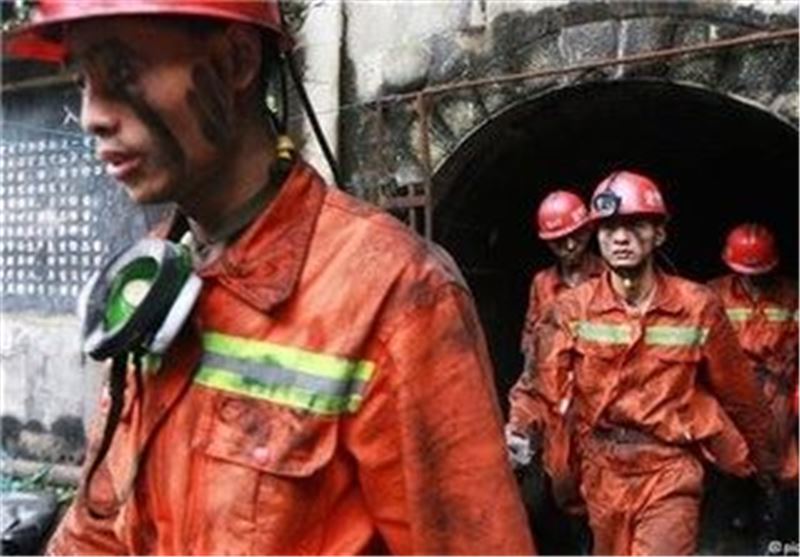

In parallel, the Shanxi government has also decided to conduct strict safety inspections on mining activities at all coal mines under its jurisdiction till May 31. The government authorities will be checking to see that no mine is producing beyond its approved capacity, that output is at ‘normal’ production intensity, and that the number of mine workers employed underground does not exceed regulations, the government notice said.

Last year, Shanxi produced 1.36 billion tonnes of raw coal, accounting for around 29% of China’s total coal production and representing an on-year rise of 3.3%, according to data from the country’s National Bureau of Statistics.

As of February 21, Mysteel’s assessment for the price of Anze primary coking coal (ash<9.5%, VM<20%, sulfur<0.5%, GRI>85) produced in Linfen city, Shanxi province, was stable for the second straight day at Yuan 2,450/t on EXW basis and including the 13% VAT, after Monday’s decline of Yuan 10/t.

Written by Tammy Yang