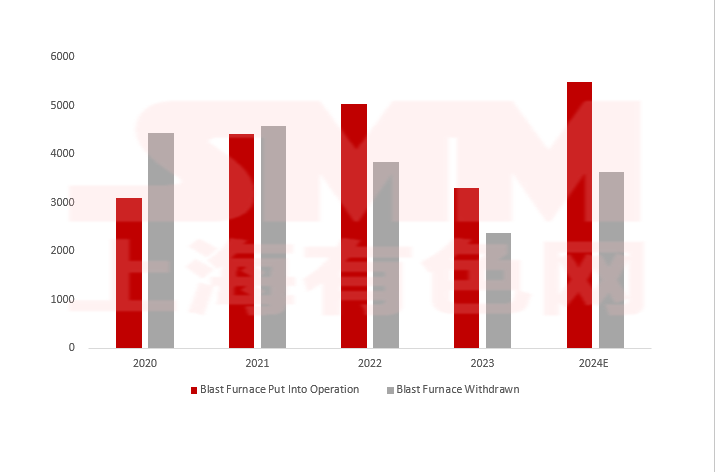

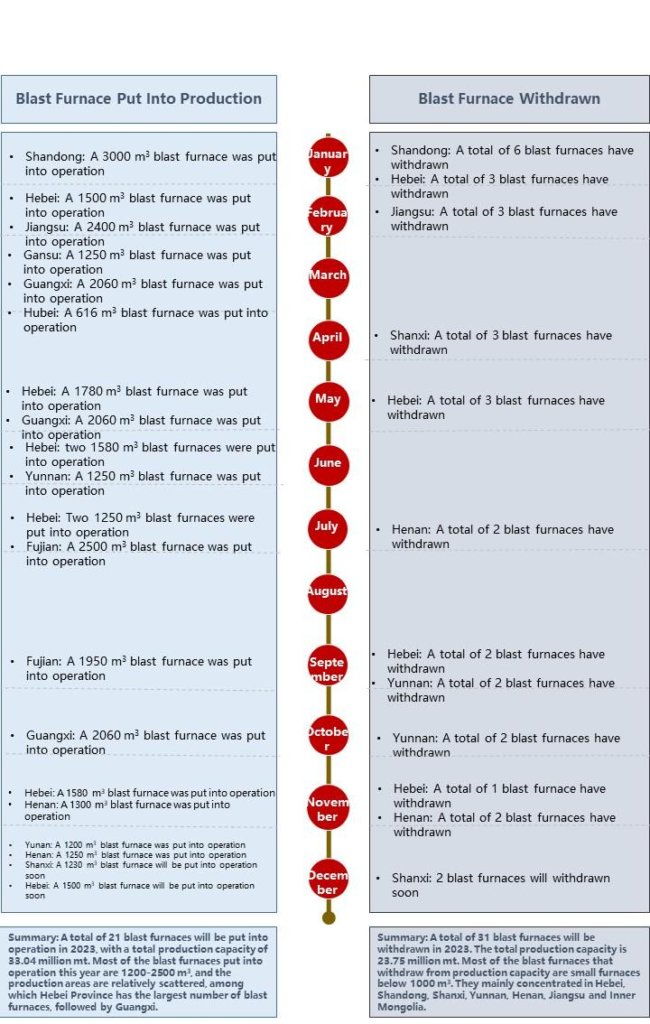

Based on the initial capacity replacement plan, the past few years were expected to be a peak period for blast furnace capacity replacement. However, with the shrinking downstream demand, the steel industry is now facing oversupply, and the struggling profits of steel mills have led to delays or cancellations of some capacity replacement projects. The steel industry’s winter in 2023 is no exception. According to SMM’s data on blast furnace production and shutdowns in 2023, 19 blast furnaces have been put into operation, with 2 more planned to start operating before the end of the year, totaling 33.04 million mt of capacity, which only completes 36.94% of the planned capacity. In addition, 29 blast furnaces have been shut down, with 2 more planned to shut down after the new blast furnaces start operating at the end of the year, totaling 23.75 million mt of capacity that has completed 31.2% of the shutdown plan.

Based on the timeline of production and shutdown capacity for the whole of 2023, the specific situation is as follows:

According to the tracking data from SMM on blast furnace capacity replacement progress, 21 new blast furnaces were put into operation in 2023, with a total capacity of 33.04 million mt. The phased-out capacity amounted to 23.75 million mt, resulting in a net increase of 9.29 million mt. This is compared to a net increase of 5.71 million mt in 2022. Some capacity has already been phased out or even dismantled in the previous two years. Considering the current downturn in the steel industry demand and the consecutive two years of poor profitability for steel mills, the number of newly commissioned blast furnaces has been relatively slow.