Coking companies across several provinces in China are facing a profound market crisis in the coke industry, marked by a notable decrease in coke prices by RMB 300-330/t since January 2024 , exacerbating industry-wide losses surpassing RMB 450/t in certain regions.

Some Chinese mills in Hebei and Tianjin have accepted another round of metallurgical coke price cut on 20 February by RMB 100-110/t amid weak buying interest. End-users favoured Indonesian coke, exerting downward pressure on prices. Met coke prices in Hebei’s Tangshan were assessed at RMB 2,160/t ($300/t), a fall of RMB 100/t ($14/t) d-o-d.

However, coking coal prices have only dropped by RMB 100/t since January. Despite a marginal decline in coking coal prices, this discrepancy fails to offset coke production costs, leading to operational challenges and prompting some enterprises to suspend production.

The late resumption of coal mine operations, coupled with stringent policy controls and impending important events, constrains coking coal supply. Conversely, an anticipated macroeconomic recovery and heightened demand from steel mills signal a potential upturn in coke demand. However, production constraints pose challenges to price reduction efforts.

In response, participating companies unanimously agree on critical measures:

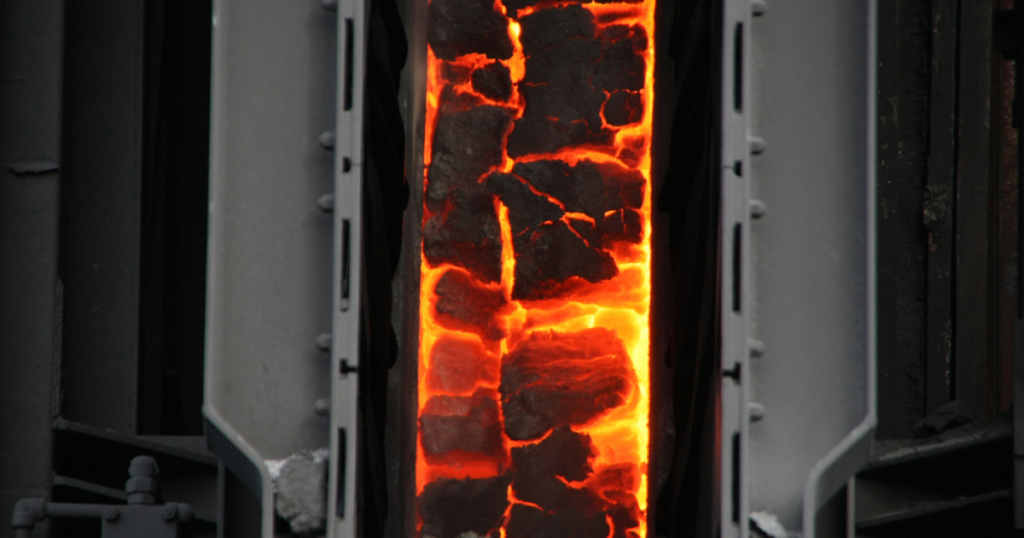

- Production adjustment: Extending coking times in line with individual losses, limiting tamping coke production by 30%, and top-charging coke by 50%, particularly for enterprises experiencing losses exceeding RMB 300/t, are recommended actions.

- Raw material procurement: Adopting a cautious stance on raw material procurement by slowing down or halting purchases. Materials will be acquired on-demand while minimizing overall production.

- Inventory management: Adjusting inventory levels according to individual losses and operational requirements. The principle of “no production without orders, no sales without profits, and no shipments without payment” will be rigorously followed.

Through strategic production adjustments, prudent raw material procurement, and inventory management, the sector aims to mitigate losses and uphold market stability.

Source: CoalMint