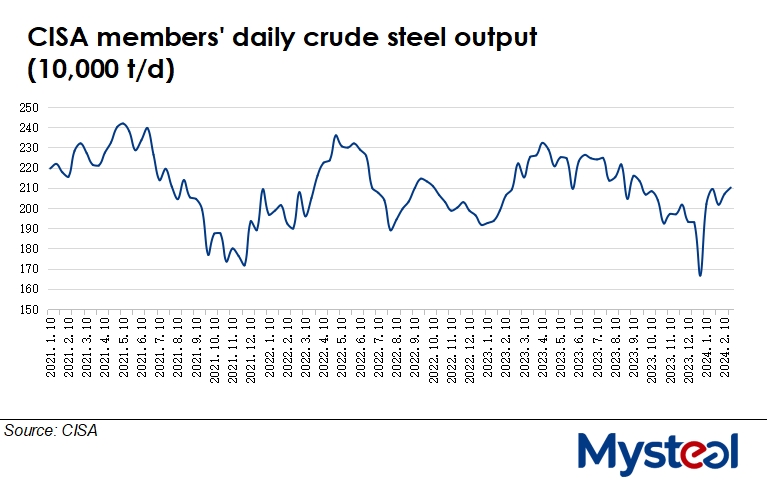

Daily crude steel output among the member mills of the China Iron and Steel Association (CISA) picked up further during February 11-20, rising by another 1.5% or 31,000 tonnes/day from the prior ten days to reach 2.1 million t/d on average, according to the association’s latest statistics released last Friday.

The daily output in mid-February was also slightly higher by 0.4% from the corresponding period in 2023, CISA notes.

Accounting for the further growth in daily output was the fact that mini-mills resumed production after most electric furnaces had been switched off during the Chinese New Year holiday. By contrast, blast-furnace mills had maintained steady operations over the period, according to market sources.

Based on the performance of its member mills, CISA estimated that the country’s daily crude steel output averaged 2.69 million t/d during the middle ten days of this month, up 1.2% from February 1-10.

As of February 20, finished steel stocks among CISA member mills had mounted further by 17.7% or 2.8 million tonnes from February 10 to reach approximately 19 million tonnes, as against the 23.8% jump in the prior period, the CISA data indicated. This result was mainly due to weak steel demand and higher output, sources said.

Meanwhile, China’s finished steel prices in the physical market had been mildly rangebound during mid-February. By February 20, the country’s national price of HRB400E 20mm dia rebar, for example, was assessed by Mysteel at Yuan 4,033/tonne ($560/t) including the 13% VAT, edging up Yuan 2/t from that on February 9.

“Looking forward, finished steel output is likely to rise in sync with the improvement in actual demand from end-users, and the extent to which demand recovers will play a decisive role in determining how widely steel prices fluctuate,” a market insider predicted.

Written by Rong Zhang