The Chinese market for thermal coal is seen hovering at a low ebb this month, as restocking demand for the fuel among domestic end-users may stay weak in the traditional off season for demand for the commodity.

The dim market outlook reflects the weakness of market fundamentals this month, the report says, as thermal coal consumption will see a clear decline across the country with the arrival of warmer weather significantly lowering the need of householders to heat their homes. The slower coal usage by power plants, the largest consumers of thermal coal in China, will cause their coal stocks to further accumulate and so lessen their appetite for new cargoes, an industry insider said.

The report pointed out that although some cement and chemical plants may release some moderate demand for thermal coal alongside their elevated operations this month, support for the domestic thermal coal market would be relatively weak.

On the supply side, the country’s thermal coal production is likely to be subject to small contractions in March as a consequence of escalated safety regulations on coal mines being rolled out by local authorities. However, any favorable boost in the domestic thermal coal market could be offset by falling demand for the fuel by downstream users and the resultant accumulation of stocks, the report warned.

In the first half of February, the domestic thermal coal market gradually entered a stalemate, with miners, traders and end-buyers generally leaving the market early for the Chinese New Year (CNY) holiday over February 10-17, as reported.

The post-holiday market initially showed improving demand from domestic buyers, encouraging portside traders and miners to lift their thermal coal offering prices. However, the rising momentum of the prices soon caused buyers to pull back due to their languishing demand.

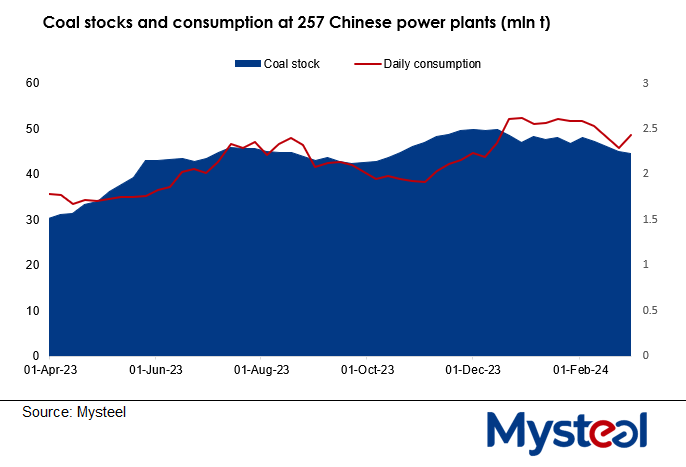

For example, Mysteel’s survey showed that daily coal consumption among the 257 power plants under its monitoring averaged 2.47 million tonnes/day in February, lower by 4.3% on month. As a result, though the utilities firms’ coal stocks were lower by 4% on month, as of February 22 these were still sufficient for 19.7 days of consumption, up from 18.1 days a month earlier.

Last month, the average capacity utilization rate among the 462 thermal coal mines under Mysteel’s tracking declined to 81.35%, down from an average of 93.35% in February. In parallel, their daily coal output also decreased by a substantial 9.6% on month to reach 4.89 million t/d in the same month.

The weakness on both the supply and demand sides has kept China’s thermal coal mine-mouth market steady at low levels after the CNY holiday – except for days of rebounds buoyed mainly by short-lived replenishment after the holiday, Mysteel’s monthly report said.

For example, Mysteel’s assessed price of 5,500 kcal/kg NAR thermal coal (ash<11%, VM<35%, sulfur<0.8%) produced in Yulin city, a main coal-mining hub in Northwest China’s Shaanxi province, stayed flat on month at Yuan 760/tonne ($105.6/t) as of February 29. However, the price was lower by Yuan 310/t compared with the year-ago level, on mine-mouth basis and including the 13% VAT.

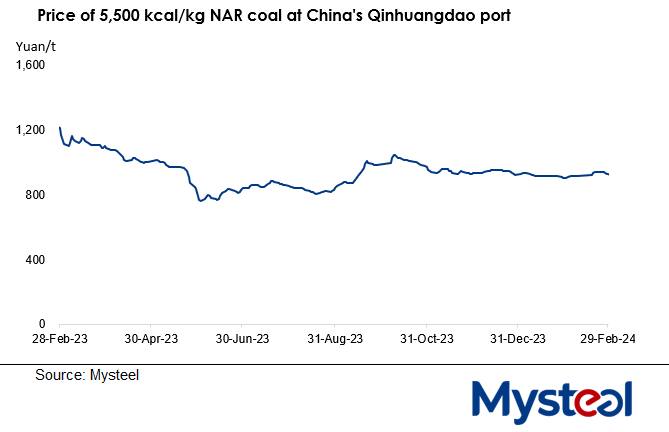

In parallel, Mysteel’s assessed price of 5,500 kcal/kg NAR thermal coal traded at Qinhuangdao port, the largest coal transfer port in North China’s Hebei province, started losing strength in late February, although the post-holiday rebounds have led to a Yuan 25/t on-month increase to reach Yuan 930/t as of February 29, on FOB basis and with VAT included. The price was significantly lower than the Yuan 1,215/t recorded a year earlier.

As of the same day, total coal inventories at the eight major ports in North China were largely flat on month at 20.44 million tonnes, down by 18.1% from the year-ago level, the results of another Mysteel survey showed.

Written by Tammy Yang