Despite the efforts towards the global economy’s decarbonization, coal still remains a key component, still feeding demand for large bulkers. In its latest weekly report, shipbroker Xclusiv said that “despite widespread discussions of green energy and zero emissions, coal remains a major economic force in the coming years. In the United States, coal mining companies are expanding production and investing in new mines, particularly for metallurgical-grade coal. Demand for this type of coal, used in steelmaking, is increasing, while demand for power generation coal is declining. Although U.S. coal imports are at their lowest since 2017, 2023 exports have rebounded to 2019 levels, representing an 18% increase over 2022”.

Source: Xclusiv

According to the shipbroker, “China, the world’s largest coal consumer and producer, is actively maintaining this position. In 2023, it approved 106GW of coal-based electricity generation capacity. Despite the country’s climate goals, continued investment in new coal power suggests inadequate progress in overcoming systemic reliance on coal-fired electricity. China’s coal output reached a record high of 4.65 billion metric tons in 2023. Additionally, despite increased domestic production, China’s coal imports totalled 386.3 million metric tons in 2023, a jump from 257.2 million metric tons in 2022. While forecasts suggest similar import levels in 2024, the country’s economic health remains uncertain due to corporate debt and a struggling property sector”.

Xclusiv added that “on the contrary to United States and China, India’s thermal coal imports are expected to fall for the first time in 2024 since the COVID-19 pandemic due to increasing domestic output and record high inventories. Surging production by domestic coal miners have pushed stockpiles at power plants to record highs of over 43 million metric tons, prompting it to sell more to non-power sector users such as sponge iron and aluminium smelters, which have traditionally imported the coal fuel. India imported 176 million tons of thermal coal in 2023 but in 2024 the preliminary forecasts show that the imports are not going to be higher than 160 million tons, a decrease of 9% compared to 2023”.

The shipbroker also noted that “coal demand continues to bolster the dry bulk market, particularly the Capesize sector, which is closely linked to coal trading. Following a strong year for Capesize S&P transactions in 2023 where over 100 vessels changed hands, 2024 appears to be continuing this trend. In the first quarter alone, 24 Capesize vessels have been sold – already exceeding Q1 2023 numbers by 1 vessel and matching the transaction volume of the entire first half of 2022. Greek owners have been particularly active, buying 8 vessels and selling 6 within this period”.

Source: Xclusiv

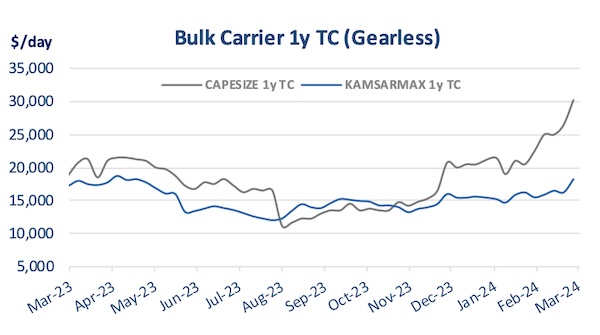

“Investor sentiment for large bulk carriers remains bullish, driven by healthy freight rates. The Baltic Capesize Timecharter Average stands at USD 32,985 per day, consistently exceeding USD 10,000 daily since September 8th, 2023. Subtracting the BALTIC Capesize Operating Expense index (USD 5,669/day) and the Capesize Dry Dock Daily cost (USD 404/day), a Capesize vessel generates an estimated daily EBITDA of USD 26,912 – approximately USD 9.8 million annually. This represents almost 25% of the current value of a 10-year-old Japanese Capesize. In contrast, the yearly EBITDA of a Cape during Q1 2022 (based on Baltic Exchange indices) was significantly lower at around USD 3 million – only 10% of a Japanese Cape’s USD 32 million valuation at the time. Similarly, in Q1 2023, the yearly EBITDA was slightly over USD 1 million, merely 4% of a 10-year-old Cape’s value”, Xclusiv concluded.

Source: Hellenic Shipping News